Financial Ratios Warren Buffett Uses When Analyzing Companies

Post on: 16 Март, 2015 No Comment

Warren Buffet is one of the most successful investors in the United States and is also considered to be among the most successful business man in the world. When analyzing companies, Warren Buffett (in view of how he selects his business) uses the following financial ratios.

Return on Equity (ROE)

ROE measures the rate of return on the ownership interest (shareholders’ equity) of the common stock owners. It measures a firm’s efficiency at generating profits from every unit of shareholders’ equity (also known as net assets or assets minus liabilities). ROE shows how good a company uses investment funds to generate earnings growth. ROEs between 15% and 20% are considered desirable. The formula represents the fiscal year’s net income (after preferred stock dividends but before common stock dividends) divided by total equity (excluding preferred shares), expressed as a percentage.

Intrinsic Value

Intrinsic Value is the actual value of a company in terms of both tangible and intangible factors, based on assets, on an underlying perception of its true value including all aspects of the business. This can be much different from what the market value is. Warren Buffett hasn’t exactly published his formula for what he calls the intrinsic value of a company, but he has dropped a number of hints.

Analysts agree he probably multiplies the estimated future earnings by a confidence margin between zero and a hundred. He uses there probable earnings and compares it to something he has total confidence in, by using a U.S. treasury yield as the rate (discounted).

Retained Earnings

The percentage of net earnings (not paid outÊas dividends to shareholders,) but retained by the company to be reinvested in its core business or to pay debt.

The formula calculates retained earnings by adding net income to (or subtracting any net losses from) beginning retained earnings and subtracting any dividends paid to shareholders:

Also known as the “retention ratio” or “retained surplus”. Warren Buffett, determines that the management of a company is competent, when they can use the retained earnings well. If the management uses them foolishly, then Buffet would rather go with companies who give shareholders full dividends.

Profit Margins

Profit margin is simply profit divided by sales. This means that there are as many measures of profit margin as there are measures of profit. Buffett looks for companies with above-average profit margins. Net profit margin equals to the total net income divided by total sales for the same period.

For instance, a company would have a 20% net profit margin if it earned $20 million on sales of $100 million ($20 million divided by $100 million).

The higher the net profit margin, then a higher profitability can be expected from the company.

Owner’s Earnings

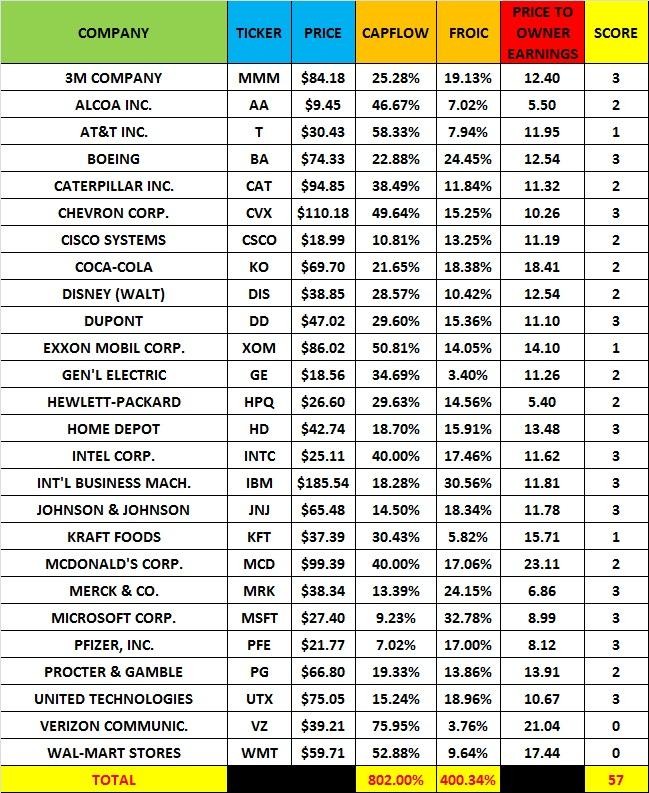

Warren Buffett uses a calculation called Owner’s Earnings which determines how much actual cash a company can produce for a true owner. Things like goodwill, depreciation, or huge pension returns make up these factors. These are good ÒbuyÓ signals for companies with consistent growth. The discounts means very little for inconsistent growers and heavily cyclical companies. He has referred to the owner earnings of a company as the true measure of earnings. He has defined Ôowner earning’s as: Reported earnings + depreciation, amortization, other non-cash items – average annual amount of capitalized spending on plant, machinery, equipment (and presumably research and development).

All in all, these are just some of the top five ratios and considerations Warren Buffett uses to analyze companies and where to invest.