GAAP v Depreciation

Post on: 30 Апрель, 2015 No Comment

Hey everyone just a few questions about depreciation:

1) I know that MACRS depreciation is for tax reporting purposes, but is it legal to use MACRS percentages for depreciation that affects the company’s financial statements? Or are only straight-line, double declining, and sum of years digits legal for depreciation on financial statements?

2) Are companies able to use the useful life years as outlined by MACRS? Or are there separate useful lives to be used for GAAP?

3) Does depreciation for a company have to be consistent among all long term assets (the same type of depreciation for everything)

Thanks for any input!

*.*

The depreciation method you use in any given set of financials is determined by the recipient of the financials, or by the context of the financials.

For example, if you’re a publicly-traded entity in the US, the SEC requires that you report to your shareholders using GAAP methods. If your shares are traded on a particular exchange, that exchange will have a similar requirement.

If you have some bank debt outstanding, it’s likely that the lender requires you to submit financials (quarterly or annually, usually) until the loan is paid off. In the loan agreement, the bank will specify the accounting methods it requires for such financials. Note here that’s not uncommon to have multiple lender-banks, with each one specifying a different depreciation method in their respective loan contracts. So you might be using GAAP deprecn in your reports to First National, straight-line over X years in your reports to Second National, and so on. (As a practical matter, though, banks are pretty consistent with just specifying GAAP in the loan agreement, with the happy result that you don’t have to keep seventeen different depreciation schedules.)

If your entity is licensed by some governmental agency, it’s a fair bet that the agency requires periodic financials from you. The more sophisticated agencies have the foresight to specify the accounting methodology in the licensing requirements; the lazier ones are silent on this point, and, by implication, leave it up to you to pick your deprecn method.

If you’ve taken on any private equity money, the investment contract you inked with that investor mandates, among other things, periodic financial reports. It’s probably the case that the investor has specified the accounting methods and conventions to be employed in such reports.

There are plenty of other possibilities (a vendor who requires you to submit a balance sheet and PnL before they’ll approve you to run a tab, e.g.), but you get the drift. For any particular set of financials, first ask Who is requiring these? Then, you’ll know where to look to answer the follow-up question, What kind of accounting methodology does this party require?

*.*

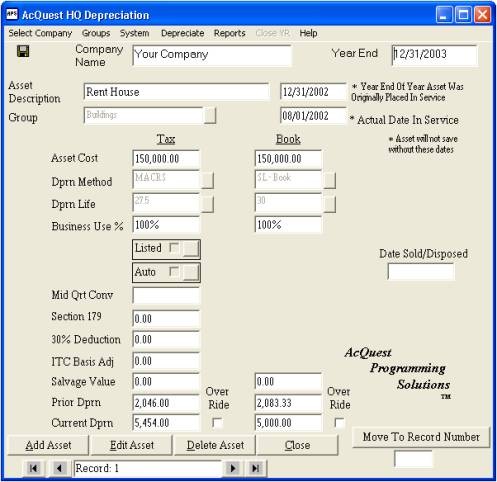

Is the difference in depreciation computed under Tax and GAAP methods material? Is this a capital intensive company? Even though Section 179 is not GAAP, Double Declining balance certainly is which makes it awfully close to MACRS.

Based on the size of the company, maybe tax basis financials will suffice.

I would not be too concerned about banks dictating the accounting practices other than perhaps requiring the accrual method. They almost always add depreciation back because banks these days are only interest in one thing and that is Cash Flow.