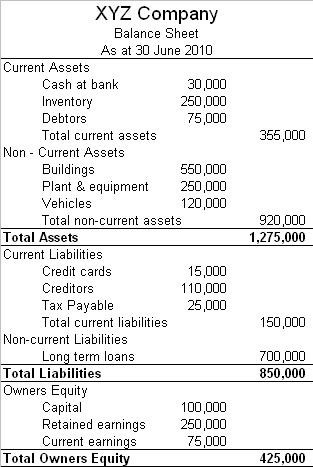

Financial Analysis and Accounting Book of Reference Statement of Financial Position

Post on: 16 Март, 2015 No Comment

Profitability ratios: What is it?

Profitability ratios measure a companys ability to generate earnings relative to sales, assets and equity. These ratios assess the ability of a company to generate earnings, profits and cash flows relative to relative to some metric, often the amount of money invested. They highlight how effectively the profitability of a company is being managed.

Common examples of profitability ratios include return on sales, return on investment, return on equity, return on capital employed (ROCE), cash return on capital invested (CROCI), gross profit margin and net profit margin. All of these ratios indicate how well a company is performing at generating profits or revenues relative to a certain metric.

Different profitability ratios provide different useful insights into the financial health and performance of a company. For example, gross profit and net profit ratios tell how well the company is managing its expenses. Return on capital employed (ROCE) tells how well the company is using capital employed to generate returns. Return on investment tells whether the company is generating enough profits for its shareholders.

For most of these ratios, a higher value is desirable. A higher value means that the company is doing well and it is good at generating profits, revenues and cash flows. Profitability ratios are of little value in isolation. They give meaningful information only when they are analyzed in comparison to competitors or compared to the ratios in previous periods. Therefore, trend analysis and industry analysis is required to draw meaningful conclusions about the profitability of a company.

Some background knowledge of the nature of business of a company is necessary when analyzing profitability ratios. For example sales of some businesses are seasonal and they experience seasonality in their operations. The retail industry is example of such businesses. The revenues of retail industry are usually very high in the fourth quarter due to Christmas. Therefore, it will not be useful to compare the profitability ratios of this quarter with the profitability ratios of earlier quarters. For meaningful conclusions, the profitability ratios of this quarter should be compared to the profitability ratios of similar quarters in the previous years.

Cash Return on Capital Invested (CROCI)

Cash return on capital invested (CROCI ) is metric that compares the cash generated by a company to its equity. It is also sometimes known as cash return on cash invested. It compares the cash earned with the money invested.

DuPont Formula

DuPont formula (also known as the DuPont analysis, DuPont Model, DuPont equation or the DuPont method ) is a method for assessing a company’s return on equity (ROE) breaking its into three parts.

Earnings Before Interest After Taxes (EBIAT)

Earnings Retention Ratio

Earning Retention Ratio is also called as Plowback Ratio. As per definition, Earning Retention Ratio or Plowback Ratio is the ratio that measures the amount of earnings retained after dividends have been paid out to the shareholders.

EBIT (Earnings Before Interest and Taxes)

EBITDARM

Short for Earnings before Interest, Taxes, Depreciation, Amortization, Rent and Management fees, EBITDARM refers to a financial performance measure which is used in comparison to more common measures like EBITDA in situations where the rent and management fees of a company represent a larger-than-normal percentage of operating costs.

EBT (Earnings Before Tax)

Net Profit Margin

Net profit margin (or profit margin. net margin ) is a ratio of profitability calculated as after-tax net income (net profits) divided by sales (revenue). Net profit margin is displayed as a percentage. It shows the amount of each sales dollar left over after all expenses have been paid.