Forex Market World Largest Market Foreign Currency Exchange

Post on: 21 Июль, 2015 No Comment

FOREX MARKET—THE LARGEST MARKET IN THE WORLD TO INVEST AND GET RICHER IF YOU USE THE RIGHT TOOLS

THE FOREX MARKET:THE WORLD LARGEST EXCHANGE MARKET

The foreign exchange market, or forex, has notoriously been the domain of government central banks

and commercial and investment banks. But now more than ever individuals are tackling the forex

market as it offers trading 24-hours a day, five days a week, and the daily dollar volume of currencies

traded in the currency market exceeds $1.9 trillion daily, making it the largest and most liquid market in

the world.

KNOWLEDGEFINANCIAL.COM

The foreign exchange (also known as forex or FX) market is the place where currencies are traded.

The overall forex market is the largest, most liquid market in the world with an average traded value that

exceeds $1.9 trillion per day and includes all of the currencies in the world.

There is no central marketplace for currency exchange, rather, trade is conducted over-the-counter. The

forex market is open 24 hours a day, five days a week, with currencies being traded worldwide among the

major financial centers of London, New York, Tokyo, Zrich, Frankfurt, Hong Kong, Singapore, Paris and

Sydney — spanning most time zones.

The forex is the largest market in the world in terms of the total cash value traded, and any person, firm, or

country may participate in this market — KNOWLEDGEFINANCIAL.COM

Authorized Forex Dealer — KNOWLEDGEFINANCIAL.COM

Any type of financial institution that has received authorization from a relevant regulatory body to act as a dealer

involved with the trading of foreign currencies. Dealing with authorized forex dealers ensure that your transactions

are being executed in a legal and just way.

In the United States, one regulatory body responsible for authorizing forex dealers is the National Futures

Association (NFA). The NFA ensures that authorized forex dealers are subject to stringent screening upon

registration and strong enforcement of regulations upon approval

Currency

A generally accepted form of money, including coins and paper notes, which is issued by a government and

circulated within an economy. Used as a medium of exchange for goods and services, currency is the basis for

trade.

Generally speaking, each country has its own currency. For example, Switzerland’s official currency is the Swiss

franc, and Japan’s official currency is the yen. An exception would be the euro, which is used as the currency for

several European countries.

Investors often trade currency on the foreign exchange market, which is one of the most heavily traded markets in

the world.

Foreign Currency Effects — KNOWLEDGEFINANCIAL.COM

The gain or loss on foreign investments due to changes in the relative value of assets denominated in a currency

other than the principal currency with which a company normally conducts business. A rising domestic currency

means foreign investments will result in lower returns when converted back to the domestic currency. The

opposite is true for a declining domestic currency.

Foreign investments are complicated by currency fluctuation and conversion between countries. A high quality

investment in another country may prove worthless because of a weak currency. Foreign-denominated debt used to

purchase domestic assets has led to bankruptcy in several cases due to a fast decline in a domestic currency or a

rapid rise in the currency of the foreign-denominated debt.

Decentralized Market —- KNOWLEDGEFINANCIAL.COM

A market structure that consists of a network of various technical devices that enable investors to create a marketplace

without a centralized location. In a decentralized market, technology provides investors with access to various bids/ask

prices and makes it possible for them to deal directly with other investors/dealers rather than with a given exchange.

The foreign exchange market is an example of a decentralized market because there is no one physical location where

investors go to buy or sell currencies. Forex traders can use the internet to check the quotes of various currency pairs from

different dealers from around the world.

Exchange —- KNOWLEDGEFINANCIAL.COM

A marketplace in which securities, commodities, derivatives and other financial instruments are traded. The core function

of an exchange — such as a stock exchange — is to ensure fair and orderly trading, as well as efficient dissemination of price

information for any securities trading on that exchange. Exchanges give companies, governments and other groups a

platform to sell securities to the investing public.

An exchange may be a physical location where traders meet to conduct business or an electronic platform.

May also be referred to as share exchange or bourse depending on geographical location.

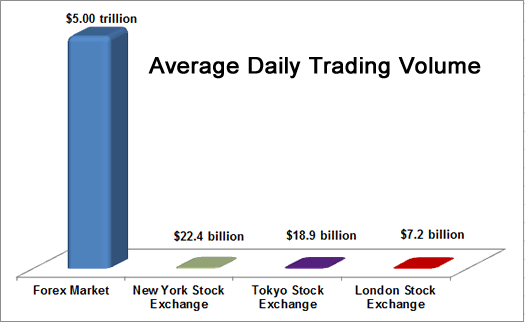

Exchanges are located all around the globe, with some of the more famous ones being the New York Stock Exchange,

Nasdaq and the Tokyo Stock Exchange. More and more trading is being done on electronic exchanges as markets become

more advanced and as the exchanges themselves are able to ensure fair trading without requiring all members to be on the

same trading floor.

Each exchange will have certain listing requirements for any company or group that wishes to offer securities for trading.

Some exchanges are more rigid than others, but basic requirements for stock exchanges include regular financial reports

and audited earnings reports. KNOWLEDGEFINANCIAL.COM

Base Currency — KNOWLEDGEFINANCIAL.COM

The first currency quoted in a currency pair on forex. It is also typically considered the domestic currency or accounting

currency. For accounting purposes, a firm may use the base currency to represent all profits and losses.

It is sometimes referred to as the primary currency.

For example, if you were looking at the CAD/USD currency pair, the Canadian dollar would be the base currency and the

U.S. dollar would be the quote currency. The price represents how much of the quote currency is needed for you to get one

unit of the base currency

Cross Currency

A pair of currencies traded in forex that does not include the U.S. dollar. One foreign currency is traded for another without

having to first exchange the currencies into American dollars.

Historically, an individual who wished to exchange a sum of money into a different currency would be required to first

convert that money into U.S dollars, and then convert it into the desired currency; cross currencies help individuals and

traders bypass this step. The GBP/JPY cross, for example, was invented to help individuals in England and Japan who

wanted to convert their money directly without having to first convert it into U.S dollars.

Quote Currency —- KNOWLEDGEFINANCIAL.COM

The second currency quoted in a currency pair in forex. In a direct quote, the quote currency is the foreign currency. In an

indirect quote, the quote currency is the domestic currency.

Also known as the secondary currency or counter currency.

Understanding the quotation and pricing structure of currencies is essential for anyone wanting to trade currencies in the

forex market. If you were looking at the CAD/USD currency pair, the U.S. dollar would be the quote currency, and the

Canadian dollar would be the base currency.

Major currencies that are usually shown as the quote currency include the U.S. dollar, the British pound, the euro, the

Japanese yen, the Swiss franc and the Canadian dollar

How does this market differ from other markets ?

Unlike the trading of stocks, futures or options, currency trading does not take place on a regulated exchange. It is not

controlled by any central governing body, there are no clearing houses to guarantee the trades and there is no arbitration

panel to adjudicate disputes. All members trade with each other based upon credit agreements. Essentially, business in the

largest, most liquid market in the world depends on nothing more than a metaphorical handshake

How much does it cost to trade forex? KNOWLEDGEFINANCIAL.COM

Before trading forex, you will have to open a trading account with a forex dealer. There are no rules about how a dealer

charges a customer for the services the dealer provides or that limit how much the dealer can charge. Before opening an

account, you should check with several dealers and compare their charges as well as their services.

The FX market is different from other markets in some other key ways that are sure to raise eyebrows. Think that the

EUR/USD is going to spiral downward? Feel free to short the pair at will. There is no uptick rule in FX as there is in stocks.

There are also no limits on the size of your position (as there are in futures); so, in theory, you could sell $100 billion worth

of currency if you had the capital to do it. If your biggest Japanese client, who also happens to golf with Toshihiko Fukui,

the Governor of the Bank of Japan, told you on the golf course that BOJ is planning to raise rates at its next meeting, you

could go right ahead and buy as much yen as you like. No one will ever prosecute you for insider trading should your bet

pay off. There is no such thing as insider trading in FX; in fact, European economic data, such as German employment

figures, are often leaked days before they are officially released.

Exchange Rate — KNOWLEDGEFINANCIAL.COM

The price of one country’s currency expressed in another country’s currency. In other words, the rate at which one currency

can be exchanged for another. For example, the higher the exchange rate for one euro in terms of one yen, the lower the

relative value of the yen.

In most financial papers, currencies are expressed in terms of U.S. dollars, while the dollar is commonly compared to the

Japanese yen, the British pound and the euro. As of the beginning of 2006, the exchange rate of one U.S. dollar for one

euro was about 0.84, which means that one dollar can be exchanged for 0.84 euros.

Currency Pair — KNOWLEDGEFINANCIAL.COM

The quotation and pricing structure of the currencies traded in the forex market: the value of a currency is determined by its

comparison to another currency. The first currency of a currency pair is called the base currency, and the second

currency is called the quote currency. The currency pair shows how much of the quote currency is needed to purchase

one unit of the base currency.

All forex trades involve the simultaneous buying of one currency and selling of another, but the currency pair itself can be

thought of as a single unit, an instrument that is bought or sold. If you buy a currency pair, you buy the base currency and

sell the quote currency. The bid (buy price) represents how much of the quote currency is needed for you to get one unit of

the base currency. Conversely, when you sell the currency pair, you sell the base currency and receive the quote currency.

The ask (sell price) for the currency pair represents how much you will get in the quote currency for selling one unit of base

currency. — KNOWLEDGEFINANCIAL.COM

For example, if the USD/EUR currency pair is quoted as being USD/EUR = 1.5 and you purchase the pair, this means that

for every 1.5 euros that you sell, you purchase (receive) US$1. If you sold the currency pair, you would receive 1.5 euros for

every US$1 you sell. The inverse of the currency quote is EUR/USD, and the corresponding price would be EUR/USD =

0.667, meaning that US$0.667 would buy 1 euro.

FOREIGN EXCHANGE -(forex or FX for short) is one of the most exciting, fast-paced markets around. Until recently, trading in

the forex market had been the domain of large financial institutions, corporations, central banks, hedge funds and

extremely wealthy individuals. The emergence of the internet has changed all of this, and now it is possible for average

investors to buy and sell currencies easily with the click of a mouse.

KNOWLEDGEFINANCIAL.COM

Daily currency fluctuation s are usually very small. Most currency pairs move less than one cent per day, representing a less

than 1% change in the value of the currency. This makes foreign exchange one of the least volatile financial markets

around. Therefore, many speculators rely on the availability of enormous leverage to increase the value of potential

movements. In the forex market, leverage can be as much as 250:1. Higher leverage can be extremely risky, but because of

round-the-clock trading and deep liquidity, foreign exchange brokers have been able to make high leverage an industry

standard in order to make the movements meaningful for FX traders.

Extreme liquidity and the availability of high leverage have helped to spur the market’s rapid growth and made it the ideal

place for many traders. Positions can be opened and closed within minutes or can be held for months. Currency prices are

based on objective considerations of supply and demand and cannot be manipulated easily because the size of the market

does not allow even the largest players, such as central banks, to move prices at will.

The forex market provides plenty of opportunity for investors. However, in order to be successful, a currency trader has to

understand the basics behind currency movements.

The goal of this tutorial is to provide a foundation for investors or traders who are new to the currency markets. We’ll cover

the basics of foreign exchange, its history and the key concepts you need to understand in order to be able to participate in

this market. We’ll also venture into how to start trading currencies and the different types of strategies that can be employed.