FX Exchange Rate

Post on: 3 Сентябрь, 2015 No Comment

Currency Converter,FX Exchange Rate

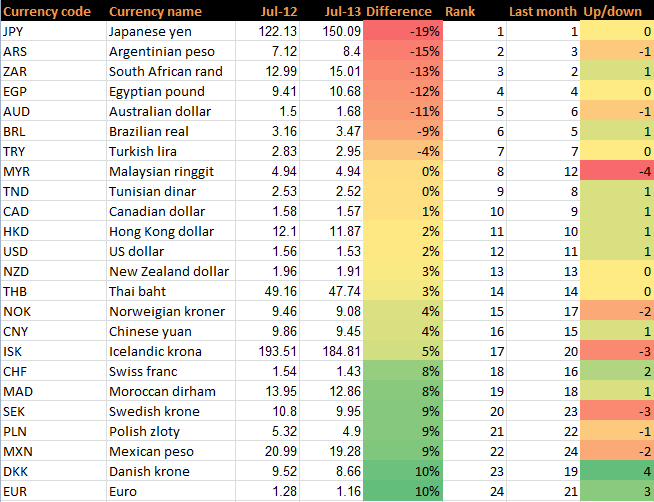

History values are calculated using averages from the currency exchange rate day’s range. See more exchange rate history on each country specific exchange rates page.

Definition of Exchange Rate

Exchange Rate (also known as forex rate, FX rate, foreign-exchange rate, or Agio) is a relative value between two currencies at which one currency can be exchanged for another currency. It is also thought as the price of one currency in terms of another currency. For example, the US Dollar (USD) — British Pound (GBP) exchange rate means the relative price of USD in terms of GBP. It is assumed that the USD/GBP exchange rate is 0.62, which means you need £0.62 to buy $1. Exchange rate is commonly used for converting currency (for travel, or oversea online shopping), engaging in speculation, or trading in the foreign exchange market.

Where to buy foreign currency in everyday life?

Currency as a medium of exchange is a system of money (monetary units) in common use. Different country uses different currency; therefore, people may need to exchange currencies in some situations. For example, when people are planning to oversea travel may buy foreign currency cash, traveler’s checks or a travel-card in their home country’s bank. As the people arrive at destination, they can buy local currency at the airport, either from a dealer or through an ATM, also can buy local currency at their hotel, a local money changer at a bank branch, or through an ATM. In addition, traveler may use a credit card to purchase goods in a store if they do not have local currency. When people oversea online shopping, they commonly use credit card to pay for.

Besides, people may invest in foreign exchange market. The foreign exchange market also called the currency market or forex (abbreviated as FX), is the world’s largest financial market. It allows investors to buy, sell, exchange and speculate on currencies, including banks, investment management firms, commercial companies, non-bank foreign exchange companies, central banks, hedge funds as speculators and retail investors.

What should you do if you would like to invest in foreign market?

Like all investments, investing in the foreign exchange market involves risk. It can bring you high profits, but also may make you bankrupt. Therefore, before deciding to invest in foreign currency, you should carefully understand all kinds of information of foreign exchange market. The forex market is the largest and most liquid market in the world, and determines the relative values of different currencies. Apart from weekends, the currency trading is continuous: 24 hours a day, from 20:15 GMT on Sunday until 22:00 GMT Friday. In forex, the exchange rate between two currencies constantly changes.

Choosing the right time to take part in investing forex market is also extremely important. The currency reflects the strength of its corresponding economy, which is affected by a wide variety of factors, such as inflation and the state of politics and the economy. The forex market is indeed extremely volatile, investors should be well familiar with all of dynamic factors which influence the currencies’ values to help mitigate these risks and improve their long-term returns.