Fundamental Analysis and Technical Analysis A Comparison to create Wealth!

Post on: 17 Апрель, 2015 No Comment

We know the importance of understanding all we can about the stock market. Making decisions on what to buy and when to sell however is an entirely different ball game. While the goal of making profits is always the same, the route one takes can vary enormously.

Technical and fundamental analysis are the two approaches an investor may opt for. While both have their benefits, they are at completely opposite ends of the stock market spectrum. What sets them apart from each other is the time-frame and beliefs, but most importantly the difference is due to the methods they subscribe to.

A. THE THEORIES

In fundamental analysis, the investor examines the financials of a company, along with any factors which may influence the demand and supply. Fundamental investors believe that if a company has a stable foundation, it most likely holds promise for healthy, long-term growth.

On the other extreme, technical analysis tends to shun the fundamental factors of a company; and instead focuses on price and volume.

Technical investors believe that the determining factors are already reflected in the price of stock. Therefore, there is no need to individually assess company fundamentals. The technical analyst decides to buy or sell based on what the trading indicators presently point to.

B. THE METHODS

Fundamental and technical investing both employ vastly different techniques to determine the value of stock.

Analysing Financial Statements in fundamental analysis

In fundamental analysis, the investor starts his exploration of a company by paying close attention to the financial statements. How much money the company makes, spends or owes are all contributing factors which must be taken into account. There are three statements of importance which you must look into while undertaking a fundamental analysis. They are the balance sheet, income statement and cash flow statement.

The balance sheet of a company speaks volumes about how the business is faring. It tells you how much it owns in terms of wealth, how much it has to repay and how much cash is still owed by the customers.

The income statement gives a clear picture of the amount of profits a company makes. Therefore it takes into account the earnings and expenses over a set period of time. The profit of a company comes down to the difference between how much amount it brings in and how much it spends on its daily upkeep.

The cash flow statement tells the fundamental analyst how much money goes in and out of the company over a period of time. Unlike the income statement, this doesn’t take into consideration the non-cash sales or expenses. When a company has free cash flow, it signifies that it will be easier to pay back the money it owes.

Analysing Charts in Technical Analysis

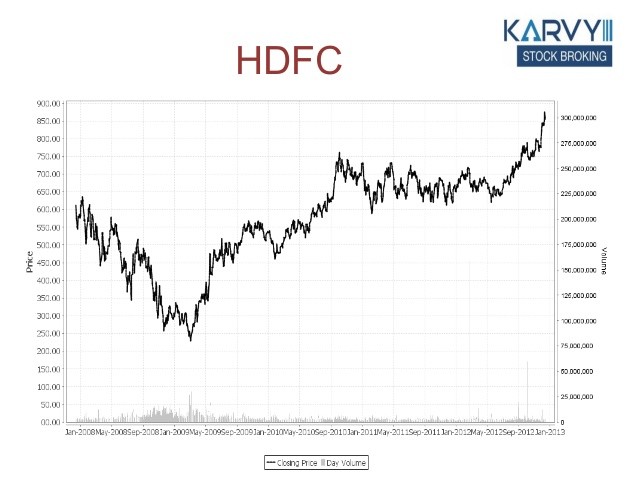

The technical analyst uses a variety of indicators on share price charts to represent market movement over time. The focus here is on price and volume, which the technical analyst believes are all you need to determine future worth.

The charts are useful for highlighting where prices are impacted, while indicating future scope. This is done by using indicators, which compare different averages to point to either an uptrend or downtrend. While the use of these charts helps the technical analyst to effectively trace the variations, the speed with which the changes occur can be a factor in missing out on profits.