Funds ETFs

Post on: 8 Май, 2015 No Comment

‘Funds of ETFs’ are likely to grow in number, but understanding their plusses, minuses is key

Exchange-traded funds have been a big hit with investors in recent years, swelling in number and money under management. Now, ETFs are catching on with some of their biggest competitors — mutual funds.

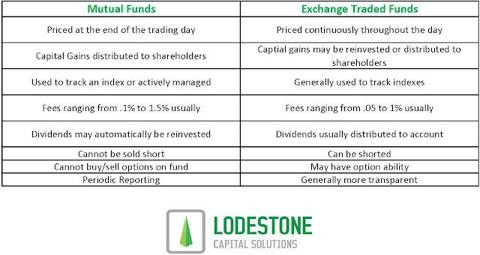

A growing number of mutual funds are investing in ETFs, which usually track market indexes and trade throughout the day on exchanges, like stocks. In addition to being easier to buy and sell than their mutual-fund cousins, which are priced only once a day, ETFs sport lower annual expense ratios on average and generally are more tax-efficient.

The Journal Report

The mutual funds investing in ETFs are mostly target-date retirement funds, which provide one-stop shopping for investors seeking exposure to a variety of asset classes. Researcher Morningstar Inc. tracks 49 mutual funds with at least 70% of their assets invested in ETFs. The majority of these funds, available from firms such as Federated Investors Inc. and J. & W. Seligman & Co. have been launched in the past two years.

ETFs allow investors to quickly and cheaply put money to work across a variety of securities, and these new funds of funds give investors exposure to huge portions of the investing world via ETFs such as iShares S&P 500 Index, iShares S&P MidCap 400 Index, iShares Lehman 1-3 Year Treasury, iShares Lehman TIPS Bond,Vanguard Europe Pacific, iShares MSCI Emerging Markets Index and WisdomTree International SmallCap Dividend.

Still, some financial advisers and analysts say this new breed of fund isn’t for everyone. They say investors who buy ETFs through mutual funds lose some of the advantages that set ETFs apart — namely trading flexibility and tax efficiency. And despite ETFs’ generally competitive prices, funds of ETFs can be costlier than funds of mutual funds.

Most mutual funds that invest in ETFs take all the advantages of ETFs and nullify them, says Simon Maierhofer, co-founder of ETF Guide.com, a Web site focused on ETFs. Investors also should look carefully at the makeup of these funds because some with ETF in their name have holdings other than ETFs.

When it comes to tax efficiency, both mutual-fund and ETF investors can face capital-gains tax hits if they sell their fund shares for a profit. But mutual-fund investors also can take a hit when the fund distributes its trading profits, which are generated when managers sell stocks that have rallied strongly or when they are forced to sell some holdings to pay investors who want to cash out.

The unique structure of ETFs helps them eliminate many of the tax-triggering capital gains before they have to be distributed to shareholders.

Here’s how it works: ETFs are created when securities brokerages or specialists assemble baskets of securities that match an ETF’s underlying index, and exchange them with the fund for ETF shares that can be sold to small investors. The ETF shares trade on exchanges without the underlying stocks being touched. Since most ETFs track indexes, capital gains aren’t created as a result of strategic moves like selling a holding after it has rallied. In addition, investors who want to liquidate shares of an ETF simply sell them to other investors through exchange trading, eliminating the need for the ETF to sell securities to cover redemptions, a move that could generate capital gains for remaining investors.

What’s more, the brokers and specialists who created the ETF shares sometimes opt to take them off the market. They swap ETF shares for some of the underlying stocks and bonds in an in-kind transaction that generally isn’t considered a taxable event to fund shareholders. In this transaction, the ETF can hand over securities with the biggest capital gains attached to them, reducing potential tax bills for investors who continue holding the ETF shares.

Once ETFs are inside a mutual fund, however, these advantages disappear. If a fund manager is forced to sell ETF holdings to raise cash for investors who want to liquidate, a capital-gains tax bill may result.

The Cost Factor

On the cost front, the average U.S. stock ETF tracked by Morningstar has an annual expense ratio of 0.56% of assets, compared with 0.89% for U.S. stock-index mutual funds. But funds of ETFs can be pricier than funds that invest in low-cost mutual funds like those of Fidelity Investments, T. Rowe Price Group Inc. and Vanguard Group Inc.

For example, the A share class of Federated Target ETF 2015 has an expense ratio of 0.71%, and the same share class of Seligman TargETFund 2015 charges 1.21%. Both funds, which invest in ETFs, are sold through brokers and are subject to a maximum load, or sales commission, of 5.5% and 5.75%, respectively.

That compares with expense ratios of 0.19% for Vanguard’s Target Retirement 2015, 0.67% for Fidelity Freedom 2015 and 0.66% for T. Rowe Price Retirement 2015 — all no-load funds that invest in mutual funds.

The higher costs are partly a function of the relatively small size of many fledgling funds of ETFs, which forces them to spread fixed costs across a smaller number of shares. Federated Target ETF 2015 recently had about $8 million in assets and Seligman TargETFund 2015 had just under $40 million. Vanguard’s Target Retirement 2015 weighed in at $8.4 billion, according to Morningstar.

Charles W. Kadlec, co-manager of J. & W. Seligman’s TargETFunds, says the fees on his firm’s funds compare favorably with the 1.45% average for all target-date funds sold through brokers. He adds that Seligman’s target-date funds offer exposure to asset classes not available in some competitors’ offerings, such as emerging-markets stocks and international small stocks, which can increase fees.

The funds also have above-average exposure to relatively expensive asset classes such as U.S. small stocks, real-estate investment trusts and Treasury inflation-protected securities, he says.

We think providing that kind of diversity really produces value over time in terms of investment results, and that is more than worth the cost, he says. The fund is 100% invested in ETFs from Barclays PLC’s Barclays Global Investors’ iShares family, State Street Corp. Vanguard and WisdomTree Investments Inc.

Federated didn’t respond to requests for comment on the expense of its target-date ETFs. Besides iShares from Barclays, the Federated target-date fund included 2.4% in common stocks and 12.4% in funds run by Federated units, as of June 30.

Despite the drawbacks, funds of ETFs do offer a way to make ETFs more common in retirement-savings plans. ETFs have had trouble cracking this market, partly because they often don’t really make sense for investors who add to their holdings on a monthly or even more-frequent basis, as is common with 401(k) programs. ETFs must be bought from a broker, and the commissions on smaller trades can quickly add up, eating into returns.

If you’re in the accumulation phase of retirement planning, [individual] ETFs aren’t the best product, says Scott Burns, director of ETF analysis at Morningstar. But funds of ETFs offer a way for investors who invest in small amounts on a regular basis to avoid the trading-commission problem.

Mr. Kadlec says about half of the $170 million in J. & W. Seligman’s TargETFund family is held in 401(k) accounts.

Meanwhile, there are ETFs of ETFs hitting the scene. In May, Invesco PowerShares, a unit of Invesco Ltd. launched three ETFs that provide exposure to a variety of asset classes by investing in ETFs from PowerShares and other providers. The expense ratios range from 0.66% to 0.86%.

These products retain the trading flexibility and tax efficiency of the original ETFs. Like traditional ETFs, they must be purchased from a broker.

Ed McRedmond, PowerShares’ senior vice president for portfolio strategies, says ETFs of ETFs may not make sense for people who invest a little at a time, because of the trading commissions. But he says there has been a lot of interest in the products from investors in rollover individual retirement accounts. It can be much more cost-effective to purchase ETFs through these accounts, which are used to hold often-large sums of money transferred out of 401(k)s when people change jobs or retire.

Ms. Colter is a writer in Maplewood, N.J. She can be reached at reports@wsj.com .