Flipping Phoenix Houses Auction Sales

Post on: 15 Май, 2015 No Comment

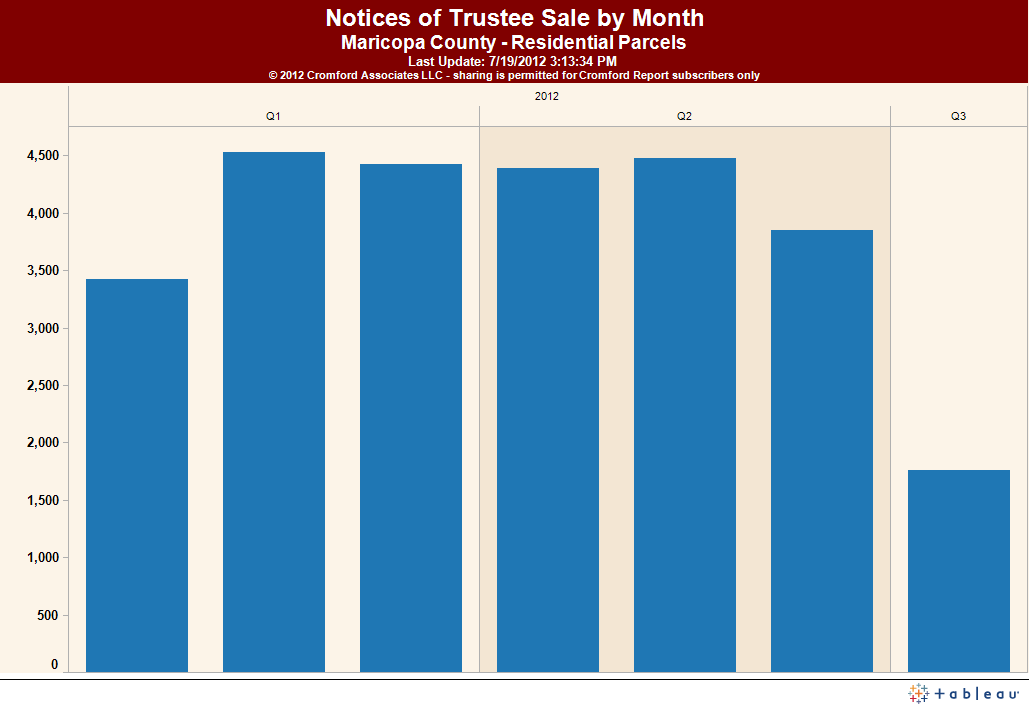

Auction Sales

First of all, it’s not called an auction in Arizona. The legal term is trustee’s sale. That’s because when a homeowner defaults on their deed of trust (Arizona is a trust deed state, mortgages are not typically used to securitize loans here) a trustee is named to collect the debt. The trustee is usually a law firm like Tiffany & Bosco, or a collection company like ReconTrust (owned by Bank of America).

Secondly, these sales don’t just take place at the courthouse steps. They occur all over the city in law firms and conference rooms, at 9a, 10a, 11a, 11:30, 12p, 12:30p and 2p. Some trustee’s do a handful of sales a day, others do hundreds.

These trustees handle all aspects of the sale, from the initial notice to the homeowner (called the Notice of Trustee’s Sale), to publishing the notice with the Maricopa County Recorder, to facilitating the sale.

The notice of trustee’s sale is sent to the borrower via certified mail and posted in a visible location at the property (usually the front door or garage door). The borrower then has 90 days to either bring the loan current or pay off the debt. If neither occurs then the property will go to sale.

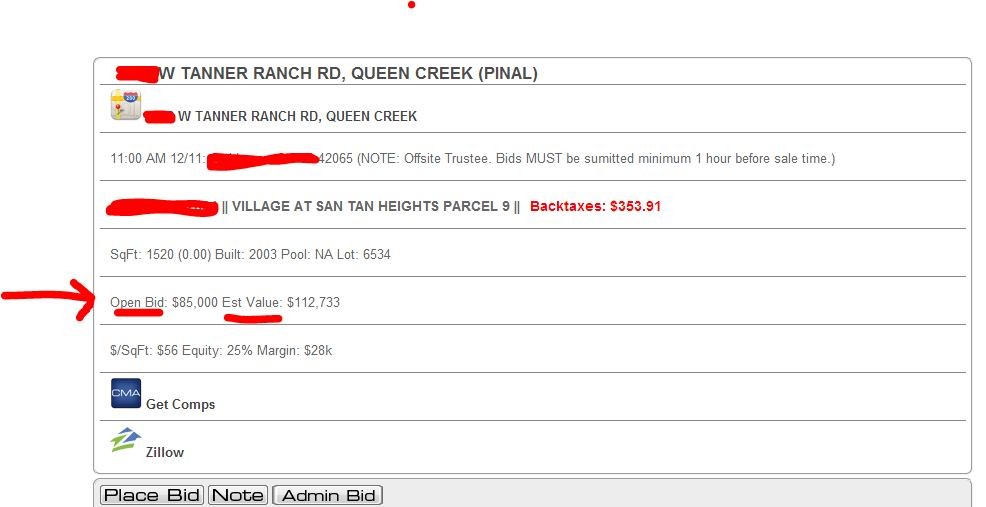

The trustee, at the direction of the lender they represent, will set the opening bid for the sale. Most of the time the opening bid is set at what the borrower owes, plus arrears. This is why so many homes end up back in the hands of the bank – no third party bidder in their right mind would be willing to pay more than what the home is worth.

It’s also important to note that few of these sales actually take place on the date written in the original Notice of Trustee’s Sale. Many are postponed a week, a month, a year, or longer. This is because the borrower may be working with their lender on a loan modification or short sale. The lender may have other reasons for postponing the scheduled sale (i.e. they already have too many other homes on the market or they think they can recover more money by waiting to foreclose.)

So, if you have your sights set on going to a trustee’s sale to bid on a specific property be prepared to be disappointed because the opening bid most likely will be higher than what you’re willing to pay. Or, the sale will be postponed, again and again and again.

At the Auction

There are usually 25-50 bidders at a Maricopa County trustee’s sale, most of them professional bidders. Professional bidders can represent numerous clients. Some or all of their clients may be interested in buying the same property. These bidders carry smart phones, tablets and laptops and are in direct contact with their clients during the sale.

Their clients also have different exit strategies. Professional bidders represent primary home buyers, second home buyers, and investors – small, medium and large. These investors each have different exit strategies (fix and flip, buy and hold). Depending on condition, it’s not uncommon to see homes sell for 85-95% of retail value.

The auctioneers don’t have gavels, nor do they talk really fast. However, as many as three auctioneers, or more, often will start accepting bids simultaneously so you better know which one of them is handling the sale of the property you want to buy.

Here’s an interview with Dusty Figgs of AZBidder.com to explain what it’s like at a trustee’s sale at the courthouse steps:

Do Your Homework

Before you show up at a trustee’s sale you better do your homework. That’s good advice from professional bidder Dusty Figgs of AZBidder.com. What does he mean by do your homework?

For starters, you need to know if the opening bid is set low enough to join the gang down at the courthouse steps. About 60-70% of the time the opening bid is set at what the homeowner owes, plus arrears. This is why so many houses go back to the beneficiary (the bank).

Where do you go to find out the opening bid? If you have a copy of the Notice of Trustee’s sale, which can be found on the Maricopa County Recorder’s website, there should be a phone number with the sale information. There are also third-party websites, like AZBidder.com, that publish this information for free. Many of the trustees have their own websites where you can check for opening bids. The trustees are required to publish the opening bid 24 hours prior to the sale, but they play fast and loose with the rules. Sometimes they’ll do a “drop” bid hours or minutes before the sale. If you’re not at the sale, or have some at the sale to represent you, you’ll have no idea the opening bid was lowered.

Next, you need to know what lien position you’re bidding on – anything but the 1 st lien and you’ll have to pay off all senior lien holders. Let’s say, for example, you bid on a property with an opening bid of $90,000. You bid all the way up to $115,000 and win, only to find out there’s a senior lien of $150,000. Guess what? You now have to pay off that senior lien holder to get clear title to the property.

How do you find out what position the foreclosing lien holder is in? You order a title report from a reputable title company or bidding service. The title report will reveal all sorts of stuff – junior lien holders, child support judgments, state and IRS tax liens, HOA judgments, unpaid property taxes and pending bankruptcy.

Once you’re certain the foreclosing lender is in first lien position it’s not a bad idea to drive by the property you want to bid on and make sure it hasn’t burned to the ground. If the house is vacant you can probably peek through the windows and over the fence.

In the event the house is occupied you’ll have to take your chances. Sure, you could knock on the door, explain to the homeowner that you plan to buy their house at the auction and then ask for a guided tour. WARNING: This tactic usually doesn’t work. Expect to have the door slammed on your face, or to get punched in the face. If the house is occupied and you win the bid the homeowner must be evicted, like a tenant that hasn’t paid their rent. There are several law firms here in town specializing in evicting foreclosed homeowners. This process can be done in about 3-4 weeks. Of course, you can also bribe, I mean offer cash for keys to the occupant. I’ve found a $1,000 will get just about anyone to move out in 7-10 days.

The trustee’s sale works a lot like a traditional auction. Bids are placed in increments of $100, or more, depending upon how low the opening bid is set for and how many bidders are involved.

If you win a bid the auctioneer will require $10,000 in certified funds made out to the trustee. The remainder is due the following day at 5p in the trustee’s office. Don’t expect a traditional bank to finance the purchase of your property at the trustee’s sale. You’ll need cash, or a hard money loan. There are numerous hard money lenders in Phoenix that will finance your purchase in 24 hours for 25-30% down at 16-18% interest.

For more insight into this part of the process here’s another interview with Dusty Figgs of AZBidder.com:

Taking Ownership of the Property

Congratulations! You won the bid. Except don’t expect 30 pages of escrow documents proving you’re the new owner. No, all you’ll get from the auctioneer is a one-page vesting sheet.

What’s a vesting sheet?

Basically, it’s a receipt for $10,000 that says you were the winning bidder. The auctioneer will ask how you want title vested. If you want the title in your name then give them your name. If you want it in an LLC then give them your LLC’s name – pretty simple.

In about 2-3 weeks you’ll receive the trustee’s deed in the mail. This is the certified document that gives you title to the property and it’s up to you to make sure it’s recorded with Maricopa County. Don’t lose this. That would be very bad.

And now that you’re the new owner of the property you’ll be responsible for all of the stuff homeowners have to be responsible for – back property taxes, homeowner’s association dues and most importantly, insurance. Whether you’re paying cash or getting a hard money loan it’s imperative to obtain insurance, especially if there’s someone still living in your house.

There are insurance companies that will underwrite a policy on a vacant house, for a steep price of course.

Buying a house at the courthouse steps is not for primary homebuyers or the novice real estate investor. As you heard from professional bidder Dusty Figgs there’s a lot of homework required prior to the trustee’s sale. You’re better off hiring an experienced bidding service to help you.

I’ve been fixing and flipping houses for 10 years and I still use a bidding service. Why? Because I don’t have the time to be at the courthouse steps everyday. Nor do I have the resources to pull title and drive by 10-15 houses a day.

AZBidder.com does all of this for me (by the way, I get nothing from AZBidder for these blog posts, I’m just a very satisfied customer). And yes, there are other companies here in Phoenix that offer similar services. I just believe that the guys at AZBidder.com do it the best.

Here’s one last interview with Dusty Figgs. He’ll give you some real world examples of why using a professional bidding service is the difference between winning a bid and losing your assets.