Five Ways to Improve your P2P Investment

Post on: 9 Июнь, 2015 No Comment

Peer to peer (p2p) lending has been around for several years now, but during this time there has been a wide range of investor returns. The most successful investors are earning more than 20%, but there are some unfortunate individuals who have lost money with returns of -25% or worse. Most investor returns fall somewhere in the 6-12% range. So how can you ensure as an investor that you earn an above average return? Here are five keys that will help you become a successful p2p investor.

Diversification

This is the most important point of all. You can really limit your chances of a good return if you do not diversify. If you invest $5,000 or less then you should consider keeping each loan to just $25 (the minimum). You will have defaults during the life of your loans, and you want to limit the damage that defaults can do to your returns. Don’t make the rookie peer to peer lending mistake I made and split your initial investment between a small number of loans. If you only invest in a handful of loans and one of those loans defaults, then you have ruined any chance you had of a good return. Both Lending Club and Prosper have automated plans that allow you to easily diversify your investments among many loans. But serious investors will consider each loan individually, which brings us to the next point.

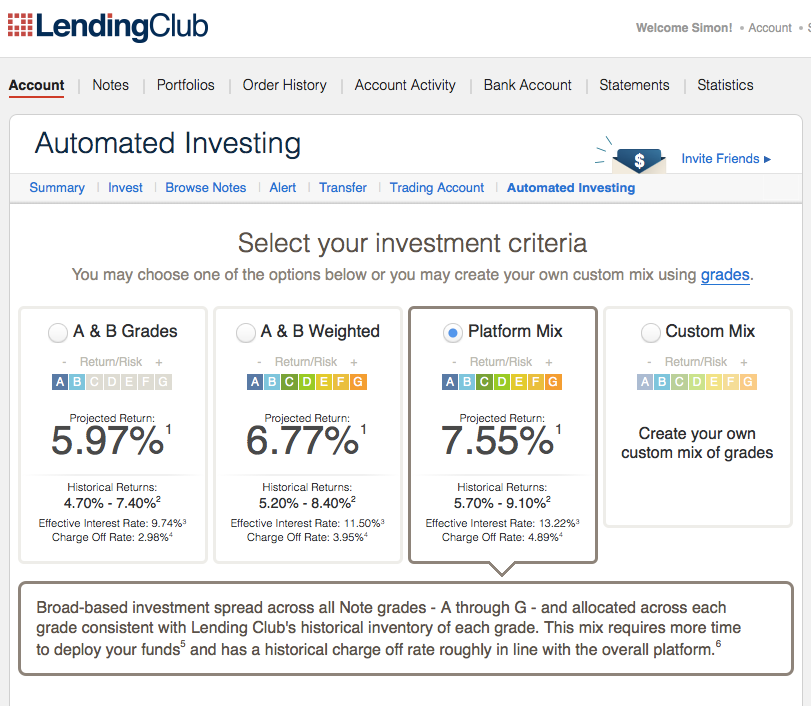

Choose Your Loans Carefully

You can use the automated investing plans, if you want to receive an average return. Don’t take it the wrong way. An average return with p2p lending continues to be an excellent investment in today’s low interest rate climate, but if you want a great return, you need to be better than average. This means you need to look at the loans individually. This can be a little daunting with hundreds of loans to choose from, so I recommend you narrow down your loan selection first by using some p2p lending filters. Once you have narrowed down your selections, then you can read the details of each loan to find out more about the individual borrower. You can even ask the borrower some questions before making your decision.

Invest Slowly

With most investments you just transfer your money in, and it starts working for you right away. With p2p lending it is best to invest slowly. If you have followed point two here then you likely only have a small number of loans that seem worthwhile. Depending on your investment amount, invest a small amount (I recommend $25 or a maximum of 1% of your loan portfolio) in each loan and then wait a few days until more loans are available. Then repeat the process. It might take you several weeks until you have all your money invested, but in the end you will have a high performing loan portfolio.

Select Longer Term Loans

This is not something that Investor Junkie does, but longer term loans provide you with a 2-3% bump in interest rates. My research has shown that the majority of defaults occur early in the life cycle of a loan so I would expect defaults to be only slightly more than with the three year loans. Even if they are a little more you have some more wiggle room with the higher interest rate. Having said that, these five year loans are still new, they were introduced just last year by both Lending Club and Prosper, so there is no guarantee that these longer term loans will perform better in the long run. The way I see it, if you choose your loans carefully, thereby limiting your number of likely defaults, the extra 2-3% is worth the extra risk of the longer loan duration.

Reinvest Interest Payments

Once you have invested in loans you will start receiving payments in your account within 30-45 days. This cash will sit in your account earning 0% interest until you reinvest in new loans. As soon as your balance goes over $25, you can invest your cash into a new loan. Depending on your account balance, this can happen quickly. With a diversified $10,000 loan portfolio you typically get enough cash to invest in two or three new loans every week. Keep in mind with p2p lending you are getting interest plus principal payments for each loan every month.

In Summary

One final point that will help you become a better investor. Don’t rely on the ROI numbers that Lending Club or Prosper provide. Do your own analysis to determine your real p2p lending ROI. Both companies tend to overstate your actual return a little, and so it is best to find the real number yourself using a simple Excel spreadsheet and the XIRR() function.

Many investors are drawn to p2p lending because of the promise of high returns, but few investors take the extra time to discover how they can maximize these returns. If you implement these five keys it is highly likely that you will become a successful p2p investor with above average returns.

This was a guest post by Peter Renton, editor of the Social Lending Network. a blog dedicated to the peer to peer lending industry.