Financial Ratio Analysis

Post on: 12 Апрель, 2015 No Comment

Financial ratio analysis relating line items from an organisations financial statements to assess the organisations financial status or performance at a point in time; or by indicating a trend over a time series; or by comparison with another similar organisation.

Ratios may be calculated slightly differently by different analysts, the important thing is whether the particular ratio makes sense and actually addresses the underlying economic issue of interest (eg short- or long-term solvency, asset management, profitability and market value).

Following below (alphabetically) are a descriptions of a number of common financial ratios. And some free downloads!

Accounts payable turnover. A measure of efficiency or activity.

Accounts payable turnover = cost of goods sold / average accounts payable.

Accounts payable turnover = credit purchases / average accounts payable.

Accounts Payable period. A specific measure of working capital management.

Accounts payable period = (average accounts payable / purchases) x 365.

Accounts receivable turnover. A measure of efficiency or activity.

Accounts receivable turnover = credit sales / average accounts receivable.

Acid test. See quick ratio.

Activity ratio. A measure of efficiency or activity. For example, see working capital turnover, inventory turnover, collection period, fixed asset turnover, asset turnover, net asset turnover, receivables turnover and accounts payable turnover. Download our template for some of these activity ratios.

Adjusted accounting measures. See Return on Invested Capital (ROIC), Economic Profit (EP) and Market Value Added (MVA).

Altman Z-Score. Developed by Edward I Altman, the Z-Score is a quick way to assess the solvency of an organisation – it can indicate current and potential financial distress. It uses 5 financial ratios based on 8 variables from the organisations financial statements. A Z-Score of less than 1.8 indicates a high probability of financial failure. Whereas a Z-Score of greater than 3.0 indicates a low probability of financial distress. Download our template for the Altman Z-Score. Download Predicting Financial Distress of Companies: revisiting the Z-Score and ZETA Models. a paper by Edward I Altman (July, 2000). Download our template for the Z-Score.

Asset turnover. A measure of overall asset management.

Asset turnover = sales / assets.

Note: This maybe current, non-current or total assets and either beginning, ending or average value.

Cash coverage. A measure of long-term solvency.

Cash coverage = (EBIT + depreciation) / interest.

Cash ratio. A measure of short-term solvency or liquidity.

Cash ratio = cash / current liabilities.

Cash ratio = (cash + marketable securities) / current liabilities.

Days sales in inventory = 365 / inventory turnover.

Days sales in receivables. A specific measure of working capital management.

Days sales in receivables = 365 / receivables turnover.

Days sales outstanding. See days sales in receivables.

Days to collect. A measure of efficiency or activity.

Days to collect = 365 / accounts receivable turnover.

Debt to equity ratio. A measure of long-term solvency.

Debt to equity ratio = (total assets – shareholders equity) / shareholders equity.

Debtors turnover. See receivables turnover.

Discount to growth. For listed companies, a comparative measure of value relative to potential for growth. For example: Establish the ratio of the companys share price to cash flow, compare that with the sustainable growth rate of cash flow per share.

Dividend payout ratio. A measure of cash dividends paid to income.

Dividend payout ratio = cash dividends paid / net income.

Dividend retention ratio. See retention ratio.

Dividend yield .

Dividend yield = dividend per share / current market price per share.

Dividend yield = profit after interest and tax / total dividend.

du Pont analysis. See Return on Equity (ROE) decomposition and Return on Assets (ROA) decomposition. Download our template for calculating the du Pont financial ratios.

Earnings per share. A measure of market value.

Earnings per share = net income preferred stock dividends / weighted average number of shares outstanding.

EBIT. Earnings Before Interest and Taxes.

EBITDA. Earnings Before Interest, Taxes, Depreciation and Abnormals.

EBIT margin. A ‘before interest and taxes measure of the price premium that the organisations products or services can commend in the marketplace and the efficiency of the organisations procurement, production, sales and distribution processes.

EBIT margin = EBIT / sales.

EBITDA margi n. A ‘before interest, taxes, depreciation and abnormals measure of the price premium that the organisations products or services can commend in the marketplace and the efficiency of the organisations procurement, production, sales and distribution processes.

EBITDA margin = EBITDA / sales.

Economic Profit (EP). A measure of economic value created over time period.

EP = invested capital x (ROIC WACC). Where WACC is the Weighted Average Cost of Capital.

Economic Value Added (EVA). EVA is measure of whether a company is earning better than its cost of capital.

EVA is calculated from reported earnings, specific accounting adjustments and after deducting the cost of capital. It is a sophisticated but complex measure requiring specialist expertise. Also see Market Value Added (MVA) and Future Growth Value (FGV). EVA was devised by Stern Stewart & Co.

Equity multiplier. A measure of long-term solvency.

Equity multiplier = total assets / shareholders equity.

Equity multiplier = 1 + debt to equity ratio.

Fixed asset turnover. A measure of efficiency or activity.

Fixed asset turnover = sales / average PP&E (net).

Fixed asset turnover = sales / net fixed assets.

Future Growth Value (FGV). FGV is a measure of the markets expectation of EVA growth. Also see Economic Value Added (EVA) and Market Value Added (MVA). EVA was devised by Stern Stewart & Co.

FGV = MVA EVA.

Gearing ratios. See debt to equity ratio, cash coverage and total coverage.

Gross profit margin. A measure of the price premium that the organisations products or services can commend in the marketplace and the efficiency of the organisations procurement and production processes.

Gross profit margin = (sales – cost of goods sold) / sales.

Historical accounting measures. See profitability ratios, activity ratios, liquidity ratios, capital gearing ratios and shareholders and investors ratios.

Interest rate cover. See cash coverage.

Inventory turnover. A specific measure of working capital management.

Inventory turnover = cost of goods sold / inventory.

Note: This maybe beginning, ending or average value for inventory.

Investors ratios. See earnings per share, price earnings ratio and dividend yield.

Leverage. This is a measure of gearing, the relative value of the organisations debt to shareholders equity.

Leverage = assets / shareholders equity.

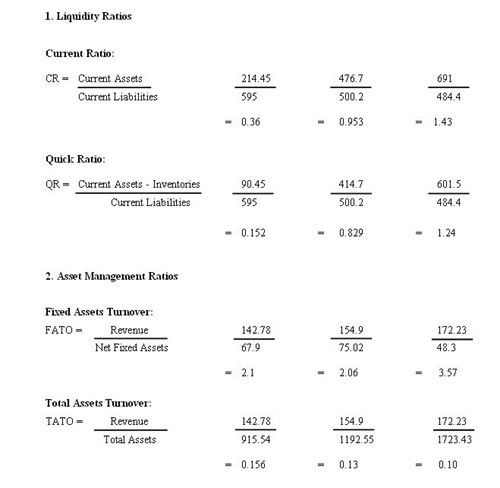

Liquidity ratios. See current ratio, quick ratio and no credit period.