France REITs aim to diversify sources of debt financing for property investments EY

Post on: 16 Июнь, 2015 No Comment

Contents

Current market

In the first quarter of 2012, the French REIT Index (IEIF) increased 13.1% compared with a decline of more than 12.0% in 2011. The rebound in the stock performance of French REITs was part of a broader recovery in the shares of European REITs. The Euronext IEIF REIT Europe index increased 11.5% during the period, outperforming broader European stock indices.

Because French REITs generally are trading below NAV, they are not in a position to raise equity capital.

Market outlook

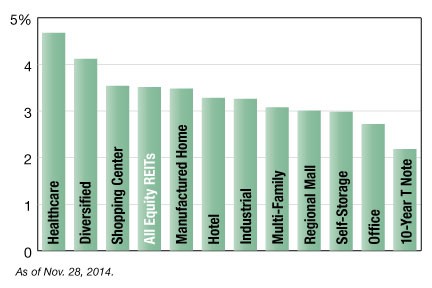

Like European REITs in general, French REITs are restructuring their balance sheets, paying off bank loans, refinancing existing debt and raising new debt capital for property investment. In a recent report, Fitch Ratings noted that European REITs are more proactive in arranging their debt profiles, using longer-term debt instruments and alternative funding 2 .

The disintermediation trend is expected to continue, with European REITs further diversifying their funding channels.

Challenges

With the notable exception of Unibail-Rodamco, French REITs are trading at discounts to NAV; the discounts on some REIT shares range from 15% to more than 20%. As a result, it is impractical for French REITs to raise equity capital to help finance property investments. Instead, they are increasingly going to the bond markets for funding. They are also trying to improve share values through asset sales, consolidation and other measures, as previously discussed.

Opportunities

Because of the previously discussed efforts to restructure their balance sheets, French REITs have increased their liquidity, and investment grade REITs can go to the bond markets to raise debt capital at low interest rates.

With capital to invest, some REITs are buying properties to add to their portfolios or considering whether to do so, and some are planning or have started development projects. They have particularly shown an interest in investing in the retail sector.

Some are investing or thinking of investing in other European countries, particularly those in Eastern Europe, where there is a need for development of more shopping centers.

Conclusion

Because French REITs generally are trading below NAV, they are not in a position to raise equity capital. However, having restructured their balance sheets and increased their liquidity over the past few years, they are positioned to finance property investments with low-cost debt capital.

As always, the challenge is to find investments that will deliver the highest value based on cash flows, yields, property appreciation and other investment criteria.

www.reuters.com/article/2012/03/23/idUSWNA329120120323.

Connect with us

Stay connected with us through social media, email alerts or webcasts. Or download our EY Insights app for mobile devices.