Free Cash Flow Ratio Analysis

Post on: 12 Апрель, 2015 No Comment

Free Cash Flows / Operating Cash Flows Ratio – Definition. This ratio compares the free cash flows (FCF) to the operating cash flows (OCF). The more free cash flows are embedded in the operating cash flows of a

Price -to-Free Cash Flow Ratio (P/FCF) Free Financial – Sep 17, 2011 · What It Is: The price-to-free cash flow ratio (P/FCF) is a valuation method used to compare a company’s current share price to its per-share free cash flow.

Free Cash Flow Calculation and Analysis About – Free Cash Flow is the Gold Standard of a Companys Financial Health Free Cash Flow Calculation and Free Cash Flow Example

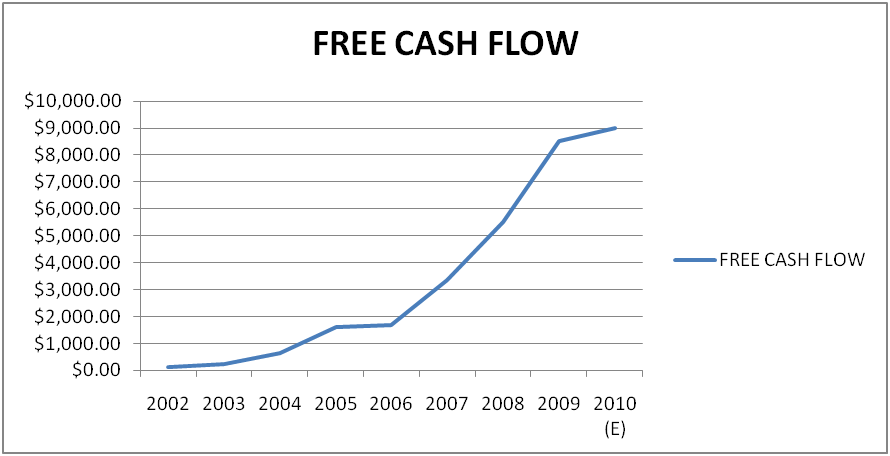

Thats because, over time, free cash flow ratios help people gauge a companys ability to withstand cyclical downturns or price wars. Analysis of Boomtowns cash flow ratios unveils a very different kind of growth. Its TFC (maintenance)

Free cash flow is a better method of determining a companys financial health than earnings per share. Here is a free cash flow example. What You Should Know About Profitability Ratio Analysis; The Business Owners Guide to Accounting and Bookkeeping; About.com; About Money;

Variations: A more stringent, but realistic, alternative calculation of free cash flow would add the payment of cash dividends to the amount for capital expenditures

Software for the intelligent financial analysis online. Statement Of Financial Position | IFRS Statements | IFRS Reports. Start free Ready Ratios financial analysis now! start online. No registration required! But if you signed up extra ReadyRatios features will be available.

Home » Financial Dictionary » Ratio Analysis. The formula for the price-to-free cash flow ratio is: Price to Free Cash Flow = Market Capitalization / Free Cash Flow. For example, lets assume that Company XYZ has 10,000,000 shares outstanding,

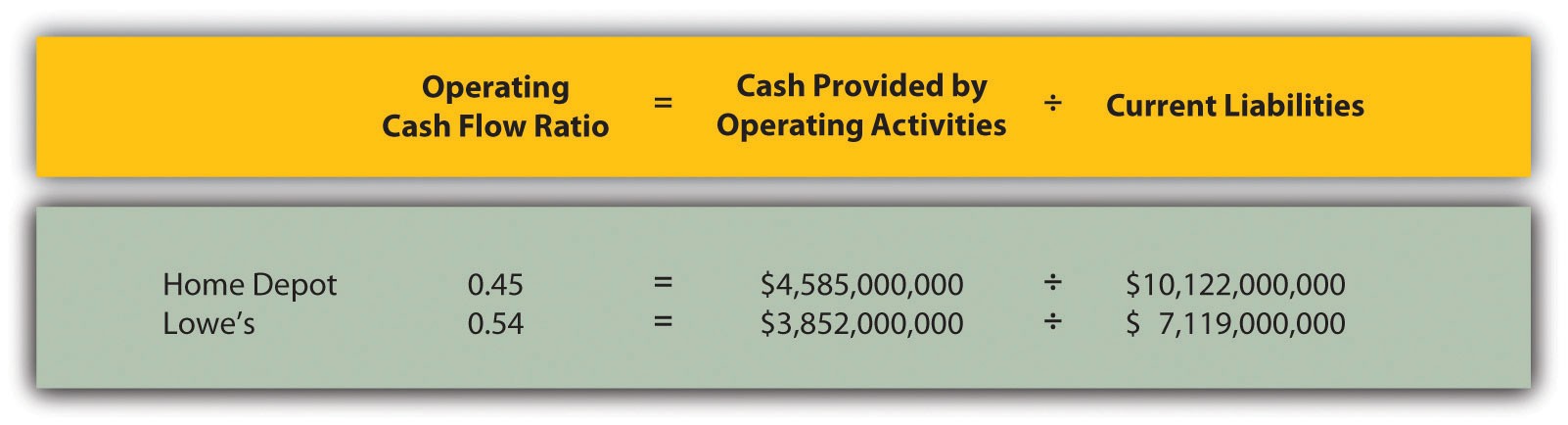

Biography)The free cash flow/operating cash flow ratio measures the relationship between free cash flow and operating cash flow. Free cash flow is most often defined as operating cash flow minus capital expenditures, which, Discounted Cash Flow Analysis. By Ben McClure.

2. Price/Cash Flow Ratio The price to cash flow ratio is often considered a better indication of a companys value than the price to earnings ratio.

but the fact that Rite Aids free cash flow trend has been improving is encouraging; The article What You Can Learn from a Rite Aid Corporation Stock Financial Ratio Analysis originally appeared on Fool.com.

Sep 18, 2011 · Many financial experts claim that cash flow gives a more accurate measurement for the value of a stock than the price to earnings ratio (P/E).

In finance, discounted cash flow (DCF) analysis is a method of valuing a project, company, or asset using the concepts of the time value of money.

by using metrics most other scouts had never heard of or given little regard—stats such as defensive efficiency ratio, value over replacement player—the analysis finds a market correlation to stocks and strong free cash flow companies. Jeff Cox

2. Price/Cash Flow Ratio The price to cash flow ratio is often considered a better indication of a companys value than

In corporate finance, free cash flow (FCF) is a way of looking at a businesss cash flow to see what is available for distribution among all the securities holders of