FreeportMcMoRan Remains A Good LongTerm Bet FreeportMcMoRan Inc (NYSE FCX)

Post on: 23 Июль, 2015 No Comment

Summary

- Copper prices are headed for a sharp decline this year.

- The drop in copper prices has hurt Freeport-McMoRan shares, which are down more than 40% this year.

- However, Freeport-McMoRan remains an excellent long-term bet.

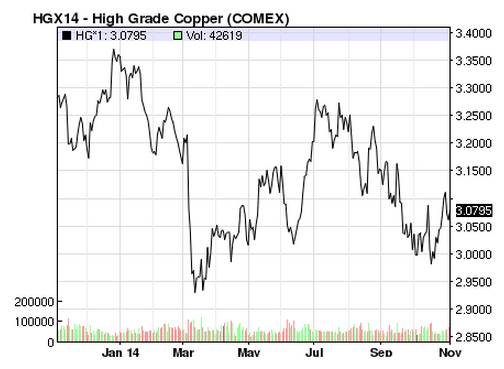

The copper market has witnessed one of its most tumultuous years in recent times. Copper prices, which slumped about 10% in the first quarter, showed some recovery in the middle of the year. But prices are sharply down again as we come towards the end of 2014.

While a slump in the broader commodity market has weighed on global miners, copper producers have also felt the heat due to simmering concerns over a possible supply glut in the market. Further, the slowing global economic momentum has also aggravated the problems for the metal.

Not surprising, American copper miner, Freeport-McMoRan (NYSE:FCX ) has been among the laggards. The stock has been out of favor this year. Already weighed-down by the fundamental weakness in the market, the sell-off pressure intensified after the news emerged that the company was close to resolving a dispute with shareholders by paying more than $100 million in compensation. The natural resources company has been alleged that it overpaid when it acquired both Plains Exploration & Production Co and McMoRan Exploration Co for $9 billion in 2013.

The news followed after Freeport-McMoRan, earlier in October, reported a 32% drop in quarterly earnings along with weaker-than-expected results. weighed-down by weakness in prices of copper, gold and oil.

The stock has now fallen more than 42%, year-to-date. Copper fell about 7.5% in 2013. With the metal on course to end down about 15% this year, there is growing uneasiness among investors.

After two successive years of fall in copper prices, investors now find themselves in a tight spot. The question they face is whether there is more downward slide on the cards, and whether they should continue their exposure to FCX.

Well, back in September, I had argued in favor of FCX. My contention was that the miner’s increased focus on low-cost high grade mines in North America would create value for shareholders in the long run as its unit cash cost per pound of copper would continue to decline.

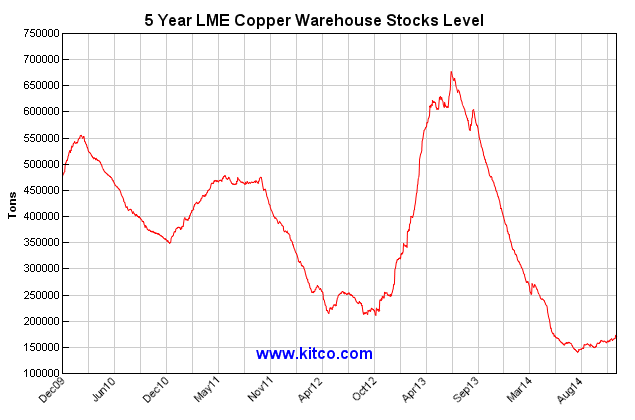

Besides, I had also mentioned that prolonged weakness in copper prices was forcing smaller players to cut both on its mining activities and CAPEX as mining under prevailing environment was proving uneconomical. I argued that a fall in copper mining should cut the excess supply. And that is exactly what happened. According to Jean-Sebastien Jacques, head of Rio Tinto’s (NYSE:RIO ) copper division, the combined copper inventories which includes those at registered warehouses of the London Metal Exchange, the COMEX in the U.S. and Shanghai Futures Exchange, have dropped to its lowest level since late 2008. The fall in inventory-levels reflects that the market is experiencing a deficit. Copper prices will draw support from depleting supplies.

But recently there have been some more developments in the copper market, as a result of which, prices should not only find a floor but could even recover. The copper market could witness some supply-chain disruption in coming months as some prominent miners expect a drop in production.

While BHP Billiton (NYSE:BHP ) recorded a lower production at its Escondida mine for the September quarter due to falling grades, Rio Tinto anticipates that its output might drop between 500,000 tons and 535,000 tons in 2015 from 615,000 tons as a result of rehabilitation process at its Kennecott operation in Utah.

According to Telis Mistakidis, head of copper unit at Glencore, the copper market could fall in to a deficit of 1.8 million tons due to production disruptions, next year. Many would argue that a deficit is highly improbable. However, one important point is that Wood Mackenzie and the International Copper Study Group have now cut down their surplus forecast for the second part of 2014.

And lastly there is China. Although China’s economic momentum is slowing, growth is still there. Indeed. China’s official manufacturing PMI data has consistently posted a reading above 50 all through the year.

The Financial Times citing Jefferies reported earlier this month that copper consumption in China has increased by an average 16%, year-over-year, between August and October. As long as demand from China remains strong, copper prices will find a floor. Moreover, China announced an unexpected rate-cut recently, which should augur well for consumption.

Given these developments, and the fact that Freeport-McMoRan is now trading at multi-year low levels, make the stock very attractive. With copper prices expected to find a floor and possibly recover, the downside risk in FCX is minimal. The upside though could be significant for long-term investors.

Disclosure: The author is long FCX. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.