For BuyAndHold Investors It s Hard To Lose Money (Part II)

Post on: 14 Май, 2015 No Comment

Summary

- Buying and holding of high-quality stocks is a remarkably safe way to ensure safety of principal.

- Passive investing yields superior performance to active management.

- The Dividend Aristocrat stocks have outperformed broader market indices and are an excellent choice for solid returns and safety.

In Part I of this two-part series, I presented evidence that stock market is not as risky as many people tend to believe, and that buy-and-hold investing of high-quality, broad market index funds almost always results in profitable returns over the long term, even if purchases were made at all-time market highs (although adding on market downturns and setting up automatic purchases further reduces risk and increases profitability). In Part II of this series, I will take a closer look at buy-and-hold risk for several individual stocks and discuss why frequent buying and selling of stocks or funds is detrimental to portfolio performance.

But First This

Volatility has returned to the markets in a big way, and the long-awaited stock market correction (defined as a 10% decrease from market highs) came close to realization with all three major index averages dropping to negative year-to-date (YTD) returns last week. This downturn marks the fourth consecutive weekly loss for the market, which has not happened since August 2011. The S&P 500 index fell to 1,820.66, which is a 9.5% decrease from its all-time high of 2011.36 set on Sept. 18. The 10% correction level for the index is 1,810. Friday’s bounce pared some of those losses with the S&P ending 7.4% off its all-time high.

While no one likes to see their portfolios take a beating, these broad pull-backs are healthy for markets, and corrections are a normal component of bull markets. It has been over two years since the last market correction, and one is certainly overdue. But could this recent downturn be more than a simple 10% correction? Could we see stocks drop closer to 15-20%? That is certainly a possibility as the level of uncertainty and fear currently gripping the markets is the highest that it has been since 2011 and 2012. But for long-term investors with positions in broad, low-cost index funds or in high-quality, dividend paying stocks, there is no reason to be concerned, although it certainly is not fun to watch your unrealized capital gains plunge (so just don’t look at your accounts!). Indeed, long-term investors should use these market downturns as opportunities to add more shares to existing positions of their high-quality, blue chip holdings (either in mutual funds or individual stocks).

What’s Causing Recent Volatility?

There are a number of factors at play that are likely contributing to the recent market retreat from record highs, including worsening economic conditions in Europe, international strife in multiple parts of the world, fears over Ebola, the Fed shift away from monetary accommodation to monetary tightening (or not), and simply because it’s the fall. The month of September has seen some of the worst single-day market pull-backs while October has been the historical host to some major market crashes, such as Black Monday, which occurred on Oct. 19, 1987 and saw the Dow lose 22% of its value in a single day. Fall volatility can occur for a variety of reasons, including increased market volume as retail and institutional investors return from summer vacations and who may then decide to take profits on some of their gains, capital inflows that tend to be higher in the first half of the year due to tax refunds and maxing out of annual IRA contributions, and because many mutual funds end their fiscal years in September and will often sell their losers and buy winning stocks as window dressing for shareholders.

Aside from all of these factors, the first half of 2014 saw a number of record increases in the S&P 500 on top of the 31% gains in 2013, which also indicate this bull run is in need of a breather. Thus the recent market pull-back is a welcome respite for stocks as it shakes off investors who aren’t quite is resilient to volatility as they thought they were, and it helps keep stocks from getting too overvalued, which could lead to even bigger losses down the road. Indeed, the market now trades at a price/earnings (P/E) ratio of 14x the consensus estimates for 2015, which is just below the historical average, indicating that the market is fairly valued and not overvalued.

Figure 1: The 10 worst one-day point declines for the DOW Jones Industrial Average since 1896. The months of September and October are a recurring theme. Source: Money Morning, Why Stocks Fall in September .

For buy-and-hold investors, such volatility is just background noise on the way to long-term growth, and this volatility can provide nice buying opportunities to purchase high-quality stocks at a substantial discount to fair value. And while the months of September and October tend to get bad raps for their notable volatility, over the past two decades October has had the highest median return for the S&P 500 (+1.76%). Of course, there’s no telling where markets are headed from here, but there’s certainly no need to panic. Market volatility is normal and long-term investors should be prepared to ride the ups and downs of the market cycles. And for long-term investors, any money in the stock market should be considered money that you don’t need (at least in the next several years or more). Investors should have plenty of money in cash reserves to cover living expenses for a protracted period of time in case of unplanned catastrophes or sudden unemployment. I personally recommend keeping 3-5 years of living expenses in cash to allow you to ride out protracted market downturns without worry. The worst thing you can do in terms of performance returns is to sell your stocks for a loss during a broad market sell off when there is no underlying fundamental reason to do so.

So now that we’ve covered recent events and have established that there is no reason to fear the recent volatility (and rather, one should welcome the opportunity it presents), let’s turn our attention to why buy-and-hold (or passive investing) is the way to achieve long-term financial health.

Why Buy-And-Hold Investing Is More Profitable, More Tax Efficient, And Less Risky

Passive Investing Is More Profitable

As I noted in Part I, investors in stocks tend to keep a nervous eye on their portfolio holdings and will often trade in and out of positions or from one asset class to another in an attempt to preserve capital and minimize losses. However, markets are very unpredictable and investors who constantly move money in and out of positions risk making costly mistakes, not to mention incurring unnecessary commission fees and short-term capital gains taxes (if held in a taxable account). Although there are a plethora of very intelligent financial experts who will opine about when one should be in or out of the market, a Duke University study found that following the recommendations of the top 10% of market-timing newsletters resulted in a 12.6% annualized return from 1991 through 1995 whereas a passive strategy with the same volatility resulted in a 16.4% annualized return. Similarly, a University of Nebraska study found that market timing strategies reduced returns by 1.56% annually. Thus, although the so-called experts often advise investors to take some sort of action as markets rise and fall, as the studies above reveal, inaction is often the best action one can take to achieve higher portfolio returns.

Passive Investing Is More Tax Efficient

High portfolio turnover results in additional costs associated with higher commission fees and higher taxes from short-term capital gains, which increases the true cost basis of an asset. For instance, a study by finance researchers Robert Arnott, Andrew Berkin and Paul Bouchey commented on the irony that the strategy of active portfolio management, whose very goal is to generate greater returns, is impaired by the consequences of their actions due to tax drag. As an example, the authors illustrate that after 20 years, a stock portfolio with an assumed growth rate of 6% annually and with a 25% turnover rate would be worth 26% less at the end due to short-term capital gains taxes (in a 35% tax bracket). In order for this hypothetical active investor to break even with the passive investor, they would have to achieve a pre-tax portfolio growth rate of 8.15% to match the passive investor’s 6% growth rate (see Tables 1 & 2).

Table 1 & 2: The extra cost of active portfolio management. To match a 20-year passive investment at an assumed 6% growth rate, an active investor in a 35% tax bracket would need to achieve an additional 2.15% annual growth rate due to short-term capital gains taxes. Source: Is Your Alpha Big Enough To Cover Its Taxes? Revisited

Passive Investing Is Less Risky

So we’ve seen that by simply doing nothing, this passive investment approach can yield higher performance growth than an active management style. However, some investors will claim that they move in and out of positions to lock in gains or will set limit orders to avoid larger losses in a declining position or market. However, there are problems with these strategies as well because no one can predict how much higher a particular stock or the broader market could run or how far it could fall. Thus by selling a position when the market is moving higher, investors who try to lock in gains may well miss substantially more upside. Likewise, investors who sell through limit orders could sell only to see the stock rebound and move even higher. In either case, the investors now have to decide where to put their fresh capital, and finding a new high-quality bargain might not be easy.

Now to be clear, there are certainly times when it may be warranted to sell a position. If the market is offering you a ridiculously high price for a stock, then it may indeed be well worth it to sell the overvalued position and buy something cheaper (if someone is offering you $10 for a $5 bill, wouldn’t you take it?). Likewise, if a company’s fundamentals have been harmed, e.g. to an unforeseen new disruptive technology, it may be worth selling the position, even at a loss, to avoid further damage (to keep your $5 from turning into a few pennies). For example, Blackberry’s (NASDAQ:BBRY ) notable fall from mobile dominance due to the sudden and unpredicted rise of smartphones from the likes of Apple (NASDAQ:AAPL ) and others. Thus, unlike with broad index funds discussed in Part I, which can truly be ignored, investments in individual stocks does require more monitoring by the investor. Just how much monitoring depends on what type of stock is being held. Investments in high-quality blue chips (e.g. the Dividend Aristocrats) would need far less regular attention than an investment in a small cap growth stock or in a newly issued IPO stock. See my recent article on the Potbelly (NASDAQ:PBPB ) IPO as an example of the latter.

In the Intelligent Investor. Benjamin Graham distinguishes between two kinds of investors — the defensive investor and enterprising investor. The defensive investor, according to Graham, is one who is chiefly interested in safety plus freedom from bother, and should thus confine their stock holdings to shares of important companies with a long record of profitable operations and in strong financial condition. These types of companies are what I am referring to when I speak of high-quality companies. In contrast, the enterprising investor, according to Graham, is an active investor who will devote much care and time to seek securities that offer more attractive returns (alpha) than the average buy-and-hold, defensive investor. But as Graham notes, as a matter of fact the proportion of smart people who try this and fail is surprisingly large. Needless to say, the focus of the two-part series is toward those who consider themselves defensive investors and not to those who are enterprising investors, as I’m sure any enterprising investor reading this will claim that they have always outperformed the market on an annualized basis.

The Safety of Defensive (Passive) Investing

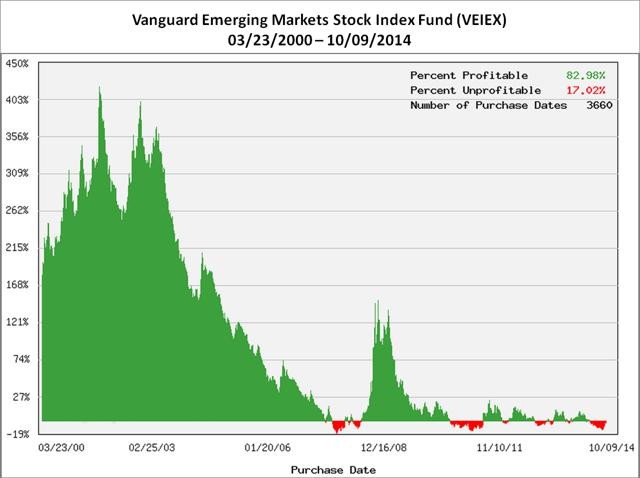

As with Part 1 of this series on index funds, I will present results obtained using the Stock Return/Purchase Date Calculator from buyupside.com to demonstrate the relatively low risk involved with buy-and-hold investing with high-quality individual stocks. However, unlike the ease with choosing a high-quality, passive, and low-cost broad market index fund (such as a total U.S. stock market fund or a S&P 500 fund from the likes of Vanguard or Fidelity), picking a high-quality stock to buy and hold requires more work on the investor’s part. To determine the quality of a company, one must look not only at the company’s growth performance, but also at other important metrics such as its 10-year debt/revenue ratio, free cash flow, dividend payout ratio, etc. Companies such as Morningstar, S&P Capital IQ and Valueline provide this information as well as give credit ratings on a company’s overall financial stability and I highly recommended these valuable resources. Access to the information from these ratings agencies can often be easily obtained electronically through your public library. Taking this into consideration, a good starting point to choosing stocks would be by looking at those within the list of Dividend Aristocrats or from Seeking Alpha contributor David Fish’s meticulously maintained list of Dividend Champions. Both lists contain high-quality companies that have increased their dividend payouts for at least 25 consecutive years and have tended to outperform both the large-cap S&P 500 and the small-cap S&P 600 indices (see Figure 2). While there are certainly many other high-quality stocks not on these lists, I will use this as the baseline comparison group.

Figure 2: The S&P High Yield Dividend Aristocrat Index (SPHYDA) has outperformed the S&P 500 Index and the S&P 600 Small Cap Index on a total return (NYSE:TR ) basis over the past 10 years. Source: S&P Dow Jones Indices

For this analysis, I used the Stock Return/Purchase Date Calculator to examine the percent gain or loss of individual stocks over a time period of close to 15 years, starting with the year 2000 market highs to present. The calculator analyzes every purchase date within this time frame and returns the percentage of profitable and unprofitable days if the stock was held to the end date (in this case, Oct. 15, 2014). By using this method, we can examine the relative risk to loss of principal for every buy date to the end date. The buy dates include purchases made at all-time market highs as well as market bottoms. Thus one can compare the historical risk to principal for stocks bought at high prices as well as at low prices.

Collectively, the average percentage of profitable returns across 3,664 possible purchase dates (March 23, 2000 to Oct 15, 2014) for the 54 Dividend Aristocrat stocks was 95.94%, while the average percentage of unprofitable returns was 4.16% (performance is for change in price performance only and does not include total returns from dividends as Figure 2 above does). Thus across all 54 Dividend Aristocrats, the risk of losing investment principal on any given investment date was only 4.16%.

This result compares similarly to the Vanguard S&P 500 Index Mutual Fund (MUTF:VFINX ) as well as the iShares Russell 2000 U.S. Small Cap Index ETF (NYSEARCA:IWM ). For the VFINX fund, there were 97.33% profitable purchase dates with 2.67% unprofitable dates, and for the IWM ETF, there were 93.26% profitable purchase dates with 6.74% unprofitable dates (see Figure 3 below). The three Dividend Aristocrat stocks with the highest percentage of profitable purchase dates were Cintas (NASDAQ:CTAS ), Consolidated Edison (NYSE:ED ) and Genuine Parts (NYSE:GPC ), with profitable percentages of 99.86%, 99.82%, and 99.81%, respectively. The three with the lowest percentage of profitable purchase dates were McDonald’s (NYSE:MCD ), Target (NYSE:TGT ) and Chevron (NYSE:CVX ) with profitable percentages of 84.29%, 87.97%, and 88.84%, respectively.

Figure 3: In aggregate, the 54 Dividend Aristocrats are acting as an index fund and provide a level of safety from loss of principal that is comparable to the safety of index investing discussed in Part I of this article. Source: buyupside.com

A Sampling of Individual Stocks

Now let’s take a look at some individual stocks and examine their profitable purchase date record from January 2000 to October 15, 2014. I chose this time frame to show the run up to the March, 2000 stock market bubble and the ensuing 2000-2002 bear market. This time frame also includes three market peaks and two bear markets. In this analysis, I will look at a variety of stocks in different sectors and will not focus exclusively on the Dividend Aristocrats. Before looking at the resulting graphs below, it is important to get a sense of valuation history for the stocks analyzed. Table 3 below provides a list of the stocks analyzed with the Stock Return/Purchase Date Calculator and indicates their current trailing-twelve-month P/E ratio, their P/E on March 23, 2000 (peak of the 2000 bubble), and their 5-year P/E average and forward P/E.

Table 3: At the peak of the 2000 stock market bubble, P/E ratios were exorbitantly high for many stocks. BlackBerry and Cisco (NASDAQ:CSCO ) were trading at hundreds of times their annual earnings. P/E ratios indicated by N/A indicate that the values are negative as those companies are currently losing money. Source: Morningstar and Y-Charts.

For each of the graphs below, each vertical line represents the percent gain or loss for a particular purchase date to the end date of the analysis (Oct 15, 2014). Positive returns are green lines and negative returns are red lines. The largest gains correspond to purchase dates with relatively low prices (e.g. purchases at or near stock price or market bottoms). Conversely, small positive gains or negative returns correspond to relatively high purchase prices (at or near stock price or market tops). See Part I of this article for a more detailed explanation.

The stocks analyzed include two favorites for dividend investors, Coca-Cola (NYSE:KO ) and Procter & Gamble (NYSE:PG ); three tech stocks, Cisco Systems, BlackBerry, and Apple; and three retail stores, The TJX Companies (NYSE:TJX ), J.C. Penney (NYSE:JCP ), Home Depot (NYSE:HD ).

Figure 4: Percent returns on share price (excluding dividends) is indicated on the Y axis. Buying stock in Coca-Cola, a Dividend Aristocrat, at any time between January 3, 2000 and held until Oct 15, 2014 would have generated a near 100% chance of profitable returns and only a 0.32% risk of loss to principal. The loss is only associated with recent purchases that were subsequently sold during the pull back from KO’s recent highs (indicated by red lines on the far right tail). Note that profitable returns would have occurred even if KO was purchased at previous all-time highs; however, return on purchases were much greater if shares were purchased at lower prices (indicated by large green lines).

Figure 5: Similar to KO, the Dividend Aristocrat Procter & Gamble had a high percentage of profitable purchase date returns (98.49%) and a low percentage of unprofitable purchase dates (1.51%). Likewise, the unprofitable returns are only for purchases made near recent all-time highs and sold at the end date.

Figure 6: In March of 2000, Cisco Systems was trading at a P/E multiple of 228x earnings. Thus investors who purchased shared at that time have never seen profitable returns on their purchase even after holding the stock for nearly 15 years (indicated by red vertical lines at the far left). Investors who bought the stock during the ensuing bubble burst between 2000-2002 bought shares at much more reasonable valuations and have profited if held to the end date shown. Overall, the risk to principal in for investors in CSCO has been far greater than for stocks in the Dividend Aristocrat list.

Figure 7: Like CSCO, BlackBerry was trading at an extreme P/E valuation of 895x earnings in March, 2000. It’s no surprise that investors who purchased shares at that time have never recovered their loss. But investors who purchased shares during the 2000-2002 bear market were wiser and saw profitable returns. However, this stock was chosen to illustrate the continued diligence needed by investors due to the possibility of a disruptive technology that can emerge and cause catastrophic losses for investors. Although BBRY was long the darling of the mobile phone industry, the disruption caused by the introduction of the Apple iPhone and other smartphones spelled doom for BBRY. It is not clear if BBRY will ever recover. Investors in large index funds like Vanguard’s VFINX do not need to worry about the collapse of any individual company.

Figure 8: Not all tech stocks during the 2000 market bubble had irrecoverable losses for investors. While not a Dividend Aristocrat, Apple has had stellar price returns with only 1.37% of purchase dates being unprofitable. This chart clearly shows the potential gains to be had with purchases of growing companies early in the growth phase. But note how the gigantic gains quickly taper as small-cap companies turn into mega-cap companies (i.e. high growth rates are not sustainable indefinitely). Importantly, it is very difficult if not impossible to predict which small cap stocks will become the next AAPL. Will AAPL eventually join the Dividend Aristocrats along with the likes of KO and PG? Time will tell.

Figure 9: Despite global recessions and emergence of disruptive online sales through the likes of Amazon.com (NASDAQ:AMZN ), the off-price retailer has seen stellar price returns over the past 15 years. Although not a Dividend Aristocrat, the stock has a similar risk profile with 96.83% of its purchase dates being profitable and only 3.17% of purchase dates being unprofitable. For more on TJX, see my recent article on the company.

Figure 10: Shareholders of J.C. Penney have not been as fortunate as TJX investors. This company has been hammered by a number of factors, including slowing retail sales, management turnover and poor business decisions. This chart again illustrates the continued diligence necessary if one is going to invest in individual stocks. Picking a high-quality stock is an important step, regular monitoring a company is just as important.

Figure 11: Home Depot is another retail stock that has done exceptionally well across economic downturns. A major strength of HD is its wide economic moat due to its large scale and bargaining power that makes it extremely difficult for new competition to emerge. Across the time frame analyzed, the stock has 98.98% profitable purchase dates and only 1.02% unprofitable purchase dates.

Conclusion: In this two-part series, I have hopefully demonstrated that investing in the stock market using a passive buy-and-hold strategy is not nearly as risky as many people would believe. Part I of this series focused on broad market index funds, such as an S&P 500 index fund, while Part II focused on some individual stocks. In both articles it was shown that the risk to an investor’s principal is actually very low if one focuses on buying and holding high-quality assets. This safety of principal generally holds even if an asset is purchased at all-time highs; however, one should always be conscious of valuation and focus on purchasing stocks or indexes at reasonable valuations and during broad market pull-backs. Setting up automatic payments into mutual funds is an excellent way to ensure that one buys into the market across a range of prices. Similarly, investing in dividend paying stocks with those dividends reinvested increases total returns through compounding of shares, and also guarantees that additional shares will be purchased across market cycles.

Recent volatility and fear in the markets has created some nice buying opportunities, and although prices have stabilized over the past couple of days, the chances of multiple single-day pull-backs on the order of 1% or greater appear more likely going forward. For buy-and-hold investors seeking to add individual stocks to their portfolios, it is suggested that they focus on high-quality stocks with superior financial health and begin their search with stocks within the Dividend Aristocrats list or from Seeking Alpha contributor David Fish’s Excel spreadsheet of Dividend Champions, Contenders, and Challengers. The recent collaborative article on Seeking Alpha entitled, The New Nifty Fifty, (Part I) — Dividend Growth Style is also a highly recommended read.

Disclosure: The author is long HD, KO, PG, TJX. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.