Financial Planning and Investment Management Services

Post on: 16 Февраль, 2017 No Comment

Sudden Wealth, Wealth Mangement and Business Services.

Sudden Wealth

There’s gradual money and there’s sudden wealth. Most of us are used to gradual money—earning an income and building a nest egg over time. It’s a slow and steady process. As our net worth increases over the years, we adapt and slowly become more financially sophisticated. It’s like riding a smooth elevator—you’re going up, but you hardly feel it.

Then there’s sudden wealth. It’s like being on the ground floor of a 60-story building and rocketing to the penthouse suite in seconds. Sudden wealth means getting more money than you’re used to being responsible for, getting it all at once, and often feeling pushed outside of your normal financial comfort zone. Although you’re the same person you were the day before you received it, you are quickly thrust into a new and often uncomfortable situation. While sudden wealth can be life changing, for some it can cause anxiety, indecision, and fear in those who don’t surround themselves with the right people and develop a strategy.

Read about each of the sudden wealth categories below and see why we are recognized nationally as the sudden wealth management experts.

Lottery

Making the right decisions.

They say all you need is a ticket and a dream to play, but to effectively manage the windfall from a large lottery win, you’ll need much more. There are many unique financial, legal, and tax issues that often must be addressed relatively quickly. Unlike other forms of sudden wealth, there is a ticking clock when it comes to claiming your lottery prize.

We help lottery winners build their team and counsel clients through the many decisions they will face. We then help them manage and protect their winnings so they can enjoy their lives.

Divorce

There is nothing easy about divorce. It can be a long process filled with highs and lows. While there is often debate over who gets what, there is often not enough discussion about what life will look like financially after the divorce. Many have told us they felt an enormous burden and responsibility for managing their money after the divorce and confusion as to how much they really have and what they can afford. We work closely with our clients and their attorneys before, during, and after the divorce to make the transition as smooth as possible and to give our clients immediate clarity into their finances and a financial plan for the future.

Inheritance

Inherited money a form of sudden wealth has its own unique challenges, unlike other forms of sudden wealth. It can be bittersweet and create mixed feelings in some clients. As financial planners specializing in inheritance planning and working with clients who come into money suddenly, we have seen what works well. It’s important to figure out the best tax and legal strategies as early as possible, and then to create a plan for integrating the new inheritance money into your existing finances.

Lawsuits & Legal Settlements

You or someone you love has been wronged. And to make matters worse, the legal system is often painfully slow and frustrating. One client remarked that the entire process was like riding a rollercoaster – moments of relief and then fast crashes. It can be long process to endure, but it is important to make the right decisions at the right times to make sure you benefit the most. There are countless financial, legal, and tax issues that need to be addressed and can make a big impact on your life going forward. We help our clients by working very closely with their legal team to make sure their interests are not forgotten. We help our clients make the tough decisions that are inevitable in the legal process and help them understand what they have and the plan to help them protect and grow it.

Sports & Entertainment Contracts

Through our years of working with athletes and Hollywood A list actors, we have learned there are many similarities between professional athletes and entertainers. These unique issues – potentially short career life, unpredictable cash flow, public nature of their work and personal lives, outside pressure, etc. – must be managed differently. Athletes and celebrities are of course just people, but the challenges and opportunities they face are unique. We help our clients build their financial, legal, and tax team and/or work closely with their existing team to help them capitalize on their strengths and take advantage of opportunities.

Business Sale

As a business owner, you have several options to create liquidity. You can transfer your business to your children or other family members, you can look for a strategic buyer, you can sell ownership to your employees through an employee stock ownership plan, or you can merge with another company. Each of these options poses unique benefits and challenges. We can help you navigate this process unlike an investment banker, business broker, CPA, or M&A attorney. Are these professionals necessary? Yes, you will surely need tax and legal advice, but before you negotiate the deal and structure the taxes, it makes sense to determine if the deal you are fighting for is even the deal you want. We provide not just financial advice, but we can help you first determine the best deal for you—yes financially, but just as importantly, emotionally and with your ultimate goals in mind.

Stock Options

The tax and legal issues around stock options can be complex. We have a team of experts who have been helping employees and business owners maximize their stock option value for years. We will work closely with your team, your HR department, and your employer’s legal counsel to make sure you stay compliant while capitalizing on your stock options. Even if you are not fully vested or unable to convert your options to cash currently, there are strategies to protect their value. We can help you create a financial plan and roadmap integrating your stock options with your other assets.

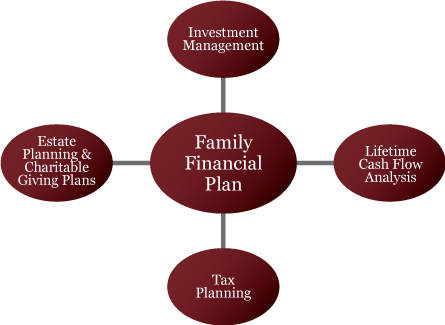

We provide financial planning and investment management services to our clients. To ensure our clients are making the most of their resources and to protect them from uncertainty, we take each of our clients through a unique five-step process called 360 Wealth Management.

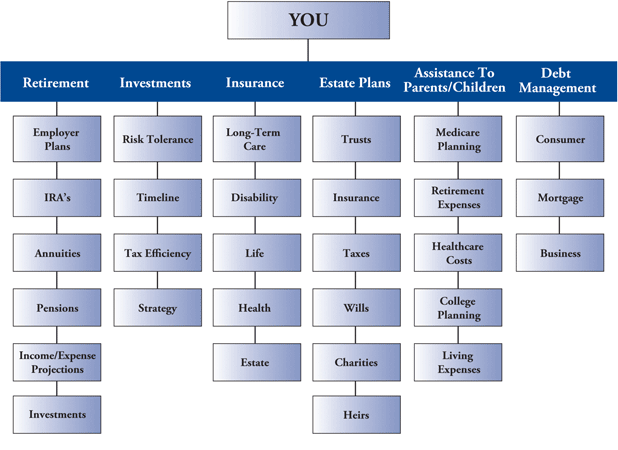

Imagine for a moment not having to think about or worry over your finances. Imagine knowing how much you are saving each month and where that money is going. That your investments are properly allocated and are being actively managed by a team whose only job it is is to look after your money. Imagine that you can sleep easy knowing you have the proper insurance coverage in case you get in an accident, become injured and cannot work, or get sued. That you have an estate plan in place that protects those you love the most. That you are not paying more than necessary in state and federal taxes. That you can instantly view your complete and up-to-date net-worth and investment allocation right from your phone anytime you wish. And imagine that you are on the right path – that your hard work has a purpose and that you are reaching all of your goals. At Pacifica Wealth Advisors, we want to improve every aspect of your finances and to leave no opportunity unturned. You can read more about our comprehensive wealth management process below.

360 Wealth Management

We provide financial planning and investment management services to our affluent clients. To ensure our clients are making the most of their resources and to protect them from uncertainty, we take each of our clients through a unique five-step process called 360 Wealth Management, which addresses a client’s investment (e.g. asset allocation, investment selection, trading), legal (e.g. asset protection, estate planning), and tax planning (e.g. income tax minimization, estate tax planning).

For Businesses

We provide business transition planning to family businesses who are selling their company to outsiders or transitioning the business to younger family members. We also have a team who provides corporate and executive benefits such as 401(k)s and health insurance plans to small and mid-sized companies.

Business Transition Planning

As a business owner, you have several options to create liquidity. You can transfer your business to your children or other family members, you can look for a strategic buyer, you can sell ownership to your employees through an employee stock ownership plan, or you can merge with another company. Each of these options poses unique benefits and challenges. We can help you navigate this process unlike an investment banker, business broker, CPA, or M&A attorney. Are these professionals necessary? Yes, you will surely need tax and legal advice, but before you negotiate the deal and structure the taxes, it makes sense to determine if the deal you are fighting for is even the deal you want. We provide not just financial advice, but we can help you first determine the best deal for you—yes financially, but just as importantly, emotionally and with your ultimate goals in mind. Learn More

Corporate Benefits

A good corporate benefits package can attract key employees, retain the employees you have, and create a better and more committed workforce. Unfortunately, evaluating 401(k) providers and health insurance plans requires the detective skills of Sherlock Holmes! If you don’t know which questions to ask, it is nearly impossible to get an apples to apples comparison and to really evaluate the best set of benefits that are not only right for your team but also cost effective. We have decades of experience asking the right questions and can help you get the best corporate benefits package for you and your employees. Learn More

Executive Benefits

If you want to create an even more robust benefit package to the owners, executives, and other key employees, we can show you how. We find that traditional group plans commonly fall short in providing the owners and employees who are critical to the success of your business with the most efficient and effective retirement plans, life insurance, disability insurance, and other offerings. Let us show you how you can carve out a group of employees and provide them with greater retirement savings and protection.