FISN Bank CDs Paying Over 8% Interest Being FDICInsured Isn t Enough

Post on: 16 Март, 2015 No Comment

Ive already written about Millennium Bank the offshore bank offering 8% certificates of deposit that are not FDIC-Insured, let alone highly regulated. More recently, a group called the Federally Insured Savings Network (FISN) has been advertising FDIC-insured Certificates of Deposit Paying Over 8%. Whats the deal?

It definitely looks too good to be true, but lets look at the fine print and see what we can find. Ill just focus on the highlighted CDs paying a 8% and 8.25% APR to save some time.

The maximum terms for these CDs are for 15 or 20 years! If you wish to withdraw early, you can be sure it will be with a fat penalty. However, it may not even be possible to re-sell them at all. From the disclosure: Lack of Liquidity. The CDs will not be listed on an organized securities exchange. JPMSI may offer to purchase the CDs upon terms and conditions acceptable to it, but is not required to do so. This could be worse than even taking money out of your IRA or 401(k).

High Minimum Investments

In this case, you need $25,000 to invest with FISN as your broker to JPMorgan Chase Bank.

They Are Callable, And Thats Not Good

A callable CD means that the bank can say I found a better deal elsewhere, so I no longer want to pay you this much interest anymore. Bye! Youll get your principal plus interest earned up to that point, but this usually happens when interest rates fall, leaving you stuck with alternative paying a lot less than you were getting before.

On the other hand, you the depositor have no such flexibility. Youre still stuck for as long as the bank wishes. Again up to 20 years! Put another way: Heads, the bank wins; Tails, you lose.

Not A Fixed Rate CD 8% Rate Isnt Guaranteed

When talking about a bank CD, youre usually referring to a fixed rate CD. However with this investment, you may or may not get paid any interest based on the following criteria:

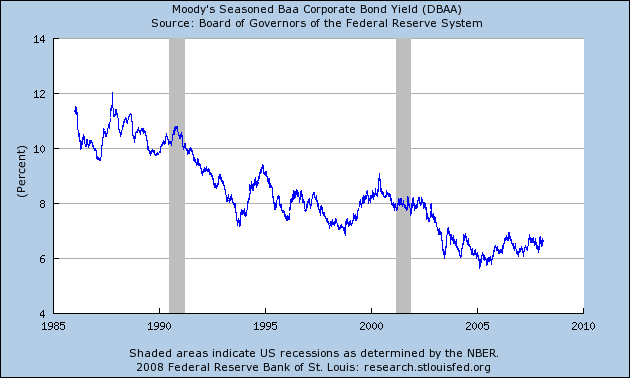

Interest is paid quarterly for every day the 30Yr Constant Maturity Swap (CMS) Rate is greater than the 10Yr Constant Maturity Swap Rate (Positive Yield Curve). If the 10Yr CMS Rate is greater than the 30Yr CMS Rate on any day (Negative Yield Curve) no interest is accrued for that day. Full 8.00% rate guaranteed for first year.

Trying to figure out exactly what CMS rates were made my head hurt. But very generally, if the long-term interest rates are higher than short-term interest rates (positive yield curve) youll get paid your fraction of 8% annual interest that day. However, if the curve goes negative, which it has for extended periods in the last few years, you dont get paid any interest that day. So 8% is basically a best-case scenario. Over a 15-year period, I highly doubt youll be getting the full 8% each year. Earning 0% is the worst-case scenario.

Im Not Interested

So yes, technically these are FDIC-insured to the extent that your principal is safe. But your money could be stuck sitting around earning nothing while inflation eats away at the actual value. And the bank will only keep paying the interest if it remains profitable for them. These seem to be sophisticated investments being marketed at the unsophisticated public. Buyer beware!