Fundamental Analysis The Top Down Approach Investing It!

Post on: 7 Апрель, 2015 No Comment

Fundamental Analysis — The Top Down Approach

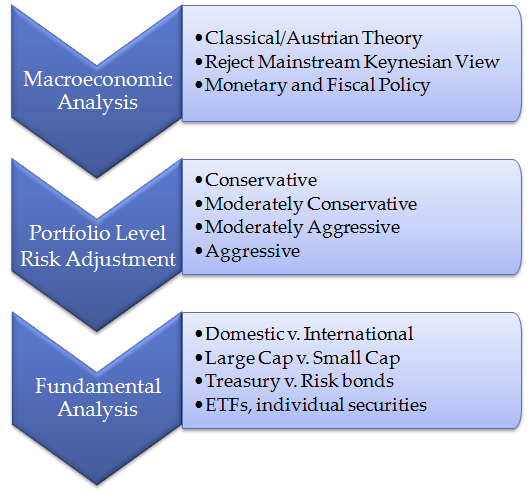

In my previous article “ Baby Steps for New Equity investors ” on Investment Yogi, I touched upon the two basic tools which one needs to master so as to minimize the mistakes while investing in stock market. In continuation to the previous article, we will be discussing the Top Down approach of fundamental analysis in this article. The top-down, three-step approach to security valuation starts with the forecast of the direction of the General Economy. Based on this Economic forecast, projection of the outlook for each industry/sector is analyzed. Third, within each industry, we select the firms most likely to perform the best given the economic and industry outlook. As indicated, this approach is a three-step analytical process:

Step 1: Studying the Economy and its effect

This step starts with the analysis of Fiscal and Monetary policy of the government. Fiscal policy affects aggregate demand leading to increase or decrease in the pace of economic growth. Tax cuts encourage spending (demand) and speed up the economy while tax increases discourage spending and slows down economic growth. Increase in Government spending generates employment resulting in increased aggregate demand. Similarly monetary policy is used by the central bank to manage economic growth. Decrease in the money supply causes interest rates to rise, putting upward pressure on costs and downward pressure on demand. Increase in the money supply reduces interest rates and increases demand. Inflation is a necessary evil which can result from increasing the money supply too fast. Rising interest rates and inflation reduce the demand for investment funds and product demand. Additional to local economic policies, we need to consider the global perspective which includes domestic economic impact from political changes in major international economies. This analysis helps in deciding the overall trend of the economy using which allocation towards stock market can be figured out. Basic rule to follow is — allocation percentage towards equities should be more in growing economic scenario.

Step 2: Determine effect on various industries and sectors

Based on the outcome of first step identify industries/sectors that are supposed to prosper or suffer as per the economic outlook. Analyse how these industries/sectors react to economic changes as some industries are cyclical, some are counter-cyclical and others are noncyclical. Analyse how global economic scenario affects the industrys prospects based on the product market of the industry. Industries or sectors having exposure in overseas market are likely to perform in line with the overseas economy. The outcome of this step is to identify the industries/sectors in which one should invest or avoid.

Step 3: Perform Company analysis

Once the industry analysis is done, we need to identify the companies within the industry which will outperform in the future. To achieve this, compare firms within each target industry based on the profitability, cash flow, and product acceptability. This step is quite complex and you need to be very careful with this. Decisions are subject to a lot of fluctuations based on the assumptions undertaken while analysis. For building long term portfolio, identify the company with the most upside potential. If you are comfortable with short selling, identify the firm whose stock will underperform in the current economic scenario. This involves not only examining a firms past performance, but also its future prospects. Outcome of this step is identification of the companies in which one needs to finally invest.

Conclusion

If you religiously follow the above steps, chances of losing money in stock market will be minimized. Having said that investment decisions purely based on fundamental analysis might not generate optimum return as some fine tuning is still needed. This fine tuning is provided by technical analysis and I will take this up in my next article. So please stay tuned.

For more details on stock trading and demat account, please click here

About the Author:

The author Bimlesh Singh is a financial advisor. He holds a Bachelor’s degree from IIT and is a CFA Level 2 candidate. He can be reached at expert@investmentyogi.com