Fitch Financial Companies Hold 99 7% Of All Derivative Contracts

Post on: 16 Март, 2015 No Comment

Fitch has released a comprehensive study on derivatives held by various corporations and has come out with some disturbing results: as Zero Hedge’s recent disclosure of data from the Office of the Comptroller of the Currency confirmed, the bulk of the derivative risk is concentrated not merely in the financial company category (99.7%) but in a subset of just five companies, which account for an overwhelming majority of derivative assets and liabilities.

The companies in question (Total Notional Derivatives: Assets & Liabilities, $ in Trillions)

- JP Morgan:$81.7;

- Bank of America:$80.0;

- Citigroup:$31.5;

- Morgan Stanley:$39.3, and of course

- Goldman Sachs: $47.8 (this is an OCC estimate: Goldman has not disclosed notional amounts in their derivative book. only # of contracts);

If you want a preview of what the Basel III definition of Too Big To Fail will look like, the above five companies is a great place to start.

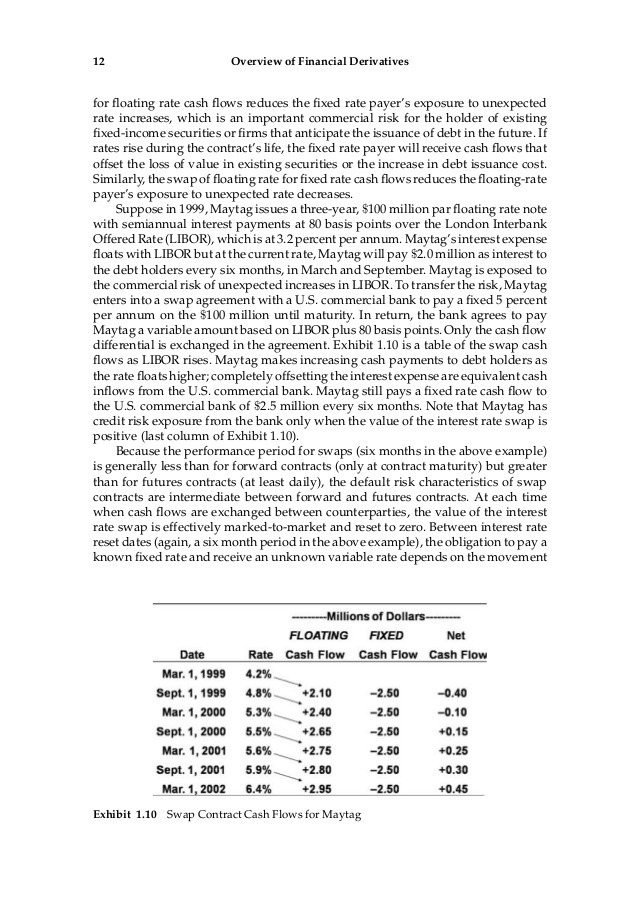

For those unfamiliar with the concept of derivatives, here is a good blurb provided in the Fitch report:

Companies use derivatives to manage risks related to interest rates, foreign currency exchange rates, equities, and commodity prices, as well as more obscure risks such as weather and longevity. According to the Bank of International Settlements, the notional amount of the global over-the-counter derivatives market was nearly $600 trillion at the end of December 2008. Furthermore, gross market value (the sum of gross derivative assets and gross derivative liabilities) stood at $33.9 trillion.

While improved disclosures and transparency are a good start to helping gauge the risks posed by these instruments, it is important for analysts and investors to take a fresh look at risk management practices, including the use of derivatives within that context.

The need for better disclosure on derivatives has been obvious since the implementation of Statement of Financial Accounting Standards (SFAS) 133, Accounting for Derivative Instruments and Hedging Activities (now Financial Accounting Standards Board [FASB] Accounting Standards Codification [ASC] 815). However, comprehensive derivatives disclosure did not become a U.S. GAAP requirement for most companies until March 2009 with the implementation of SFAS 161 (now ASC 815-10-50), Disclosures about Derivative Instruments and Hedging Activities.

For a more quantifiable overview of derivatives, we recommend the most recent quarterly report from the BIS. especially the data starting on page 28.

The key findings presented by the Fitch report are as follows:

- Not surprisingly, an overwhelming majority (approximately 80%) of the derivative assets and liabilities carried on the balance sheets of the companies reviewed were primarily concentrated in five financial services firms: JPMorgan Chase & Co. (JPMorgan); Bank of America Corp. (Bank of America); Goldman Sachs Group Inc. (Goldman Sachs); Citigroup, Inc. (Citigroup); and Morgan Stanley (Morgan Stanley).

- Fifty-eight percent of the companies reviewed disclosed the presence of credit riskrelated contingent features in their derivative positions. These contingent features generally require a company to post additional collateral or settle any outstanding derivative liability in the event of a downgrade of the companys credit rating.

- The use of credit derivatives was limited to financial institutions, with 17 of these reporting such exposure.

- Proprietary derivatives trading by utilities and energy companies appear to be very limited, but most of the companies reviewed in both industries report the use of derivatives for hedging commodity risks.

- Generally, non-financial companies appear to use derivatives only for hedging specific risks.

Derivative valuation is often model-based, making changes in significant valuation assumptions particularly important. Analysis would be enhanced if issuers provided additional disclosure on the sensitivity of their derivative valuations to major assumptions.

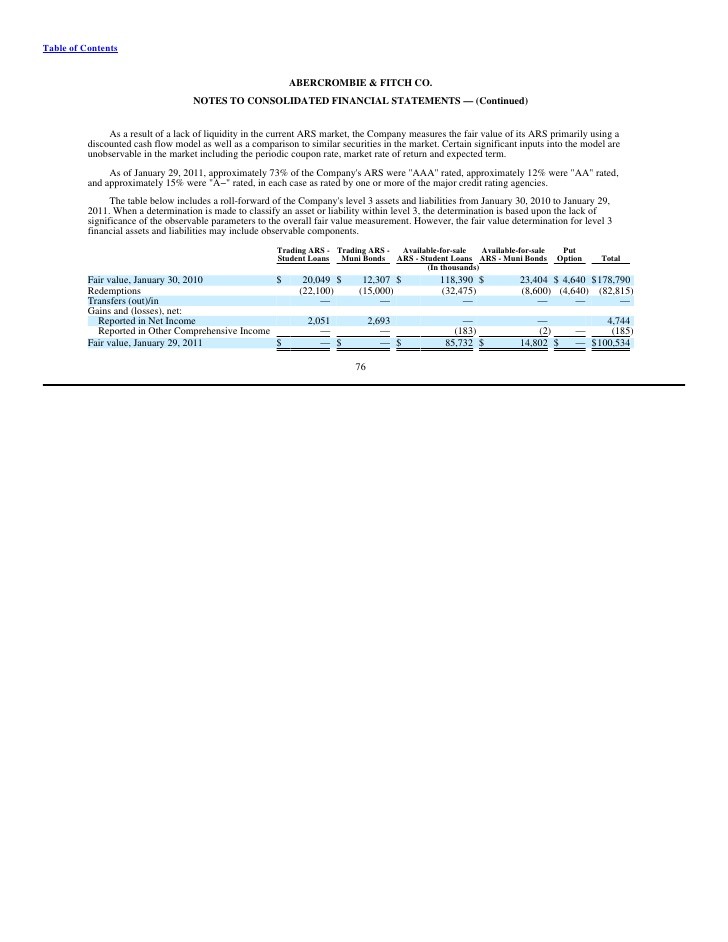

And some charts that indicate why the Big 5 as listed above will never be allowed to go under, as the unwind of the $300 trillion in derivatives that are intertwined within their balance sheets would be end of what was previously known as free and efficient markets. %img src=file:///C:/Users/ADMINI

1/AppData/Local/Temp/moz-screenshot-7.jpg /%

And while the gross notional value is a useful metric, in terms of actual capital it risk, it is necessary to apply a netting to the gross. Conveniently, Fitch has done the calculation. No surprise: of the Big 5, almost all (except Morgan Stanley) have a net notional exposure of over $100 billion! How about them VaR apples.

The other notable conclusion is that while virtually all non-financial companies had participated in derivative designated as a hedging exposure, it was energy companies (83%) but mostly financials (97%) that used derivatives merely as a method to speculate on underlying assets. Yet a net notional speculative exposure of almost half a trillion is staggering: this represents roughly 5% of the US GDP, the bulk of it focused on interest rate exposure. As we have speculated, in the event of a interest-rate black swan event, the fall out from the implosion of this over $500 billion in speculative derivative exposure would be enough to make the Lehman fiasco seems like a walk in the park.

It is this potential risk that these BHCs’ regulator, the Federal Reserve, should be trying to mitigate, not to enhance its risk regulatory powers even more, having proven that all it does it promote increasing speculation until such time that the house of cards inevitably comes tumbles down.