Foreign Exchange Hedging

Post on: 10 Июль, 2015 No Comment

Who is this site for?

Posted by Dan Osborne Filed in foreign exchange hedging

People who are trying to build a commercial (not investment) business, grow market share, improve profitability and probably wish they did not have to deal with foreign exchange markets but . they do. We want to show you the most effective and efficient approach so you can go back to concentrating on your customers and not on the bouncing currency markets. I am not saying there is anything wrong with trading in and of itself, only that the methods used in trading should not be confused with those used in foreign exchange hedging. For example, some web sites call a stop loss a hedge. That can be somewhat confusing to a novice. A hedge should increase in value as your underlying or hedged position loses money. A stop loss is used in trading to exit a position which may or may not be losing money. Sure a stop loss can protect you from losing more money as the market moves against you but only by taking you out of the market. A business owner struggling with foreign exchange markets does not have the luxury of getting out of the market without going out of business. A subtle difference but an important one.

What is Hedging?

Posted by Dan Osborne Filed in basics

Hedging is the activity of entering in to financial transactions to reduce your exposure (risk) of financial loss. Most of the confusion with this concept is usually just caused by the terminology or the jargon. The financial transaction is often referred to as an instrument or tool but its really just a contractual agreement very similar to an insurance policy you might purchase. In fact, lets use the example of buying (i.e. entering in to a contract) home fire insurance to really get our head around this thing called hedging.

Lets say you just bought a new house for $250,000 and that you paid cash for the house. By purchasing that home you have created what is referred to as an exposure, that is, you could incur a financial loss if particular adverse events take place, in this example lets say that adverse event was fire. To reduce or eliminate your exposure (to loss due to fire) you engage in hedging activity or we say you put on a hedge. The activity you undertake is the purchase of an instrument called a home fire insurance policy. This policy is just one of several types of tools available to effectively manage your risk of fire. Once the insurance policy is purchased, you have eliminated your exposure and are therefore referred to as hedged with respect to fire risk.

Now hopefully the above was all pretty straight forward for most people, now lets just change a few of the details to see how it works for foreign exchange risk.

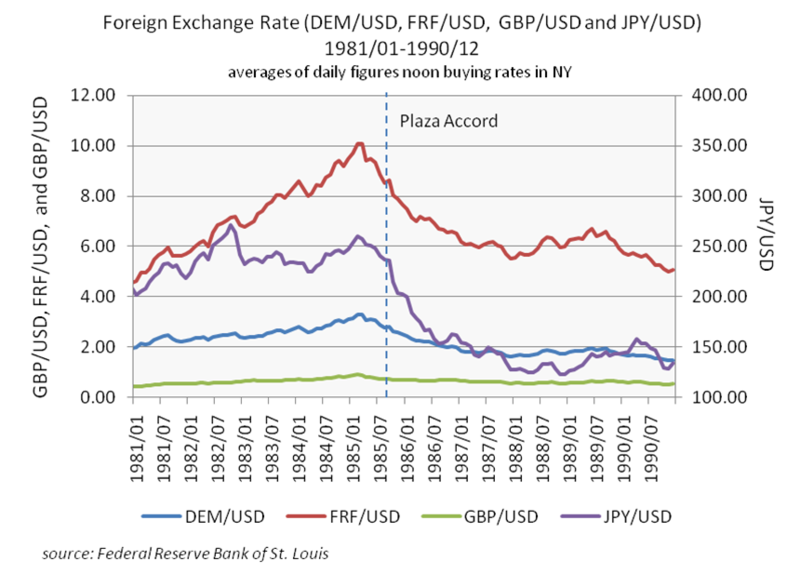

Lets say you just bought 100 TVs from a manufacturer in Japan to resell on Ebay for $250,000 and that you have to pay for them in Japanese Yen. By purchasing those televisions you have created what is referred to as an exposure, that is, you could incur a financial loss if particular adverse events take place, in this example that adverse event is the appreciation or increase in value of the Japanese Yen relative to your home currency (lets say the US dollar). To reduce or eliminate your exposure (to loss due a stronger Yen) you engage in hedging activity or put on a hedge. The activity you undertake is the purchase of an instrument called a forward exchange agreement or forward exchange contract (FEC). This agreement is just one of several types of tools available to effectively manage your risk of adverse exchange rate movements. Once the forward exchange contract is put in place, you have eliminated your exposure and are therefore referred to as hedged with respect to foreign exchange risk.

Hope this makes sense, love to hear some feedback on the comments section.

Technorati Tags: hedging