Financial Tales A Tale of Diversification

Post on: 1 Май, 2015 No Comment

Image by u m a m i via Flickr

A Tale of Diversification

People say diversification is the only free lunch on Wall Street. By this they mean that if you properly diversify your portfolio you can reduce the risk of your portfolio without necessarily reducing the expected return. This is a powerful mathematical concept. What is diversification? It means that for every stock that you buy and add to your all-stock portfolio you have a good likelihood that it will add return as well as reduce risk or some combination of the two. In any event adding more stocks to an all-stock portfolio is a good thing. As a student of finance and as a financial practitioner I completely embrace the claim diversification makes and you should as well.

In this tale, I want you to eliminate everything except stocks from the diversification discussion. My focus on diversification will be limited to that of an all-stock portfolio. Of course everyone knows that a portfolio gains diversification when asset classes other than stocks are added to it, but in this tale I am trying to isolate the effect of the stock component of your portfolio only. It is critical. Furthermore, I consider the addition of asset classes such as bonds, cash, real estate, or commodities to an all-stock portfolio as more of an asset allocation decision than a diversification decision. The two concepts of diversification and asset allocation are so intertwined that it is difficult to know where one ends and the other begins. However, they are very different. Investment diversification is a mathematically precise derivation and asset allocation is a theory. Diversification is robust while asset allocation is untested.

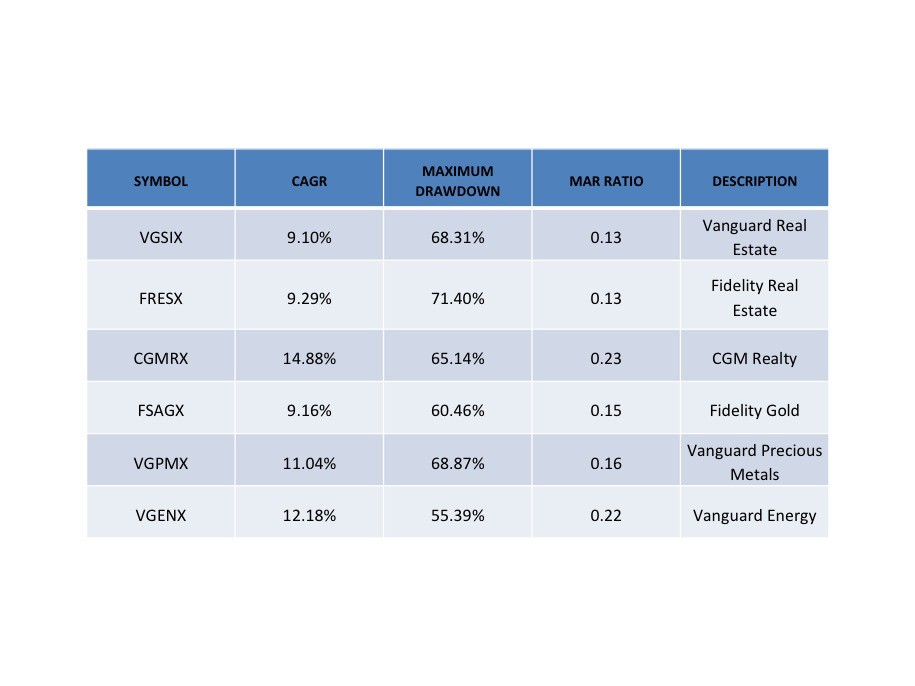

Incidentally, I don’t espouse the use of real estate or commodities in my asset allocation models. I think it’s a form of self-delusion to think that these two asset classes will protect the investor during turbulent times. My research indicates that when markets are turbulent, this means when they are going down, that there is no safe shelter other than cash or bonds. As we see the events of 2008 play out we can witness that the asset allocation theory where practitioners have included real estate and commodities in their portfolios did not work out. It might work for the next 50 years but it did not in 2008 and it won’t the next time there is major turbulence. Nevertheless, I will explore the subject of asset allocation in An Asset Allocation Tale .

Is there a limit to the benefits of adding stocks to a portfolio? The answer is yes. There is a limit or point of diminishing return where adding another stock does very little to either increase return or reduce risk. When you reach this point you theoretically have a diversified portfolio. Because there are so many ways to construct a diversified portfolio of stocks and because Americans have a compulsive need to measure things they had to create a stock market benchmark or measuring stick. The first and to this day still most recognizable benchmark or index is the Dow Jones Industrial Average. or DOW. Since then we have progressed to bigger and more encompassing indices or benchmarks such as the S&P 500. Russell and others. Ironically another American trait is to overdo a good thing and soon we will be to the point where there will be more benchmarks than individual stocks that make up these benchmarks. But for purposes of this tale let’s say that the S&P 500 is the best measure of performance for the stock market.

We know that if you properly diversify your portfolio you can reduce the risk of your portfolio without necessarily reducing the expected return. You do this by adding stocks to your portfolio. We also know that when you construct what you think is a diversified portfolio of stocks you will measure it against a diversified portfolio of stocks called the S&P 500. The question then becomes is there a way to construct a diversified portfolio of stocks that has better characteristics than the S&P 500? Can we build a portfolio that makes us more money with less risk, or more money with equal risk or maybe less money but substantially less risk? These are the questions that everyone asks. It’s good to ask these questions because it shows that you are thinking but once you delve deeper into the concept of diversification you will learn that the answer in most cases is no. If you have a diversified portfolio of stocks then by definition it will behave like the stock market, which in this case is represented by the S&P 500. This means that if you own a diversified stock portfolio by definition you own a basket of stocks that acts like the entire universe of stocks.

So at first we were happy to hear that diversification is Wall Street’s version of a free lunch but now we’re not so sure we want to accept the invitation. Diversification sounds wonderful but it’s misleading. It’s incomplete because it doesn’t take people’s behavior into consideration. Diversification is a double-edged sword. What’s the problem with diversification . Diversification doesn’t allow for spectacular returns and many people want spectacular returns because, you guessed it, they think they are spectacular.

To make spectacular returns you must concentrate, overweight or trade your portfolio. A concentrated, over-weighted or traded portfolio is the antithesis of diversification. It means putting all or a substantial portion of your money in the best performing investment opportunities that you envision. This is the way that most great fortunes are made. These fortune builders put all or most of their eggs in one basket by starting a business or investing in a small company that grows to a large company. This is an all-or-nothing strategy however and when they are wrong they end up on the Nothing end of the rate of return spectrum instead of the All. We only hear about the Alls but rest assured that the Nothings far exceed the Alls. Diversification assures that you will be somewhere in between All-or-Nothing.

This brings us to the critical issue about diversification and one that is seldom discussed in the financial literature. The question to diversify or not is the question that every investor faces. It is unavoidable. This tale is not about telling you how to diversify a stock portfolio . you can do that in 1 minute by picking up the phone or punching in a buy order for a mutual fund or exchange traded fund that buys the S&P 500. Diversification in America today is easy. The choice is not. This tale focuses on the question to diversify or not? That is the central question of diversification, not the how to. Because you must choose to diversify, you are the integral component of your portfolio. How you behave matters.

Lets look at where we are as of this writing with regards to stockmutual fund investing. We see that approximately 20% of the assets that are invested in the United States are invested in low cost index funds or exchange-traded funds. These types of investments that just buy the S&P500 or other well known indices are called passive investments because they don’t require an expensive portfolio manager or what I call a Hired Asset Manager or HAM. People that choose to invest this way are called passive investors. Where’s the other 80% invested? The remaining money is invested in active investments that require the skill, expertise and expense of an active manager or HAM. People that invest this way are called active investors and the HAMs are called active managers. Unfortunately, the two terms alone, passive and active, are enough to see where this takes us. Do you want to be passive or active? Given this choice I would vote active. After all isn’t active better than passive? Don’t we all want this? Aren’t we taught this from birth? The correct answer is passive however. There is no evidence that active management outperforms passive management over the long run.

This 80/20 dichotomy is perplexing. How can it be even after 20-30 years of academic research that preaches the futility of active management that more people choose active management over passive management? Certainly the terms active and passive have something to do with it. If I were running an index fund company I would work on changing how my indices are branded. I would rephrase the question is active better than passive to is a “Favorite” more likely to make you money than a “Long Shot?” Would investors change their answers? What if I were to say that there are two ways to invest in stocks. If you bet on the “Favorite” every time you will over time make the same or more money than 95% of the people that bet on the “Long Shot.” If the question were phrased this way you wouldn’t see 20% of the people investing in the “Favorite” and 80% investing in the “Long Shot” as we do today. The percentages might in fact be reversed. This is a better way to think of diversification. If you are passive, if you bet on the “Favorite”, if you diversify you will more than likely be far better off than if you don’t. Yet we can observe that people don’t invest this way.

Why don’t we see this type of rational behavior when we examine the facts? One reason is people are sold active investments because they are in the best interest of the salesman, sales driven advisor or SAD. A second is lack of education. This tale educates you. The last reason and perhaps most misunderstood is because of human behavior. In cultures such as America’s where people think they are special it is difficult for someone to say that they must be satisfied with average results. It seems un-American to think that as an investor you will be average. Research in the field of Behavioral Finance shows that over-confidence or entitlement plays a major role in the poor returns that most people experience. People reject diversification and choose active management because even after I or someone else tells them the realities they still think it’s the other guy that is going to lose, not them.

Let’s extend the definition of diversification to include what we’ve learned. We can now say that if you properly diversify your portfolio you can reduce the risk of your portfolio without necessarily reducing the expected rate of return, that you will outperform or equal at least 95% of your fellow investors, that you will never make extraordinary returns but that you will make about the same returns as others that choose to diversify. Let’s focus on the phrases expected rate of return and the same return as others that choose to diversify. As you diversify your portfolio your returns will resemble the returns of S&P 500. In fact it may be exactly the S&P 500, which is available for purchase in its entirety. This means that for the 20% of investors that own passive investments today, if the expected rate of return for the stock market is 10-12% per year on average, they will make these returns.

Choosing diversification makes you average amongst other investors that choose diversification as well. It presents a paradox however. How can a group of people that choose to be average make higher rates of return than those that don’t. Are they smarter? Are they more educated? Are they more self-aware? Do they know something we don’t know? We know from decades of stock market research that when one chooses to be average, when one diversifies, actual long-term performance translates to way above average performance since most individual investors as well as active professional portfolio managers never come close to achieving long-term returns of 10-12%. In people’s quest to be above average they fall below average and in many cases way below average. It’s of note that in any given year, about 80% of active, professional, highly compensated portfolio managers fail to outperform those that simply invest in the S&P 500. Active management is a losing game for individual investors as a whole. It can be won as many have proven but overall it’s a bad bet because even when you win you win by so little that it’s not worth it.

So is diversification a free lunch? The answer is yes if you want it to be because all are welcome. Diversification welcomes the entire spectrum of investors from expert to novice. It’s a bet on the “Favorite.” In a very democratic fashion, diversification doesn’t discriminate; it offers the novice the same expected rate of return as the expert. The novice will never get better investment odds anywhere else. Let’s be clear, it is not the goal of investing. The goal of investing is to increase the purchasing power of your money. Diversification is a technique that you would use to achieve your goal and one that most people should use and that I recommend. It is a portfolio state but before it can be a portfolio state it must be a state of mind. A diversified portfolio doesn’t happen by chance. It is not a random event. It is a conscious decision that an investor makes and makes every day since it is also so easy to reject diversification after you have started down the path. However, be certain that you will never achieve extraordinary returns with a diversified portfolio. To achieve extraordinary returns you must by definition choose to not diversify. The choice is yours. Choose wisely. Recognize that throughout history anyone that has ever achieved extraordinary returns did not do it by diversifying.

Let me try to influence your choice. Let me give you a thought to ponder. One of the largest and most successful money management firms in the world is Fidelity Investments. People that know baseball will know that Yankee Stadium was called “The House that Ruth Built.” I call Fidelity Investments “The House that Peter Lynch Built.” Peter Lynch is the legendary investor that managed the Fidelity Magellan fund and racked up the best mutual fund performance of his generation. He was the Babe Ruth of mutual fund managers. He has been retired for almost fifteen years and my question to Fidelity and others is, where is the next Peter Lynch? When the payoff for the firm that finds, creates or nurtures the next Peter Lynch can be counted in the billions it begs the question where is the next Peter Lynch? I can’t find him and either can Fidelity and others.

Clearly these firms have resources that an individual investor doesn’t have and yet they have met failure after failure in their pursuit of a superstar money manager. These large money management firms have infinite resources devoted to discovering the next great money manager, yet they can’t. Once again, despite all their resources they can’t find another star money manager to take them to the next level of profitability. With that in mind, I find it difficult to believe that if they can’t when they have billions of dollars of profits as an incentive, that the individual investor picking active managers from their living room can achieve spectacular results. It’s laughable. I also find it laughable to think that if Fidelity and the rest of the mutual fund establishment can’t find these managers that people buy into the concept that a SAD at a full service brokerage firm such as a Merrill Lynch or Smith Barney or Wachovia can find private money mangers for the individual investor. I think the choice for most people is simple—–insist that either you or your advisor construct a diversified portfolio of low cost index funds and focus on designing an asset allocation model that accommodates your risk threshold for a large portion of your portfolio.