Get Ready for Tax Season Start Your 2014 Taxes

Post on: 29 Март, 2015 No Comment

Key Points

- Preparing your taxes isn’t fun, but doing them early can mean fewer headaches. Get started now and avoid scrambling to fund an IRA or chase down missing paperwork before the filing deadline. Be sure you’re up to date on cost basis reporting rules and take advantage of all the deductions you’re eligible for this tax season.

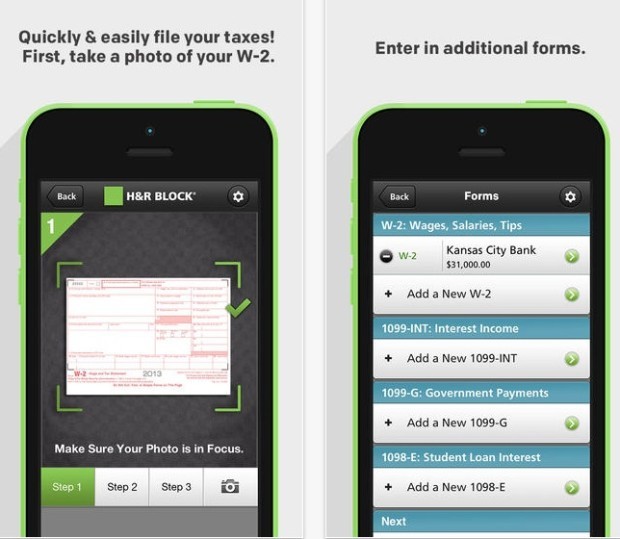

Sure, you have until April 15 to file your tax return, but waiting until the last minute isn’t worth the headache. With W-2s, 1099s, and other tax-related documents in hand, you can start your taxes at any time.

Why start now?

With tax season well underway, here are four reasons why you should prepare your tax return as soon as possible:

- You may be due a refund but won’t know for sure until you run the numbers. If you expect a refund, make use of e-filing and direct deposit to get money back quicker. However, if you prep in advance and it turns out you owe taxes, you’ll have more time to pay the IRS. Just remember to pay your taxes before the deadline, or a failure-to-pay penalty may apply.

Sometimes mutual fund 1099s arrive late

While unusual, it’s possible for certain mutual funds to restate their distribution information as late as the end of February.

Normally, you’ll get a Form 1099-DIV near the end of January or mid-February. But if a fix is necessary, a corrected 1099 is usually mailed by the end of February. Typically the chances of this happening are small, so you shouldn’t delay tax preparation just because you might get a restated 1099.

Your Form 1099-DIV should break down your investment income between qualified dividends (taxed at 15% or 0%, depending on your tax bracket), long-term capital gains and income taxed at your ordinary tax rate (short-term capital gains, non-qualified dividends, and taxable interest income). Tax-exempt income should also be separated to show the portion of private activity bond interest, if any, reported to the IRS. Private activity bond interest is subject to the alternative minimum tax (AMT), unless the bond was issued in 2009 or 2010.

Overlooked tax deductions you should know about

As you sit down to organize your documents, keep in mind these often-overlooked tax deductions:

- Non-cash charitable contributions . Most charities will provide a range of thrift values for commonly donated items; for example, The Salvation Army posts a valuation guide for tax-deductible donations. Keep in mind that any gifts of used clothing or household items must be in good condition or better. It’s also a good idea to keep receipts of your contributions and take digital pictures in case of an audit. If you volunteered last year, any mileage you incurred may also be deductible.

Note: The IRS requires a receipt for charitable gifts of $250 or more (if you’re audited, a canceled check isn’t enough). And you’ll need a bank record for all cash donations, regardless of the amount.

- Refinancing costs. If you refinanced your mortgage, any points paid can be deducted on an annual basis amortized over the life of the new loan. Unamortized points on a previous refinance can be deducted in full the year of the subsequent refinancing.

Cost basis reporting rules

Since 2011, financial institutions have been required to report the adjusted cost basis of sold securities to the IRS, including:

- Equities acquired on or after January 1, 2011.

- Mutual funds, ETFs and dividend reinvestment plans acquired on or after January 1, 2012.

- Other specified securities, including most fixed income and options acquired on or after January 1, 2014.

Keep in mind that the reporting rules only apply to the sale of securities purchased on or after the effective dates above. As the taxpayer, you are ultimately responsible for the information on your tax return. So, it’s a good idea to save your original purchase and sale documentation, including records of any automatic reinvestments, to make sure it matches the information financial institutions report to the IRS. You should also make sure your financial institution is using the accounting method of your choice. Even though FIFO (first in, first out) is the IRS default method for both individual securities and mutual funds, most institutions (including Schwab) will report individual securities using the FIFO default method and report mutual funds using the average cost single-category method.

Knowledge is power

Even if you don’t prepare your returns yourself, taxes can have such a significant impact that you should be aware of how the rules affect you. Schwab clients can log in to access tax tools and resources that include a cost basis calculator. You can also learn more about taxes from commentaries on Insights & Ideas. The IRS is also a good resource.

Along with the tax return package and instructions you receive in the mail (see the first few pages for Important Changes …), you can check out IRS Publication 17: Your Federal Income Tax. You may also find Publication 550: Investment Income and Expenses chock full of valuable information on everything from how to report interest, dividends and capital gains, to which investment-related expenses are deductible for income tax purposes.

So, don’t put off preparing your tax return until the last minute. Getting an early start might make the whole process a lot less stressful. Give it a try this year.

I hope this enhanced your understanding of early tax preparation. I welcome your feedback—clicking on the thumbs up or thumbs down icons at the bottom of the page will allow you to contribute your thoughts. (If you are logged into Schwab.com, you can include comments in the Editor’s Feedback box.)

1 Subject to the 2% of adjusted gross income floor for miscellaneous itemized deductions.