Forex Scam Fraudulent setup claiming to be regulated broker

Post on: 21 Июнь, 2015 No Comment

A forex scam that could happen to stocks, futures and commodities as well

Judy is an aspiring forex trader who was recommended to a new Broker A in town by her best friend Jason. Like Judy, Jason is also an aspiring forex trader. He heard about A on the radio.

A attracted a lot of attention in the community. In a short span of 6 months, the broker has set up 6 offices in the city. It was difficult not to encounter the brand since they were in every newspaper, radio channel and Internet forum. Immaculately groomed, sophisticated young employees helped Jason to go through the process of opening a forex trading account for him. The level of service impressed him so he felt this was also the best choice for Judy. Beyond his expectation, A offered him a forex trading course worth 5000 US dollars but to qualify he had to place an initial deposit of 20000 USD. Feeling that it was too good to miss, he agreed.

Hankering for more deposits

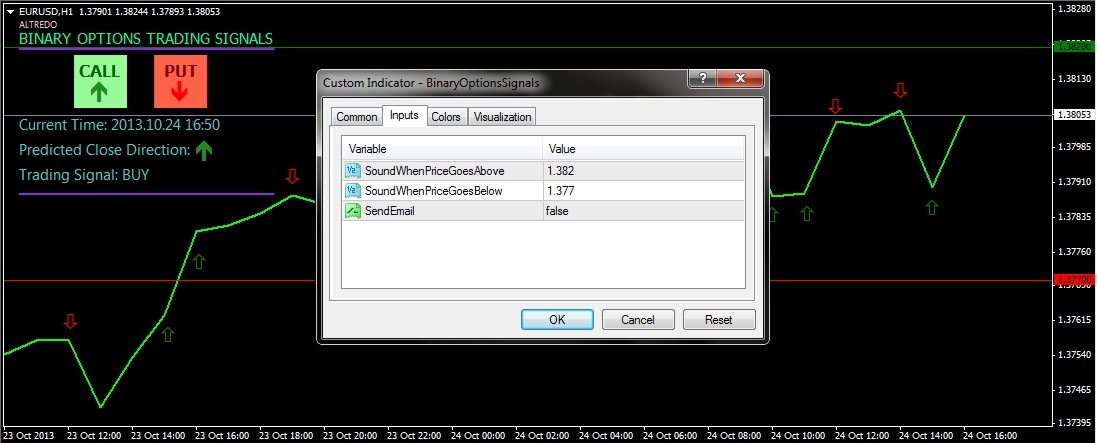

Judy signed up a trading account with A as well and attended the 5000 dollar-worth forex trading course together with Jason. Both felt that the course was wonderful. At the end of the session, staff from the broker approached them. We got this great promotional package. If you deposit an additional 20000 US D we will give you this outstanding pack of 25 indicators worth 3000 USD. Its a great deal. There is one indicator inside there that has already generated a forex trading performance of 500 percent return on trading capital in one month for the last 3 months. You will multiply your deposit in no time at all. Oh and if you introduce friends who deposit with us, we will throw in additional goodies. Jason and Judy agreed.

Jason and Judy did not really get down to trading. Being new aspiring traders, they did not really have a trading plan. But their relationship with Broker A was always more deposits, more referrals and then more goodies. Very soon Jason and Judy had each parted with 100,000 USD to deposit into their trading account.

Throwing up obstacles to prevent withdrawal

Soon Judy encountered cash flow problems with her small business and decided to withdraw some of her trading capital. To her shock, A informed her that there was a term in the account opening agreement that said funds could not be withdrawn until she had traded for 6 months. Not a single one of her friends including Jason who signed up with A recalled such a term. And each time she called to ask for a withdrawal, the condition that she was asked to meet in order to withdraw her money became more incredible.

Deposits gone, company and persons involved untraceable

On the day Judy became very agitated and deciding to go to A to confront them, she arrived to see the doors closed and blocked by a throng of angry people. All were customers. A disappeared. Authorities could not help because A was not a regulated broker. Records with the public office as well as the landlords of premises occupied by A showed that directors of A were foreigners. They could no longer be reached as the numbers were invalid.

Modus Operandi of forex scam

How to protect yourself from such a broker scam:

- Check with local authorities that the broker is a regulated one .

- If you are signing with a broker that is foreign regulated, more effort must be put in to verify the truth.

- Do not commit too much money first. Deposit a small amount first, make some trades then try to withdraw some profits. Understand the procedures involved and find out the outcome.

- If the broker appears to be too enthusiastic about additional deposits, be very alert.

See what Bank Negara says

Members of the public are usually enticed to attend such investment or training programmes with promises of quick and good returns. The modus operandi of such programmes have included:

Offering free training, seminars or workshops to lure investors

Requiring investors to deposit an amount of money into a bank account to begin trading foreign currency, and subsequently, requesting for a top up on their initial investment