Financial SWOT Analysis

Post on: 9 Май, 2015 No Comment

One of the best ways to get a good idea of where you stand (in just about anything) is to run a SWOT Analysis. A SWOT Analysis is a strategic management tool that is often used in business to analyze a company, process, system, business opportunity, etc. But a SWOT Analysis can help you analyze other situations as well, including your financial situation, career, and more.

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and running a basic SWOT Analysis is a good way to understand your current situation and help you create a plan that will account for weaknesses and threats and enable you to leverage your strengths and opportunities to help you reach your goals.

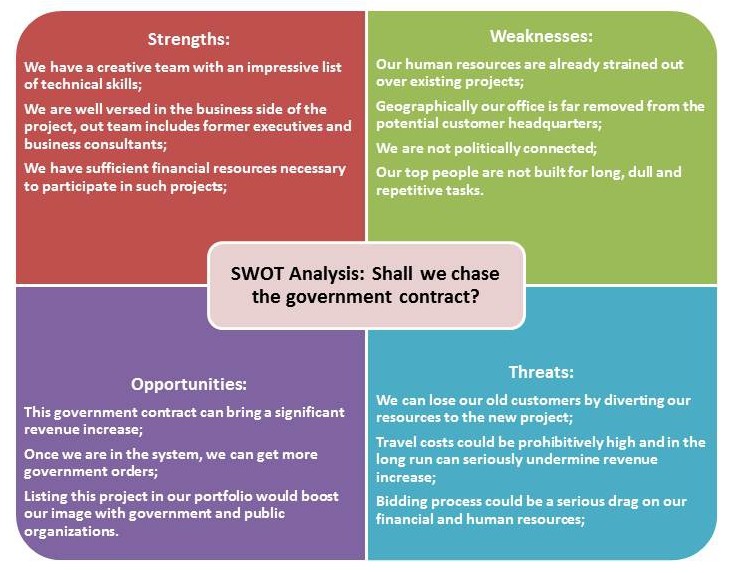

Example SWOT Matrix:

How to run a SWOT Analysis on your personal finances

Before you jump in, its important to define your financial goals; hopefully you did that as part of your financial mission statement. If not, now is as good a time as any. Defined goals are essential to measure progress and ensure you stay on the right path.

Once you have your goals and have started working on your financial plan, then you should take the time to run a SWOT Analysis to determine your areas for improvement and make sure you dont start moving in the wrong direction. When doing the following exercise, consider Strengths and Weaknesses to be internal conditions and Opportunities and Threats to be external possibilities.

Note: This exercise does not need to take long; look at it like a brainstorming session and write down any and all possibilities that you come up with. You can reorganize them or scratch them from the list later. This exercise is also more helpful if you are tracking your income with a tool such as Quicken or an online money management tool .

Determine Financial Strengths

Look back at your financial mission statement and assess your current financial position to determine where you are strong and where you can stand to make improvements. A financial strength can be anything that positively reinforces your current financial situation or helps you get closer to achieving the goals you made in your financial mission statement. Areas to examine closely include not only income and debt, but positive monthly cash flow.

Helpful questions: What are the strong areas of your finances? Do you have a positive monthly cash flow? Are you paying extra on your debts? Are you debt free? Did your income recently increase?

Determine Financial Weaknesses

What is holding you back from reaching your financial goals? It could be debt, a lack of income or earning potential, or something else. Ask yourself these, and similar questions: Have you maxed out your income potential in your current job? Are you in debt? Are you upside down on a car or house loan? Are you living paycheck to paycheck?

Determine Financial Opportunities

Opportunities are actions that you havent yet taken, or at least havent yet maximized. There are almost always opportunities if you look for them, though sometimes they may not appear evident at first glance. Financial opportunities come in many flavors, including income opportunities, debt reduction, investments, reducing interest or fees, and more.

Example for income opportunities: Do you have a skill you can leverage into a paying gig, such as consulting, tax preparation, freelance writing? Do you have any hobbies that might bring in revenue? Some examples include arts & crafts, refereeing youth sports, writing, landscaping, woodworking, and more. Can you get a promotion at work or volunteer to work extra hours for overtime? What about investment opportunities?

Other financial opportunities: Opportunities arent just limited to more work, earning a promotion, or earning more money, it could also be selling items on Ebay or Craigslist, reducing your debt with a o% balance transfer or debt consolidation, eliminating exposure to poor investments, reducing investment fees, downsizing your house, buying a more fuel efficient car, etc.

Determine Financial Threats

You also need to list and address factors that threaten your financial situation. The economy often has a direct affect on the job market and housing prices and can often be a financial threat. Remember threats are external forces that you may not always be able to control. They key isnt being able to control or eliminate each external factor (that would be impossible). The idea is to mitigate potential losses or external threats as much as possible. Because external factors arent always preventable, the idea is to create contingency plans to help you deal with unforeseen events. Some ideas to consider are a diversified investment portfolio or multiple income streams.

External factors to consider: Are you in danger of losing your job? Is your mortgage rate about to reset to a higher APR? What are the current economic factors that may affect your job/investments/income streams?

What to do with the SWOT Analysis

Running a SWOT Analysis is only half the battle; by itself a SWOT Analysis doesnt accomplish anything. You need to use the SWOT Analysis to help improve your financial/career/business situation to better handle internal and external factors that could affect you. The key is finding a way to leverage your strengths and opportunities and mitigate weaknesses and threats to solidify your financial health, or even better, turn weaknesses and threats into strengths and opportunities.

Once you have some ideas, create some strategies to improve your overall financial plan and if necessary incorporate them into your financial mission statement .