Financial Leverage

Post on: 12 Июль, 2015 No Comment

Financial Leverage Definition

Financial leverage is the amount of debt that an entity uses to buy more assets. This is done to avoid investing an organization’s own equity capital in such purchases.

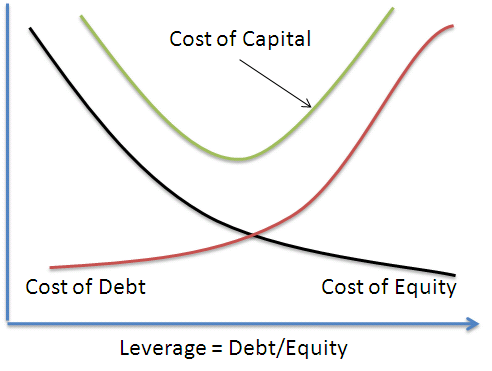

The financial leverage formula is measured as the ratio of total debt to total assets. As the proportion of debt to assets increases, so too does the amount of financial leverage. Financial leverage is favorable when the uses to which debt can be put generate returns greater than the interest expense associated with the debt. Many companies use financial leverage rather than acquiring more equity capital, which could reduce the earnings per share of existing shareholders.

Financial leverage has two primary advantages:

- Enhanced earnings. Financial leverage may allow an entity to earn a disproportionate amount on its assets.

- Favorable tax treatment. In many tax jurisdictions, interest expense is tax deductible, which reduces its net cost to the borrower.

However, financial leverage also presents the possibility of disproportionate losses, since the related amount of interest expense may overwhelm the borrower if it does not earn sufficient returns to offset the interest expense. This is a particular problem when interest rates rise or the returns from assets decline.

The unusually large swings in profits caused by a large amount of leverage increase the volatility of a company’s stock price. This can be a problem when accounting for stock options issued to employees, since highly volatile stocks are considered to be more valuable, and so create a higher compensation expense than would less volatile shares.

Financial leverage is an especially risky approach in a cyclical business, or one in which there are low barriers to entry, since sales and profits are more likely to fluctuate considerably from year to year, increasing the risk of bankruptcy over time. Conversely, financial leverage may be an acceptable alternative when a company is located in an industry with steady revenue levels, large cash reserves, and high barriers to entry, since operating conditions are sufficiently steady to support a large amount of leverage with little downside.

There is usually a natural limitation on the amount of financial leverage, since lenders are less likely to forward additional funds to a borrower that has already borrowed a large amount of debt.

In short, financial leverage can earn outsized returns for shareholders, but also presents the risk of outright bankruptcy if cash flows fall below expectations.

Financial Leverage Example

Able Company uses $1,000,000 of its own cash to buy a factory, which generates $150,000 of annual profits. The company is not using financial leverage at all, since it incurred no debt to buy the factory.

Baker Company uses $100,000 of its own cash and a loan of $900,000 to buy a similar factory, which also generates a $150,000 annual profit. Baker is using financial leverage to generate a profit of $150,000 on a cash investment of $100,000, which is a 150% return on its investment.

Baker’s new factory has a bad year, and generates a loss of $300,000, which is triple the amount of its original investment.

Similar Terms

Financial leverage is also known as leverage. trading on equity. investment leverage. and operating leverage .

Related Topics