Floating rate bonds as a hedge against rising interest rates

Post on: 22 Май, 2015 No Comment

A year ago I posted the article that follows, highlighting two very obscure and illiquid securities that should do well if and when interest rates go up.

One is a PIB 1 from Nationwide, and the other is a preference share from the UK arm of the South African bank Investec.

In the 12 months since then, the price of the first has risen 10%, while the second is up 34%.

Superficially, this doesnt make sense. Interest rates have not risen, and so the floating rate element of the coupon has not adjusted upwards. All thats happened is that the higher price has pushed the already tiny yields down for new money, meaning the securities are now paying just 3% or so on purchase.

I believe whats happening is that investors are now valuing the built-in floating rate protection more highly, given that an interest rate rise in the UK no longer seems about as likely as Charles becoming King.

Unemployment stands on the threshold of the Bank of Englands 7% target for rate rises, and the UK economy is starting to pick itself up. Its not pretty to look at and its as unbalanced as a Friday night drunk on a Saturday morning, but its definitely still alive.

Gilt yields have also responded. In Spring 2013 the ten-year gilt was yielding below 2%; this month it briefly crossed over the 3% mark.

I dont think Bank of England governor Mark Carney has any intention of raising rates yet, but they must rise eventually if the economy keeps mending. Once that happens, the only way these instruments are likely to go is up.

Ive therefore republished the piece for interested souls ahead of any such hike.

Please note:

- Ive not updated the numbers or anything else in the article. Currently CEBB costs 85.25p to buy and INVR 525p. Youll have to do your own sums.

- Clearly some of my speculation about price moves was off the market, given that theyve already moved higher. As I say, I think this reflects the optionality of the floating rate element no longer being discounted by the market.

- The spreads are absolutely horrendous – in the region of 10%. These are tiny issues. If they spike in price and you overpay, you could be looking at red in your portfolio for years to come.

- The brilliant Fixed Income Investor website wrote about INVR in October, when the price was 60p lower.

- I own a small amount of both.

I think these are interesting issues that arent big enough for hedge funds and the like to get involved with. They can be used to add interesting diversification to a portfolio at some cost, if youve got a suitably long-term mindset and are prepared to take on the credit risk.

However I repeat they are illiquid, expensive, and are best suited to sophisticated investors who know what theyre doing. You have been warned.

Original article from 24 January 2013 begins

Note: This is not a recommendation to buy any of the securities I mention (including CEBB and INVR). I am just a private investor, sharing my thoughts for your entertainment. Please see my disclaimer and do you own research.

T he Bank of England currently has interest rates set to low. In fact, at 0.5% theyre at rock bottom.

Rates are so low that if the UK economy were a patient hooked up to a life support machine, youd be banging the side of it to see whether the flat line was due to a valve getting stuck somewhere or a bed being freed for the next one.

Heres a graph from MoneyWeeks Merryn Somerset-Webb:

Yes, its a 300-year graph. Rates have not been so low since at least 1700!

The graph goes back to before the Industrial Revolution – back to an era when having a few sheep and a goat made you quite the catch around the hovels. It includes periods when Britain had the largest Empire the world has ever seen, and years when Blighty was in the dumpster, begging the IMF for a bailout.

Throughout all that, bank rates never fell below 2%, to my knowledge. Yet here we are today, and you can almost here the beeeeeeep of the flatlining base rate :

Click to enlarge

Of course, the unprecedented 0.5% base rate that prevails at the time of typing is scant reward with inflation at over 2.5%.

On the contrary, the low bank rate is meant to pull down interest rates along the curve to encourage banks and others to lend and invest in order to earn a real return, as well as to stop crucial institutions from going bust.

The resultant steep yield curve has supported an economy thats lurched in and out of recession in the face of a global deleveraging. Those who bemoan the bank for inflating away the cash savings of pensioners should at least consider the alternative.

Hunting for value in a low-yield world

As I suspected might happen back in December 2009, the resultant steep yield curve has also caused assets like equities to soar.

This isnt exactly an accident – as I said, central banks want to encourage people to move into riskier assets. However Im sure even Mervyn King and his team have been surprised by just how strong the rally has been.

As regular readers will know Ive been very fully invested in this bull market since it kicked off back in March 2009 (and, less lucratively, before then!)

But with indices now approaching new highs in the US and UK markets getting back to their pre-crisis levels, even Im a little giddy.

Dont get me wrong. Im definitely not calling the top of the stock market. Even if I thought I could do such a thing consistently, I wouldnt do it today.

Shares dont look cheap anymore, but in the UK and Europe they still seem fair value. I suspect prices will be much higher 5-10 years from now. I remain much more optimistic about shares than most people.

However when the Sunday papers start extolling the joys of shares on the back of them costing more to buy again – I know, go figure – then its only sensible to look for greater diversification.

But where? Ive been allowing my cash reserves to build with new money, but thats barely breaking even after inflation. UK government bonds are peerlessly safe, but the price you pay for a secure return of capital is very little actual return on your money.

The 10-year gilt is still yielding barely 2%, despite falling in price recently. I remain wary that these price falls could be just the start of a trend.

Ive had some nice gains with risky fixed interest preference shares such as the Lloyds LLPC issue, but running yields of around 7.5% seem to me to be up with events. Besides, I continue to hold that one and Im supposed to be diversifying.

Hunting about in the forgotten corners of the market though, Ive found two other obscure securities that offer something a bit different – and that look cheap to me.

Two illiquid and obscure floating rate securities

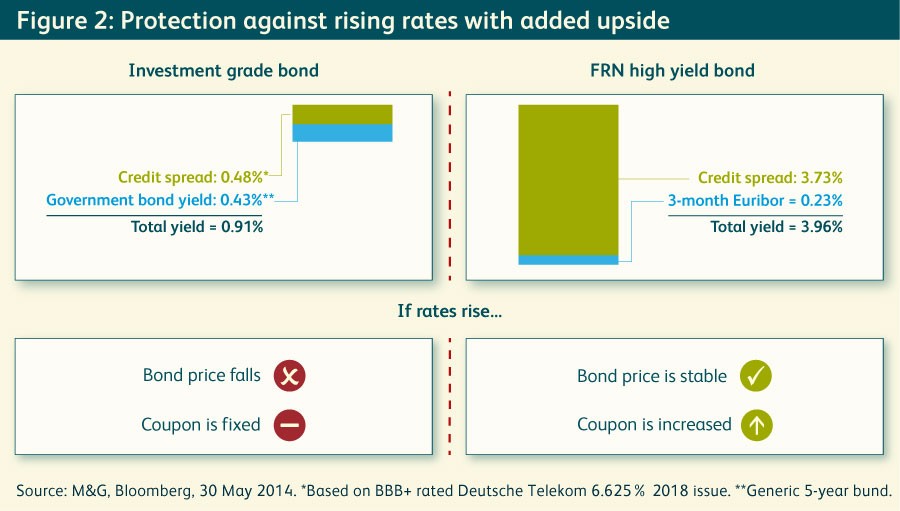

These two fixed interest securities – one from Nationwide and the other from South African investment bank Investec – pay a floating coupon, instead of the fixed coupon you get from normal bond.

The coupons are linked to interest rates. As rates go up, the coupon increases, and vice versa.

Both securities are perpetuals. This means they cannot be redeemed by their issuers, and so should pay out for as long as you hold them, provided their backers are able to pay – that is, assuming they dont go bust or otherwise have problems.

On that note, lets begin the risk notices.

Important warning: These are illiquid and subordinated securities. If the Nationwide or Investec was to get into serious trouble, they might stop paying interest. Worse, if the bank was to go bust or require new capital, you could lose some or all of your money. You have no deposit protection from the FSA.

The Nationwide is the UKs largest building society and its been a rescuer during the crisis, but its fortunes depend on what I think is still an over-priced UK housing market.

Investec is more diversified, but much of that is diversification is in South Africa. That is a bit like diversifying a hot burn youre getting from holding a frying pan by sticking your free hand into the fire.

On a brighter note, both have continued to pay throughout the crisis – and Investec has even continued to pay ordinary shareholders a dividend. So Ive put some money into these issues, knowing that I could lose it all.

You have been warned!

The joys of a floating coupon

Its vital to research any bond or building society PIBS (which is what the Nationwide issue is) before you consider investing.

What follows is just some sketch notes, not an exhaustive write-up. Please do your own research using bond-focused sites like Fixed Income Investor and Fixed Income Investments. as well as material from the banks themselves, before making your own mind up. Do not take my amateurish word for anything.

Here are the most pertinent details.