FINRA s Know Your Customer and Suitability Rules

Post on: 18 Июнь, 2015 No Comment

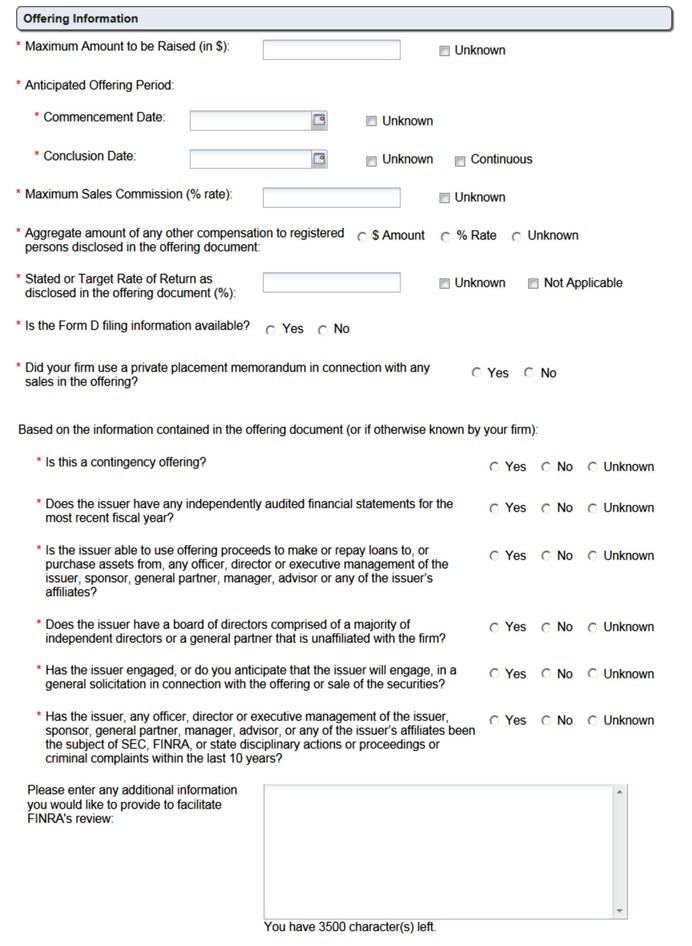

Know-Your-Customer (KYC) Rule (FINRA Rule 2090) and Suitability Rule (FINRA Rule 2111) increase the information required of a customer. The rules, in their entirety, can be found below. After, find an analysis of what they require.

2090. Know Your Customer

Every member shall use reasonable diligence, in regard to the opening and maintenance of every account, to know (and retain) the essential facts concerning every customer and concerning the authority of each person acting on behalf of such customer.

2111. Suitability

(a) A member or an associated person must have a reasonable basis to believe that a recommended transaction or investment strategy involving a security or securities is suitable for the customer, based on the information obtained through the reasonable diligence of the member or associated person to ascertain the customers investment profile. A customers investment profile includes, but is not limited to, the customers age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs, risk tolerance, and any other information the customer may disclose to the member or associated person in connection with such recommendation.

(b) A member or associated person fulfills the customer-specific suitability obligation for an institutional account, as defined in Rule 4512(c), if (1) the member or associated person has a reasonable basis to believe that the institutional customer is capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies involving a security or securities and (2) the institutional customer affirmatively indicates that it is exercising independent judgment in evaluating the members or associated persons recommendations. Where an institutional customer has delegated decisionmaking authority to an agent, such as an investment adviser or a bank trust department, these factors shall be applied to the agent.

Know your customer (KYC)

On its face the rule appears quite simple. It requires a firm to use reasonable diligence in regard to opening and maintaining every account. This includes knowing and retaining the essential facts about a customer and the authority of the persons acting on behalf of that customer.

Supplementary material identifies the essential facts as those required to service the account, act in accordance with any special handling instructions, knowing the authority of each person acting on behalf of the customer, and have sufficient information to assure that the account will comply with all applicable laws, rules and regulations. However, when this rule is read together with the new Suitability Rule, the information required of a customer is materially expanded, even in the case of institutional investors.

This is in addition to the information about customers that SEC Rule 17a-3(a)(17) requires for natural persons — name, tax identification number, address, telephone number, date of birth, employment status, and that Financial Crimes Enforcement Network Rule 1023.220 (Customer Identification Program for Broker-Dealers) requires for all customers.

The Regulatory Notices considerably expand upon this. They require the brokerage firm to know who is authorized to act for a customer. In the case of institutional accounts (accounts of persons or entities with over $50 million in assets), and accounts managed by a third party, (e.g. investment adviser-managed), the rule requires knowing who has the authority to act for the customer and the scope of that authority.

Many financial institutions have a trading desk that places orders for its various components like hedge funds, investment advisor accounts, mutual funds and custodial accounts. This suggests that information as to the authority of each trader to place orders and for whom that trader may place orders is required, as well as the scope of that person’s authority to place orders.

No standard for updating is contained in the rule or in the Regulatory Notices. However, some commentators have referred to the SEC requirement to update natural person customer information every three years.

A brokerage firm needs to have in place a procedure to update on a reasonable basis the accuracy of the information it has about a customer. Consider the following:

- Create procedures to deal with the situation where a customer fails to give all the information required by Rule 2090.

- Develop procedures to confirm the authority of a person to trade where a third party manages an account or where an institutional investor has a trading desk that the traders are in fact authorized to trade for the institution and to what extent.

- Develop procedures for where a trader or a third party manager has a limited authority over the account.

- Develop procedures to assure that an account is not affecting trades that raise legal or regulatory questions.

- Develop procedures to verify account information on a periodic basis, e.g. negative confirmation letters.

This rule requires a member firm or registered representative to have a reasonable basis to believe when it recommends a transaction or an investment strategy that it is suitable for the customer, based on information obtained through reasonable diligence according to the customer’s investment profile. FINRA has not defined what is a recommendation. However, it has set forth a number of guidelines.

Recommendations

A recommendation has to be made to a customer. A customer is someone who places an order or has an account with a broker-dealer. It may also include anyone with whom the broker has an informal business relationship relating to brokerage services. FINRA has stated that the distribution of marketing or offering materials by itself would not constitute a recommendation.

However, based on other statements in FINRA guidelines and interpretations such a distribution, including research reports that rate securities, could be part of a chain of actions that would constitute a recommendation.

Whether a communication is a recommendation, FINRA states it is a facts and circumstances test and applies three factors- the communication’s content, context and presentation. Viewing the communication or series of communications’ content, context and presentation is there a call to action? Is there an implicit or explicit suggestion that the recipient act or refrain from taking action with respect to a security or investment strategy?

The rule applies to an investment strategy. FINRA interprets investment strategy broadly. The SEC’s anti-fraud rule (Rule 10b-5) applies only where there is a purchase or sale. The suitability rule’s investment strategy applies to a recommendation to buy or sell and to an explicit recommendation to hold a security. Investment strategy also includes trading on margin or engaging in day trading.

Rule 2111.03 excludes the following from a recommendation subject to the rule’s requirements, as long they do not recommend a particular security or securities:

General financial and investment information. This includes: (i) basic investment concepts, such as risk and return, diversification, dollar cost averaging, compounded return and tax deferred investments; (ii) historic differences in the return of asset classes, such as bonds, cash or equities, based on standard market indices; (iii) the effects of inflation; (iv) estimates of future retirement income needs; and (v) assessment of a customer’s investment profile;

Descriptive information about an employer sponsored retirement or benefit plan, participation in the plan, the benefits of plan participation, and investment options available under the plan; and

Asset allocation models that are (i) based on generally accepted investment theory, (ii) accompanied by disclosures of material facts and assumptions that may affect a reasonable investor’s assessment of the asset allocation model or any report generated by such model, and (iii) if the investment analysis is in compliance with NASD Rule IM-2210-6 (Investment Analysis Tools). But if an asset allocation model becomes too narrow or specific, it may cross over the line and be a recommendation.

Generally, the more individually tailored the communication is to a particular customer or customers about a specific security or investment strategy, the more likely the communication will be viewed as a recommendation.

Required information

To make a recommendation a broker/salesperson must use reasonable diligence to have an investment profile of the customer. An investment profile includes the customer’s age, other investments, financial situation and needs, tax status, investment objectives, investment experience, investment time horizon, liquidity needs, risk tolerance and any other information the customer may disclose.

Other investments include investments held elsewhere, such as accounts at other brokerage firms. A customer’s financial ability means does the customer have the financial ability to meet the commitment of a transaction or investment strategy. Liquidity needs has been interpreted to mean the extent to which a customer desires the ability or has financial obligations that dictate the need to quickly and easily convert to cash all or a portion of an investment without experiencing significant loss in value.

Time horizon means the expected number of months, years or decades a customer plans to invest to achieve a particular financial goal. Risk tolerance means a customer’s ability and willingness to lose some or all of the investment in exchange for greater potential returns. Generally, absent “red flags” indicating inaccuracy or if the customer is unclear about the information, a broker may rely on the customer’s responses.

The rule does not require that all of the information be in hand before a firm/sales person can make a recommendation. If some information is not material under the circumstances the firm would still be able to make a recommendation. However, the firm must obtain and analyze enough information to have a reasonable basis to believe the recommendation is suitable.

If the firm does not have or seek all of the information listed above it should have a reasonable basis to believe, documented with specificity, that one or more of the factors are not components of a customer’s investment profile in light of the facts and circumstances of the particular case.

The Rule does not explicitly require the firm to update the information it has obtained. However, to the extent the customer tells the firm/sales person updated information that should be reflected in the customer’s investment profile.

Reasonable basis

The firm or sales person must have a reasonable basis to believe, based upon reasonable diligence, that the recommendation is suitable for at least some investors. Reasonable diligence includes, among other things, the complexity of and risks associated with a security or investment strategy and the firm’s or salesperson’s familiarity with the security or investment strategy. If a sales person lacks familiarity with or an understanding of a recommended security or investment strategy there is a lack of suitability, even if the firm has determined that such security or strategy is a reasonable one, e.g. placed it on a recommended or approved list.

Customer-specific

The firm or sales person must have a reasonable basis to believe that the recommendation is suitable for the particular customer based on that customer’s investment profile.

Quantitative suitability

The firm or sales person who has actual or de facto control over a customer account must have a reasonable basis to believe that a series of recommended transactions, even if suitable when viewed in isolation, are not excessive and unsuitable for the customer when taken together in light of the customer’s investment profile. Factors included in making such a determination include turnover rate, cost-equity ratio and the use of in and out trading.

In applying these three standards, FINRA has said that the suitability rule requires a broker-dealer to make only those recommendations that are consistent with the customer’s best interest and prohibits a broker from placing his or her interests ahead of the customer’s interests. In addition to applying the customer’s investment profile, additional factors are to be considered.

These include the product or strategy’s investment objectives, characteristics, liquidity risks and potential benefits, volatility and likely performance in a variety of market and economic conditions.

Showing compliance

How should a firm evidence its compliance with the suitability rule? The rule does not impose explicit documentation requirements. FINRA has suggested using a risk based approach to evidence compliance. This means based upon an assessment of the customer’s investment profile and the complexity of the recommended security or investment strategy involving a security or securities (including both its structure and potential performance) and/or the risks involved, it is more prudent to document than not to document. FINRA stated that a recommendation of a large-cap, value-oriented equity security usually would not require documentation. However, the recommendation of a complex and/or potentially risky security or investment strategy usually would require documentation.

To ensure compliance with the suitability rules, consider the following:

If your firm distributes research, whether to customers or in general, review the research to determine if the research in general or specifically constitutes a call to action by a present or prospective recipient of such research. If so suitability obligations may be incurred.

Each sales person who recommends a security to buy sell or hold or of an investment strategy should be sufficiently familiar with that security or strategy to be able to make the required suitability determinations. Firms may have to expand their training programs and go beyond a general recommended or acceptable list of investments and strategies.

Firms and sales persons should make a concerted effort to obtain and record all the required information for a suitability determination. To the extent any information is unavailable or cannot be obtained the firm and sales person should make an informed decision as to the materiality of such missing information in making a recommendation. While not specifically required to do so, it would be more prudent to record on a timely basis the reasons for such determinations.

The more complex or involved a recommendation of a security or investment strategy is the more prudent it would be to record the basis for the suitability determination.

If you have any questions about FINRA, or FINRA policies, please feel free to call the experienced FINRA attorneys at Maya Murphy, P.C. in Westport, CT for a free consultation. We can be reached at 203-221-3100 or by email at Ask@mayalaw.com.

Credit/Resource: Morris Simkin, Thomson Reuters Author, Reuters US

Keywords: Finra know your customer, FINRA suitability, FINRA 2111, FINRA 2090