Financial Ratios and Financial Ratio Analysis

Post on: 12 Май, 2015 No Comment

Thursday, October 29, 2009

Financial Ratios and Financial Ratio Analysis

Definition of Financial Ratio

- It is a ratio of two selected numerical values taken from an enterprise’s financial statements.

- It is also called accounting ratio.

Definition of Financial Ratio Analysis

- It is defined as the systematic use of ratio to interpret the financial statements so that the strengths and weaknesses of a firm as well as its historical performance and current financial condition can be determined.

- Thus, ratio analysis is a widely used tool of financial analysis.

- Ratios make the related information comparable. A single figure by itself has no meaning but when expressed in terms of related figure, it yields significant inferences. Thus, ratios are relative figures reflecting the relationship between related variables.

Types of Comparisons

Three types of comparisons are generally involved:

- Trend analysis.

- Inter-firm comparisons.

- Comparison with standards/industry average.

Trend ratios involve comparison of ratios of a firm over a period of time i.e. present ratios are compared with past ratios for the same firm. Trend ratios indicate the direction of change in the performance: improvement, deterioration or constancy over the years.

Inter-firm comparisons

Inter-firm comparison involves comparing the ratios of a firm with those of others in the same line of business or for the industry as a whole. Thus, it reflects the firms performance in relation to its competitors.

Comparison with standards/ industry average

Other types of comparisons may relate to the comparison of items within a single years financial statement of a firm and comparison with standards or plan. Figures provided by trading and profit and loss account and balance sheet are not self explanatory in nature. Figures to arrive at certain conclusions, for example, figure of net profit can be compared with total sales or total capital employed by the company and it can also be compared with figures of other company and profitability can be judged properly.

Types of Ratios

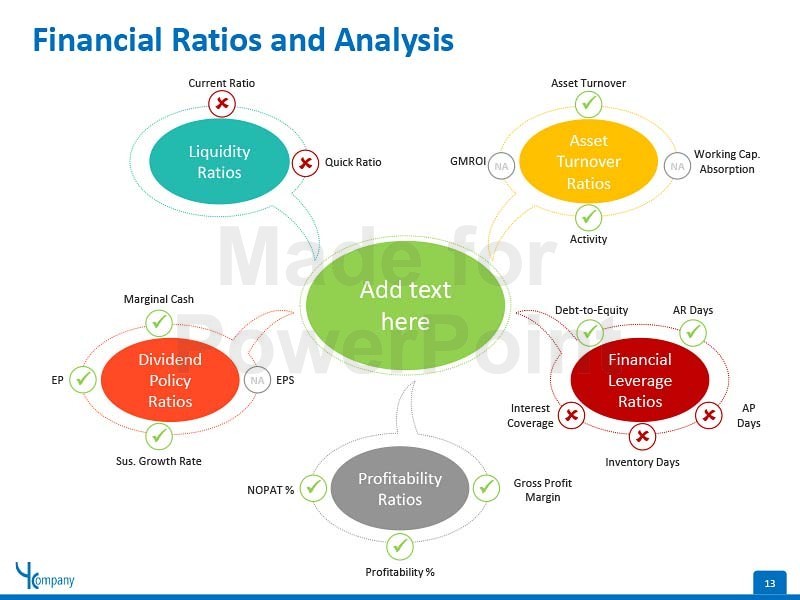

Ratios can broadly be classified into four groups:

- Liquidity ratios

- Capital structure/leverage ratios

- Profitability ratios

- Activity/turnover/efficiency ratios

Liquidity ratios measure the ability of a firm to meet its short term obligations and reflect its short term financial strength or solvency. Important liquidity ratios are:

- Current ratio: ratio of total current assets to total current liabilities. A satisfactory current ratio will enable a firm to meet its obligations even if the value of the current assets declines. It is however a quantitative index of liquidity as it does not differentiate between the components of current assets, such as cash and inventory that are not equally liquid.

- Quick or acid test ratio: takes into consideration the different liquidity of the components of current assets. It represents the ratio between quick current assets and the total current liabilities. It is a rigorous measure and superior to the current ratio. However, both these ratios should be used to analyze the liquidity of a firm.

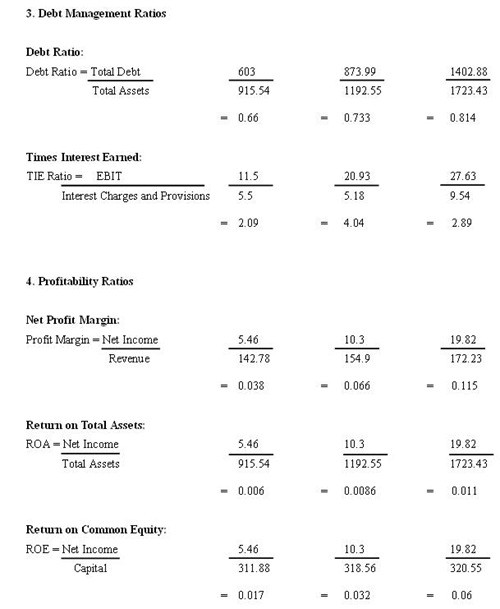

Capital Structure/Leverage Ratios

These ratios throw light on long-term solvency of a firm. This is reflected in its ability to assure the long term creditors with regard to periodic payment of interest and the repayment of a loan on maturity or predetermined instalments at due dates. There are two types of such ratios:

- Debt-equity or debt-assets ratio: It is computed from the balance sheet and reflects the relative contribution/stake of owners and creditors in financing the assets of the firm. In other words, such ratios reflect the safety margin to the long term creditors.

- Coverage ratio: These ratios are based on the income statement and shows the number of times the fixed obligations are covered by earnings before interest and taxes. They indicate the extent to which a fall in operating profits is tolerable in that the ability to repay will not be adversely affected.

Profitability Ratios

The profitability of a firm can be measured by the profitability ratios. Such ratios can be computed either from sales or investments. The profitability ratios based on sales are:

- Profit margin (gross and net).

- Expenses/ operating ratios.

They indicate the proportion of sales consumed by operating costs and the proportion available to meet financial and other expenses.

The profitability ratios related to investments include:

- Return on assets.

- Return on shareholders equity including earning per share, dividend per share, dividend-payout ratio, earning and dividend yield.

The overall profitability (earning power) is measured by the return on investment which is computed as a combined product of net profit margin and investment turnover. It is central measure of the earning power and operating efficiency of a firm.

Activity/turnover/efficiency ratios

Activity ratios are also known as efficiency or turnover ratios. Such ratios are concerned with measuring the efficiency in asset management. The efficiency with which assets are managed/used is reflected in the speed and rapidity with which they are converted into sales. Thus, the activity ratios are a test of relationship between sales/cost of goods sold and assets. Depending upon the type of asset, activity ratios may be:

- Inventory/stock turnover ratio: It indicates the number of times inventory is replaced during the year, of how quickly the goods are sold. It is a test of efficiency of inventory management.

- Receivables/debtors turnover: It is indicative of the efficiency of receivables management as it shows how quickly trade goods are sold.

- Total assets turnover: It shows the efficiency in managing and utilizing the total assets.

Advantages of Financial Ratios and Ratio Analysis

- They make it more convenient to estimate to other figures when one figure is known.

- Investment decisions are based on ratio analysis.

- They act as an index or parameter of efficiency of the firm/organization.

- They are one type of tool of management.

- They amplify many complicated financial statements.

- They highlight the weaknesses of the enterprise.

- They provide more analytical information to the management for decision making and controlling purpose.

Limitations of Financial Ratios and Ratio Analysis

- Reliability of ratios depends upon the reliability of the original data/information collected.

- Increases, decreases and constant changes in the prices distort the comparison over period of years.

- The benefits of a ratio analysis depend on correct interpretation. Many times it is observed that due to small errors in original data it leads to false conclusions.

- Ratio analysis is not an ultimate yardstick for assessing the performance of a firm.

- If there is window dressing, then the ratios calculated will fail to give the correct picture and it will be mis -management.

For More Guidance, Assistance, Training and Consultation

productivity-consultants.blogspot.com/

Other Topics of Interest

All Management Topics (General Management, Marketing and Sales, Service, Operations/Manufacturing, Quality, Maintenance, Human Resources, Finance and Accounts, Information Technology, Life Management )

The topics are listed in alphabetic order: