Forex News – Quarterly Tankan survey shows challenges ahead for Japan

Post on: 29 Июль, 2015 No Comment

Forex News – Quarterly Tankan survey shows challenges ahead for Japan

Posted on December 15, 2014 by the XM Investment Research Desk at 1:04 pm GMT

Today was an important day for Japanese markets as not only was the quarterly Bank of Japan Tankan survey of business sentiment announced, but the market got a chance to react to the results of the previous day’s Japanese elections.

The Tankan survey slightly missed expectations on the Big Manufacturers Diffusion index, as it came in at +12 against expectations of staying the same as the third quarter at +13. More worrying was the drop in the Big Manufacturers Outlook, as it fell to +9 against expectations it would climb to +14. This was despite the significant drop in the Japanese yen, which is supposed to help big manufacturers and exporters in general. Small manufacturing firms managed to beat expectations on current conditions (+1 actual versus -3 expected), but reported a disappointing outlook (-5 actual).

Non-manufacturers – particularly big ones – managed to beat expectations both on current conditions as well as the outlook, which was an encouraging piece of news. Capital expenditure plans for next year beat estimates for big firms, which plan to increase capex by 8.9%. Small firms on the other hand are planning to reduce their capex by 6.7%, a marginally smaller decrease than the 6.9% expected by economists.

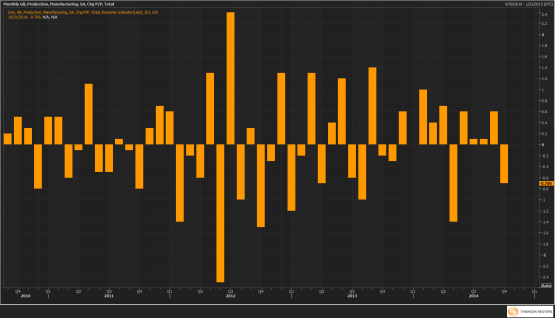

As the chart shows, there was improvement in business sentiment during 2013, but 2014 has not been as kind – perhaps as a result of the April tax hike – and Japanese business has struggled. The government hopes that a revival of business activity and profits will lead to higher wages and then a self-sustaining economic recovery. The evidence for this process taking hold is lacking.

Overall the survey showed that the Japanese economy is still struggling and no clear path towards significantly positive economic growth is evident. Policymakers will feel vindicated for their recent decisions – both the Bank of Japan for increasing its monetary stimulus and the government for delaying next October’s planned sales tax hike.

On the announcement of the Tankan survey results, there was little movement in the yen as dollar / yen traded from 119.05 before the news to 119. The yen was responding more to a big selloff on Wall Street the previous week and a falling oil price, rather than the re-election of Shinzo Abe, which was probably well anticipated by the market.

Important Notice: This investment research was produced by an independent analyst and Trading Point of Financial Instruments Ltd has verified that the producer of the investment research is subject to requirements equivalent to the requirements under Directive DI144-2007-01 of 2012 of the Cyprus Securities and Exchange Commission in relation to the production of the research.

Latest Market and Forex News

The Fed’s latest interest rate decision will be the highlight of next week. This key event is scheduled for Wednesday when the Federal Open Market Committee (FOMC) will hold a policy meeting and make the rate announcement after.

The US dollar was consolidating following major gains the previous day, but some buying of the dollar’s dips was also observed. For example, the euro rallied all the way up to 1.0640 level the previous day but fell below the []

USDJPY has scope for gains to the multi-year high of 122.01 hit on March 10th, 2015. Looking at the daily chart, the tenkan-sen and kijun-sen lines are positively aligned, which adds to the upside potential, as well as the market []

The dollar was broadly weaker today, allowing the euro to bounce off a 12-year low. Disappointing US retail sales data did not help. February sales figures showed a decrease of 0.6%, contrary to forecasts for an increase of 0.3%. Last []

The regular meeting of the Reserve Bank of New Zealand (RBNZ) resulted in a no-change decision, which kept the Official Cash Rate (OCR) at a relatively high 3.50%. Although the decision itself was widely expected, the RBNZ Governor Graeme Wheeler []

The euro was again weak today, as euro / dollar briefly traded below the 1.05 to mark a low of 1.0494 as the single currency failed yet again to find a bottom. As recently as a few days ago on []

NZDUSD bounced back post-RBNZ this morning. The pair had almost retraced the entire upleg from a 4-year low of 0.7175 to 0.7612. Prices tested the 50% Fibonacci retracement level of 0.7393.This is a critical level. A break above this would []

The euro slid to fresh 12-year lows today against the dollar to touch 1.0559. With a light economic calendar, the main driver of the single currency was the European Central Bank’s quantitative easing program. The 1.1 trillion-euro bond buying program []

The euro has been under intense pressure since the beginning of the year – particularly against the US dollar, against which it has dropped nearly 13% a huge drop in a period of almost three months.

The euro’s recent drop []