Getting An Investment Bank Job During A Recession

Post on: 19 Май, 2015 No Comment

By Sasha Cekerevac for Investment Contrarians | Dec 5, 2013

One of the most interesting ideas that came out of the last Federal Reserve meeting at the end of October is a serious issue for everyone, including the Federal Reserve and the eventual impact of monetary policy. And that idea is that slow productivity growth might actually be the new norm. (Source: “Minutes of the Federal Open Market Committee,” FederalReserve.gov, November 20, 2013.)

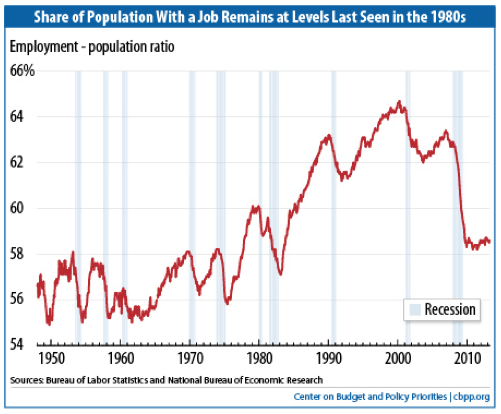

Since the Great Recession, worker productivity has been running at roughly half the rate that the U.S. experienced over the 25 years prior. The problem is that potential gross domestic product (GDP) growth comes from a combination of productivity and the labor force.

If productivity stalls and the Federal Reserve continues with its monetary policy, at some point, this excess cash will begin to seep into the economy and cause inflation.

The reason we aren’t seeing inflation in the official data despite record levels of monetary policy is that the velocity of money has been low. This basically means that money is sitting in bank reserves or is being funneled into assets, such as stocks, instead of being channeled into the actual U.S. economy. There is asset inflation, but the official measures don’t track items like the stock market.

However, at some point, this begins to shift, especially when worker productivity remains low. The last time productivity hit such low levels was during the 1970s, and we all know what happened to the U.S. economy during that time.

Clearly, the monetary policy program run by the Federal Reserve is not having a positive impact on the real economy, as unemployment remains stubbornly high.

While the Federal Reserve Read More

By Sasha Cekerevac for Investment Contrarians | Nov 22, 2013

After so many years following the Great Recession, it’s still quite astounding that job creation remains so slow. This obviously indicates the lack of economic growth, even after trillions of dollars have been pumped into the U.S. economy.

While there has been a lot of optimistic talk in the mainstream media, there have been an increasing number of data points indicating America’s economic growth is still very fragile.

Recently, the Federal Reserve Bank of New York released the results of its November 2013 “Empire State Manufacturing Survey,” and they didn’t support the economic growth theory.

This report is an indication of the state of manufacturing in New York. The net result is that overall business conditions fell to their first negative reading since May. New orders also fell 13 points into negative territory at -5.5. Labor conditions worsened, indicating a decline in the average number of hours worked per week. (Source: “Empire State Manufacturing Survey,” Federal Reserve Bank of New York web site, November 15, 2013.)

It’s no wonder that job creation is still lagging: the manufacturing industry is still experiencing a lack of economic growth. In fact, these results indicate that manufacturing is beginning to weaken once again.

We can’t have economic growth if large sectors of the U.S. economy are experiencing a decline in business activity.

On top of the decline in manufacturing, the level of prices paid is beginning to increase to a level above what firms are able to charge clients.

In 2013, prices paid by manufacturing firms increased 3.4% on average, and they are expected to increase four percent in 2014. Manufacturing firms estimate that Read More

Recently, European Central Bank (ECB) policymaker Jens Weidmann said the strategy of printing money was not the solution to the eurozone crisis. (Source: Carrel, P. “Printing money not the way out of crisis: ECB’s Weidmann,” Yahoo! Finance, November 20, 2013.) Ya, no joke!

Of course, Weidmann was not referring to the Federal Reserve, but to thoughts from within the ECB that perhaps buying assets was another tool to use. He may as well be talking about the Federal Reserve’s quantitative easing strategy, though. I’m sure he’s been looking at the Federal Reserve’s massive money printing and its overall ineffectiveness; he’s likely studying the U.S. situation and realizing that the act of simply printing money is not the end-all for achieving success in rebuilding an economy.

There’s that old saying that you learn from other people’s mistakes—that’s what we have here.

The Federal Reserve continues to balk at stopping the money printing. Current Federal Reserve Chairman Ben Bernanke expressed his disappointment in the recent jobs market readings in a recent speech, saying there were insufficient reasons to stop the quantitative easing.

Five years of quantitative easing by the Federal Reserve and, while it clearly helped the country from a much deeper recession and breakdown, the benefits are stalling.

So I say to Weidmann, fight against the use of quantitative easing via printing money in the eurozone, as it will simply cost the eurozone hundreds of billions of euros and would likely do very little for the economy. The already historically record-low interest rates in the eurozone will suffice.

The same thing should be the case on this side of the Atlantic. Read More

By Sasha Cekerevac for Investment Contrarians | Nov 12, 2013

Of all the central banks around the world, the European Central Bank (ECB) has rarely surprised markets by making monetary policy adjustments without some hints to the market first.

But this is exactly what happened last week when the ECB lowered its benchmark interest rate to a record-low 0.25% in hopes to spur economic growth. (Source: European Central Bank, November 7, 2013.)

This monetary policy change is a much bigger deal than many people realize.

First of all, as I just discussed last week, many investors have been expecting economic growth to finally emerge within the eurozone. This change in monetary policy by the ECB just validates what I’ve been saying for some time: that economic growth is nowhere in sight.

This is not news. How many years has it been since the Great Recession, and where can you find true, fundamentally strong economic growth?

All I see are central banks trying to outdo each other with easier and easier monetary policy (money printing).

With the ECB benchmark interest rate now at 0.25%, how much more ammunition does the bank have left? Does anyone really believe that a quarter-point drop in interest rates will revive economic growth for the region? I certainly don’t.

But this goes beyond just the eurozone. What the ECB is doing with monetary policy is more than simply printing money; it’s trying to lower the euro currency. And while the central bank isn’t explicitly stating that this is its plan, in my opinion, it is still a significant consideration.

Look at what the Japanese central bank has done. Japan has enacted one of the largest monetary Read More

On goes the government impasse. In fact, it could last a few more days leading up to the debt ceiling deadline next Thursday. In my opinion, it’s only going to get uglier from here.

While I could continue to discuss the politicking in Washington, I’m going to take a break. Well, kind of. With 800,000 federal workers without any pay, it’s going to be tough.

But people still have to eat and survive in spite of the lack of a paycheck—and of course, investors are still looking to profit in spite of the U.S. government shutdown.

A sector I feel will benefit from the impasse is the discount retail sector. With less money to spend, it wouldn’t be a surprise to see many of those 800,000 workers look for cheaper digs to buy goods and services, which is where the discount retail sector comes in.

Heck, I even think the discount retail sector, which did really well coming out of the 2008 recession, will continue to do well even after the government impasse, as people will still have a tendency to gravitate to bargains, especially in a market of uncertainties.

At the top of my list is Wal-Mart Stores, Inc. (NYSE/WMT), which continues to be the “Best of Breed” in the discount retail sector.

Aside from Wal-Mart, when it comes to big-box stores, there’s also Costco Wholesale Corporation (NASDAQ/COST), which may be another strong play in the discount retail sector.

On a smaller scale, take a look at Dollar General Corporation (NYSE/DG), with over 10,800 stores spread across 40 states as of August 2, 2013. Unlike Wal-Mart and Costco, Dollar Read More