Fundamental analysis as a method of share valuation

Post on: 17 Апрель, 2015 No Comment

This article reports the results of a questionnaire survey in June/July 2010 on the use of Fundamental and Technical analysis by brokers/fund managers in Indian stock market to form their forecasts of share price movements. The findings of the research reveal that more than 85 percent of the respondents rely upon both Fundamental and Technical analysis for predicting future price movements at different time horizons.

At shorter horizons there exists a skew towards reliance on Technical analysis as opposed to Fundamental analysis. But the skew becomes steadily reversed as the length of horizon considered to be extended. Technical analysis is considered slightly more useful in forecasting trends than Fundamental analysis, but Fundamental analysis is significantly more useful while taking long positions in the market.

Key words. Stock market, Long Term, Short term

INTRODUCTION

In all financial markets, a central question in the market is how market participants forecast their future market developments. Financial market participants are often classified according to two different forecasting approaches, Fundamental and Technical. Stock analysis is crucial when deciding to buy investments and when evaluating your investment strategies. Regular stock market analysis can ensure to make the most of your money and minimize your risks. While some investors use fundamental analysis while others use stock market technical analysis or stock technical analysis to evaluate their stocks.

Fundamental analysis is method of finding out the future price of a stock which an investor wishes to buy. It relates to the examination of the intrinsic worth of a company to find out whether the current market price is fair or not, whether it is overpriced or under priced. It believes that analyzing the economy, strategy, management, product, financial status and other related information will help to choose shares that will outperform the market and provide consistent gains to the investor. It is the examination of the underlying forces that affect the interest of the economy, industrial sectors, and companies. It tries to forecast the future movement of the capital market using signals from the economy, industry and company. It requires an examination of the market from a broader perspective. The presumption behind fundamental analysis is that a thriving economy fosters industrial growth which leads to development of companies. Estimate of real worth of a stock is made by considering the earning potential of the company which depends on investment environment and factors relating to specific industry, competitiveness, quality of management, operational efficiency, profitability, capital structure and dividend policy.

Technical analysis stands in contrast to Fundamental analysis. Fundamental analyses study only the stock price movements themselves and believe that the history of previous data provides indicators for future stock price movements.

Technical analysts have developed tools and techniques to study past patterns and predict future price. It is basically the study of markets only. They study the technical characteristics which may be expected at May or market turning points and their objective assessment. The previous turning points are studied with a view to develop characteristics that would help in identification of major market tops and bottoms. Human reactions are, by and large consistent in similar though not identical reaction; with the help of various tools, the technician attempts to correctly catch changes in trend and take advantage of them.

Thus, “Technical analysis is directed towards predicting the price of a security. The price at which a buyer and seller settle a deal is considered to be the one precise figure which synthesizes, weighs and finally expresses all factors, rational and irrational quantifiable and non-quantifiable and is the only figure that counts”. The purpose of doing this complex analysis is to help them decide whether it is advisable to buy, sell or hold the security of that company.

Fundamental Vs. Technical

Analyzing fundamentals such as earnings, cash flow, and assets, is useful in determining buyout and liquidation value of a company. Growth models can be made to gauge potential accumulation in the worth of the company. The difficulty is in trying to bridge this information to the market price of the shares, whereas the technical analyst often interprets the data by studying a chart. He may look for price patterns, trends, conflicting signals, or slight changes in buying momentum.

Determining the success of technical analysis is very difficult due to the subjective nature of this practice. Ten technical analysts can examine the same chart and have differing opinions of how and when the price will move. Many famous technical analysts, such as George C. Lane, have little written about their personal successes using such techniques.

Technical analysis says nothing of a company’s finances; it attempts to get inside the head of the investor. Fundamental analysts will try to figure out what a stock is really worth, versus what it is being traded at. Technical analysts will attempt to gauge the current emotional state of the buyers to forecast if further buying or selling is likely. This article discusses elaborately some of the investor’s opinion about fundamental and technical analysis. The aim of this article is not to determine which art is better. Instead, should endeavor to find out which method is commonly used on a particular stock.

Review of Literature:

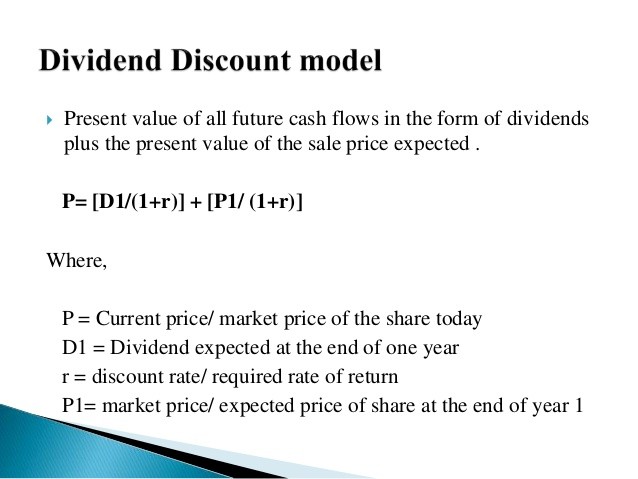

The origin of Fundamental analysis for the share price valuation can be dated back to Graham and Dodd (1934) in which the authors have argued the importance of the fundamental factors in share price valuation. Theoretically, the value of a company, hence its share price, is the sum of the present value of future cash flows discounted by the risk adjusted discount rate. This conceptual valuation frame work is the spirit of the renowned dividend discount model developed by Gordon (1962). However, the dividend discount model valuation involves the forecast of future dividend payment which is difficult due to the changes in firm’s dividend policy. Thus, the subsequent studies along this line of literature searched for the cash flow that is unaffected by the dividend policy and can be obtained from the financial statements.

A study by Yu-Hon Lui and David Mole (1998) reports on the use by foreign exchange dealers in Hong Kong of fundamental and technical analyses to form their forecasts of exchange rate movements. The findings of this study reveal that more than 90 percent of the respondents rely on both fundamental and technical analyses for predicting future rate movements at different horizons.

Thomas Oberlechner (2001) presents the findings of a questionnaire and an interview survey on the perceived importance of Technical and Fundamental analysis among foreign exchange traders and financial journalists in Frankfurt, London, Vienna and Zurich. Foreign Exchange traders confirm that, out of the both forecasting approaches, technical analysis is more prominent than the other. But the Financial journalists put more emphasis on fundamental analysis than foreign exchange traders.

Statement of the Problem

Most of research works concentrate on the foreign exchange market. Also the reviews from the study do not throw light on the complementarities of the two tools. Another gap exist that there may be difference of opinion with fundamental and technical analysis when investing for long term and short term investment which is not examined in previous studies. The current survey is done after critically reviewing the above mentioned research works. The survey is done on the Stock markets. The major aspect of the current research is to understand the attributes of the respondents when the market is bullish or bearish. The current research work suggests suitability of the two tools to different investors (Long term or Short term). It specifically analyses respondent’s preference towards the nature of the companies while choosing stocks. The highlight of the current study is the identification of different industries /sectors and the applicability of Fundamental and Technical analysis while taking positions in those industries or sectors which most of studies not covered in the research work.

Objective of the study

To find out the commonly used method in forecasting trends and turning points in the stock market.

Specific Objective

The objective of the study can be concluded by

Understanding the demographic profile of respondents ( for the purpose of this study respondents include, Brokers, Sub-brokers, Mutual fund companies, Institutional investors)

Understanding the frequency of usage of analysis by various stock market participants

Analyzing the adoptability of Fundamental and Technical analysis to various market conditions/situations.

Understanding the importance given by dealers to Fundamental and Technical analysis over intervals of forecasting horizons.

Data sources and Methodology

After analysis from licensed stock broking firms, Sub-brokers, Mutual fund companies, licensed banks and Stock market analysts, a close- ended questionnaire was designed for the analysis. The data was collected from four South Indian cities, namely, Bangalore, Hubli, Hyderabad and Cochin. The closed ended questionnaire was admitted to a sample of 100 respondents. Since the respondent’s choose are from experienced seniors, the analysis made was more accurate. The usage of these tools by informed investors such as, Brokers, Sub-brokers, Fund managers, Institutional investors is also critically reviewed in this study. The questionnaire is statistically validated using various statistical tools such as, Mean, Standard deviation. One way ANOVA test is conducted and it is tested at 1%, 5% and more than 5% significance levels.

Analysis and Interpretation

Descriptive Analysis

Analyzing the usage of Fundamental and Technical analysis while forecasting trends and turning points.