Fundamental Index Funds

Post on: 11 Июнь, 2015 No Comment

A fter meeting with Preet Banerjee (the blogger behind WhereDoesAllMyMoneyGo ) over coffee, I picked up a few tips and some new investment ideas. What really caught my attention during our get together was, not only his fancy suit, but the mention and explanation of fundamental index funds/ETFs .

What are Fundamental Index Funds/ETFs?

Fundamental Index Funds/ETFs are index based investments with a twist. Instead of basing the weighting of the index constituents on a single parameter (the size of market capitalization), a fundamental index is weighted based on multiple fundamental factors.

The theory is that since regular index funds size their positions based on market cap, its prone to putting too much weight in over priced stocks (Nortel anyone?) and too little weight in under priced stocks. As a result, a regular index will heavily follow market bubbles and crashes.

The fundamental index, on the other hand, theorizes that it can fix these problems AND outperform the regular index by weighing the index based on fundamental factors of equal weight.

The fundamental factors include:

- Dividends indicates stability

- Cash Flow measures profitability and sustainability

- Sales for growth

- Book Value indicates value

What are the Advantages?

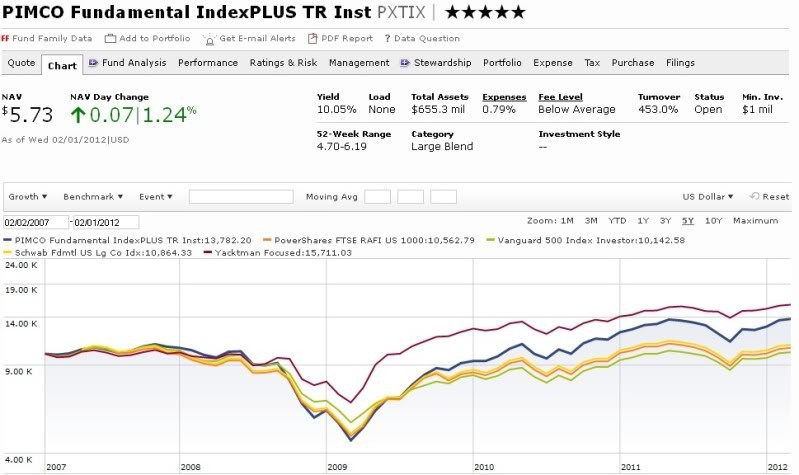

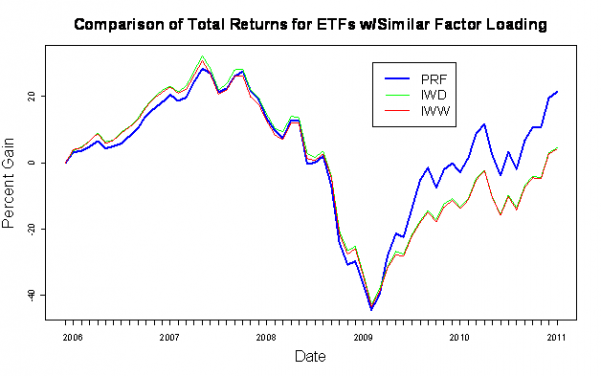

- It has been proven that index funds outperform the majority of mutual funds. Fundamental index funds have been proven to beat the majority of index funds over the past 50 years. The more inefficient the market, the higher the returns of the fundamental index.

- Fundamental index funds in efficient markets like Canada and the US have outperformed on average 2%-3% annually over the years. For inefficient emerging markets, fundamental index funds/ETFs have outperformed 10+%.

- Less volatility during down turns or market crashes along with higher recovery rate. Basically, better downside protection than a regular index fund (in theory because of the dividend weighting).

What are the Negatives?

- Fundamental Index ETFs are more expensive than regular index ETFs. For example, Claymores Canadian fundamental index ETF, CRG. charges a MER of 0.65% compared with a regular Canadian Index ETF, XIU, which charges 0.17% .

- Even though Claymore explains in their documentation that CRG would statistically beat the index over the long term, it hasnt been beating the Canadian index ETF XIU since CRGs inception 2 years ago. As you can see from the chart below, the gold line is CRG and the candlestick chart is XIU. CRG has, for the most part, lagged behind XIU.

- In CRGs defense though, the chart is only over the past 2 years as CRG is fairly new. CRG is also heavy in financials (because of the dividend factor) and underweight in materials/energy, the most recent market recovery has left CRG behind.

Where can I buy them?

These ETFs can be purchased from Claymore (CAD) or Powershares (USD). Here are some of the fundamental index ETFs that they offer by index and symbol:

- Canadian Index (S&P/TSX60): CRG (MER: 0.65%)

- US (S&P500) Index: CLU (MER: 0.65%)

- International Index (MSCI EAFE): CIE (MER 0.65%)

- Japanese Index: CJP (MER 0.65%)

- PowerShares FTSE-RAFI U.S. 1000: PRF (MER 0.60%)

- PowerShares FTSE-RAFI U.S. Small & Mid 1500: PRFZ (MER 0.60%)

- PowerShares FTSE-RAFI Dev. Markets ex-US: PXF (MER 0.75%)

- PowerShares FTSE-RAFI Europe: PEF (MER 0.75%)

- PowerShares FTSE-RAFI Japan: PJO (MER 0.75%)

- PowerShares FTSE-RAFI Asia ex-Japan: PAF (MER 0.80%)

Final Thoughts

While its all well and good that the statistics for fundamental ETFs show that they have out performed over the past 5 decades, it is not indicative of future returns. You will have to evaluate yourself whether or not fundamental index ETFs have a place in your portfolio.