Foreign investment trends down in Ethiopia

Post on: 6 Апрель, 2015 No Comment

ADVERTISEMENT

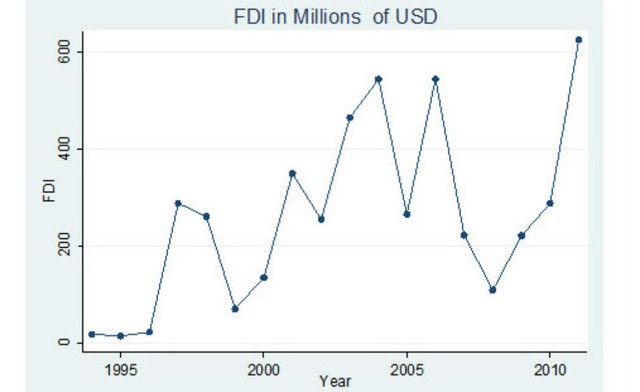

Foreign Direct Investment (FDI) to Ethiopia plunged by USD 82 million to reach a disappointing USD 206 million, according to a World Investment Report released this month by the United Nations Conference on Trade and Development (UNCTAD).

The report acknowledged that Ethiopia’s location in East Africa, historically the region with one of the lowest FDI inflows had contributed to the underperformance.

However the report noted the East African region’s FDI inflows reversed the downward trend of 2009–2010 to reach USD 3.96 billion, in 2011; a level just five percent below the peak of 2008. As most countries in this sub region have not been considered rich in natural resources, they have not traditionally attracted large investments into export-oriented production, except in agriculture. However, the discovery of gas fields is likely to change this pattern significantly.

FDI inflows to Africa as a whole declined for the third successive year, to USD 42.7 billion. The decline in FDI inflows to the continent in 2011 was caused largely by the turmoil in North Africa; in particular inflows to Egypt and Libya, which had been major recipients of FDI, came to a halt owing to their protracted political instability.

In contrast, inflows to sub-Saharan Africa recovered from USD 29 billion in 2010 to USD 37 billion in 2011, a level comparable with the peak in 2008. A rebound of FDI to South Africa accentuated the recovery.

The continuing rise in commodity prices and a relatively positive economic outlook for sub-Saharan Africa are among the factors contributing to the turnaround. In addition to traditional patterns of FDI to the extractive industries, the emergence of a middle class is fostering the growth of FDI in services such as banking, retail and telecommunications, as witnessed by an increase in 2011 in the share of FDI in services.

The UNCTAD FDI Contribution Index showed relatively higher contributions of foreign affiliates to local economies in developing countries, especially Africa, in value added, employment, export generation and R&D expenditures.

FDI inflows increased across all major economic groupings in 2011. Flows to developed countries increased by 21 percent, to USD 748 billion. In developing countries FDI increased by 11 percent, reaching a record USD 684 billion, while in the transition economies it increased by 25 percent to USD 92 billion.

The report also intriguingly revealed that the top country destination for Trans National Corporations (TNCs) for the year 2012-2014 was China, eclipsing the US to second place and just ahead of an emerging India.

The other members of the BRICS (Brazil, Russia, India, China, South Africa) group of emerging nations Brazil and Russia stood fourth and fifth respectively, while perhaps surprisingly Indonesia stood at sixth place above the European Economic power house Germany.

The UNCTAD report also said prospects for Foreign Direct Investment (FDI) continue to be fraught with risks and uncertainties said Ban Ki- moon, Secretary General of the United Nations adding that at USD 1.5 trillion, flows of global FDI exceeded pre-financial crisis levels in 2011, but the recovery is expected to level off in 2012 at an estimated USD 1.6 trillion.

He however said despite record cash holdings, transnational corporations have yet to convert available cash into new and sustained FDI, and are unlikely to do so while instability remains in international financial markets.

Even so, he said a positive sign is that half of the global total will flow to developing and transition economies, underlining the important development role that FDI can play, including in least developed countries.