Free Cash Flow vs Unlevered Free Cash Flow

Post on: 16 Март, 2015 No Comment

I tried to explain this same concept to J. Ponzio

Permalink Submitted by Chungst (not verified) on Mon, 2008-06-16 18:37.

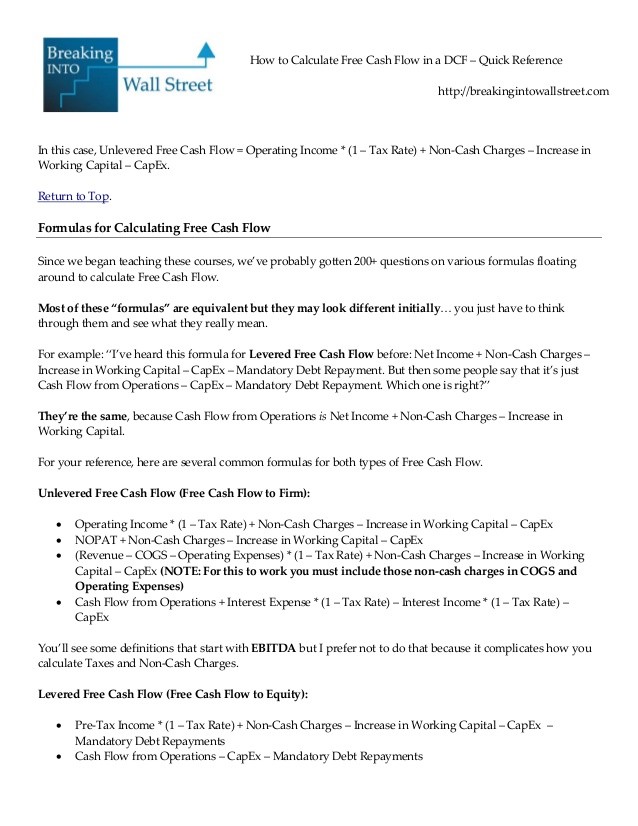

Basically, I have taken operating cash flow and subtracted out capital expenditures. However, I have started reading about unlevered free cash flows and I was wondering if my approach is really sound.

The goal of financial analysis is to also look at the economics, not just the accounting numbers (Joe P. still uses accounting numbers in his articles). There are three distinct ways a company can control key assets: via outright acquisitions, via true operating leases, and via sub-contracting. Let’s take the case of two companies in the same industry and one uses debt financing to acquire the necessary assets and the other uses operating leases. In the first company, the company shows debt on the balance sheet while the second company does not (true operating leases, FASB #13, are off balance financings). If the these companies are identical except for the financings used, then the difference in accounting results is due to financial engineering (and tax codes). The economics of these companies didn’t really change despite different accounting numbers. That’s why a company that uses operating leases generally has higher ROE but comparable ROIC when the operating leases are normalized.

The prior example focuses the reader on the economics. Now, let’s say you have a company that has used debt to acquire the asset versus another company that uses cash to purchase the asset. If both companies generated the same amount of FCF, it’s clear based on the economics that the first company’s FCF is divided between the debtholders and equityholders. In the second company, all the FCF goes to the equityholders. Therefore debt reduces FCF to equityholders and thus depress stock price.

Are there any drawbacks to using unlevered free cash flows for running DCF valuations?

No, if you account for the debt (and other balance sheet adjustments). The enterprise value of a firm is the sum of its market value of debt plus its market value of equity less surplus cash. If you used unlevered FCF to arrive at the enterprise value, you now have to subtract the debt to arrive at the value that is left for equityholders. Think of it this way, moneys for debtholders are moneys not available for equityholders.

pages.stern.nyu.edu/

adamodar/ and see link for spreadsheets.

Also see 1986 Berkshire Hawathway’s annual report where Buffett writes about the Cash Flow Fallacy in the appendix. Understanding the economics versus accounting numbers is key.