Five ETFs For A Housing Recovery

Post on: 14 Август, 2015 No Comment

Over the past 18 months, housing prices have retreated sharply from the highs reached at the end of the housing boom. However, there are reasons to believe that one of the longest and most severe housing slumps ever is nearing an end. Building permits recently increased to a 584,000 yearly pace, well above the forecasted 570,000 and the highest level since November 2008. Construction of single-family houses, which accounted for 84 % of the industry last month, increased 2.1% to an annual rate of 482,000, while work on multifamily homes jumped 67 % to an annual rate of 92,000. And most recently, home sales for November surged 7.4% over the previous month, reaching the highest level since February 2007 on a seasonally-adjusted basis.

On the high-end side of the market, Robert Toll, CEO of luxury home giant Toll Brothers said during a Bloomberg Television interview on Dec. 11. that “there is a pretty good reservoir of pent-up demand, we don’t know how fast we’re coming back, but we do know we’re coming back.” The company also recently reported a 42% surge in fiscal fourth-quarter orders, suggesting that demand is beginning to come back for luxury homes as well. The increase has not been limited to any one particular area of the country either: gains were recorded in all four regions of the country in November. [For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free seven day trial to ETFdb Pro ]

Due to the proliferation of ETFs over the past few years, there are now several ways for investors to play a bounce back in the housing sector. While the housing market remains very shaky, some are beginning to see the light at the end of the tunnel and are signaling that this may now be the time to jump back into housing related industries. ETFs that could see a big jump if the housing market is indeed back on track include:

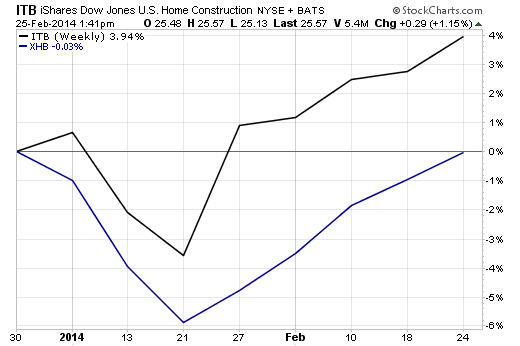

SPDR S&P Homebuilders (XHB )

The most basic and pure play on an end to the housing downturn, this fund invests in companies that specialize in home construction, maintenance, and furnishings. This results in an interesting mix of stocks ranging from Tempur-Pedic and Lowes to NVR and Pulte. The fund only has 25 stocks and is skewed towards mid cap and small cap securities, which currently account for more than 87% of the funds assets. The fund has an expense ratio of 0.35% and is up almost 29% in 2009.

iPath Dow Jones AIG Copper Total Return ETN (JJC )

A crucial component of housing construction, copper is found in everything from roofing to doorknobs to wires. This industrial metal has been on a tear in 2009, and could continue to appreciate in 2010 if the housing market rebounds. In addition to providing housing exposure, copper is a play on construction growth in emerging markets and maintains very low correlation with the S&P 500, meaning that the metal could provide valuable diversification benefits. The fund charges an expense ratio of 0.75% and has been one of the best performers this year, up 118%. This guide to copper ETFs has more information on the drivers of JJC [also see Free Report: Everything You Need To Know About Commodity ETFs ]

Claymore/Beacon Global Timber Index Fund (CUT )

An increase in housing construction will most likely cause a surge in the demand for timber products. This could help to push up the stocks in both the iShares (WOOD) and Claymore (CUT) timber ETFs, both of which have outperformed the S&P 500 by a huge margin in 2009.

While similar, the two funds have a few key differences. WOOD is much more focused on domestic companies, with 54% of the fund allocated to American firms and 19% to Canada. CUT takes a much more international approach with just 26% of the fund going to American firms and large weightings going to Japan (18%) and Brazil (9%). CUT has a higher expense ratio (0.65% compared to 0.48% for WOOD), but it has also outperformed the iShares timber fund by about 15% in 2009. For more reading on timber ETFs, see this feature .

MacroShares Major Metro Housing Up ETN (UMM )

This fund offers exposure (though not direct exposure) to the S&P/Case-Shiller Composite-10 Home Price Index. The Case-Shiller 10 Home Index is one of the main benchmarks for the housing industry, following the prices in the nations ten largest metro areas. The fund is fully-collateralized by investments in U.S. Treasuries. overnight repurchase agreements secured by Treasuries and cash which can help produce quarterly distributions. UMM has had a rocky past six months, but it could further appreciate if the housing rebounds in the nations most populous areas. UMM is up 19% this year and charges 1.25% for an expense ratio. Read more about how this ETF works here .

iShares Barclays MBS Bond Fund (MBB )

Roughly half of Americas mortgages are owned by institutions like Fannie Mae and Freddie Mac before being packaged and sold to investment firms as mortgage backed securities. This fund has nearly $2 billion in assets, making it one of the world’s largest holders of mortgage-related assets. MBB has an S&P rating of AAA, and about 45% of holdings allocated to both FHLMC and FNMA (the remaining 10% or so is in securities issued by GNMA).

MBB charges an expense ratio of 0.34% and invests in primarily short term securities with only a few years or less to maturity. The fund is only up 2.6% in 2009, and pays a respectable distribution yield of 3.4%. For more information and analysis about MBS ETFs read our recent article on the topic.

For more ETF news, make sure to sign up for our Free ETF Newsletter .

Disclosure: No positions at time of writing.