Fx Options Delta Gamma

Post on: 10 Апрель, 2015 No Comment

An introduction to gamma -delta neutral option spreads Description:

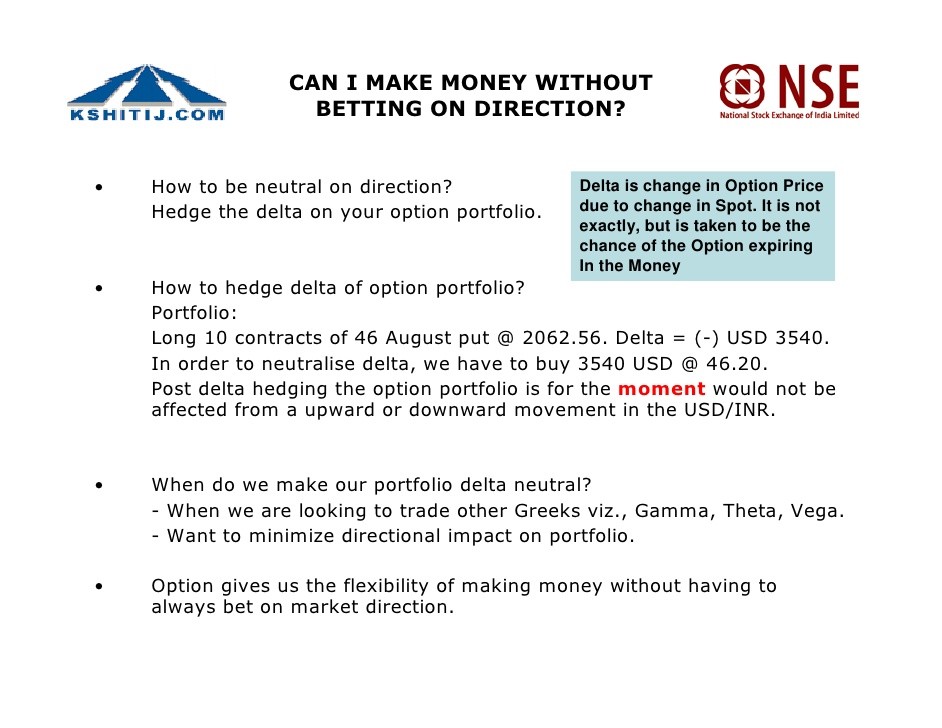

Neutralizing the delta now that we have the gamma neutralized, we will need to make the net delta zero. if our $30 calls have a delta of 0.709 and our $35 calls have.

File Name : An introduction to gamma -delta neutral option spreads

Source : www.investopedia.com

Option greeks — delta,gamma,theta,vega,rho Description:

Option greeks measure the options sensitivity to various risk components inherent to the price of an option. delta, gamma, theta, vega, and rho measure the speed of.

File Name : Option greeks — delta,gamma,theta,vega,rho

Source : www.mysmp.com

Options greeks: delta ,gamma,vega,theta, rho | hypervolatility Description:

Options trading and options greeks first of all i would like to give credit to liying zhao (options analyst at hypervolatility) for helping me to conceptualize.

File Name : Options greeks: delta ,gamma,vega,theta, rho | hypervolatility

Source : hypervolatility.com

Understanding the fx option greeks — interactive brokers Description:

• why delta, gamma and theta? • these three greek “risk gauges” are very closely interrelated • due to the potential for price gaps options have.

File Name : Understanding the fx option greeks — interactive brokers

Source : www.interactivebrokers.com

Fx options pricing, what does it mean? — interactive brokers Description:

• relationship between the strike price and the underlying exchange rate creates the value of the option at expiration • at expiration all options are worth the.

File Name : Fx options pricing, what does it mean? — interactive brokers

Source : www.interactivebrokers.com

Greeks (finance) — wikipedia, the free encyclopedia Description:

Delta, measures the rate of change of the theoretical option value with respect to changes in the underlying asset’s price. delta is the first derivative of the value.

File Name : Greeks (finance) — wikipedia, the free encyclopedia

Source : en.wikipedia.org

Options greeks: gamma risk and reward | investopedia Description:

In terms of position gamma, a seller of put options would face a negative gamma (all selling strategies have negative gammas) and buyer of puts would acquire a.

File Name : Options greeks: gamma risk and reward | investopedia

Source : www.investopedia.com

Gamma — option trading tips — learn all about trading options Description:

Option gamma. the gamma of an option indicates how the delta of an option will change relative to a 1 point move in the underlying asset. in other words, the gamma.

File Name : Gamma — option trading tips — learn all about trading options

Source : www.optiontradingtips.com

Fx options- faqs — fx options versus spot, advantages Description:

What are fx options? fx options are exchange-listed securities that are traded on the international securities exchange®, a leading u.s. options exchange..

File Name : Fx options- faqs — fx options versus spot, advantages

Source : www.fxoptions.com

Fx options trading and risk management paiboon peeraparp feb. 2010 * we call the last construction as the arbitrage pricing by replicate the cash flow of the forward..

File Name : Fx options trading and risk management — สำนัก

Source : science.sut.ac.th