Financial Analysis and Accounting Book of Reference Statement of Financial Position

Post on: 10 Июнь, 2015 No Comment

International Financial Reporting Standards (EU): What is it?

International Financial Reporting Standards (IFRS) are standards based on principles approved by IASB. The IFRS was known earlier as International Accounting Standards (IAS) and Board of the IASC started it after 1973. Later in 2001, on the 1st of the month the International Accounting Standards Board (IASB) took the initiative and liability for the implementation of the Standards.

The Board implemented the International Standards in the very first meet itself. IASB has developed standards calling them IFRS. Both IASC and the IASB issue Interpretations of Standards.

The International Accounting Standards Board (IASB) is the autonomous, personal division and was shaped in 2001 to substitute the International Accounting Standards Committee (IASC). It emerges and endorses International Financial Reporting Standards. It is monitored by the IFRS Foundation.

The International Financial Reporting Standards Foundation is the sovereign, non-profit establishment, formed in 2000 to supervise the IASB. From 1973 until an inclusive wide-ranging in 2000, the constitution for setting up International book keeping principles was known as the worldwide book keeping Standards Committee. There was no exact committee of the similar name. The normal setting panel was known as the IASC Board.

IASC aims to establish and publish book keeping principles to be observed in the management of monetary statements and to encourage their universal approval and observance for the public. It also works usually for the development and management of policy, accounting principles and measures involving the presentation of monetary statements.

The objectives of IFRS are to build up a particular set of superior quality, easy to comprehend, easy to enforce (IFRSs) through the IASB. It also aims at encouraging the use and fast implementation of those standards. In Addition to this, it also takes the report of the monetary reporting needs of promising, medium-sized economic ventures and strives to get about a negotiation of nationwide accounting principles and IFRSs for quality solutions.

International Financial Reporting Standards (IFRSs) are from the IASB Standards. Unless and until All International Accounting Standards (IASs) and analysis issued by the earlier IASC are amended or withdrawn they would be implemented.

They are applicable to the common financial reports and other reporting by business entities, including those engaged in commercial, industrial, financial and similar activities, regardless of their legal stature.

IFRS may be suitable for non-profit-oriented business entities also. Financial statements based on the guidelines of IFRS intend to cater to the frequent requirements of shareowners, public, employees and the creditors by providing information about the monetary situation, routine, and money flows of an establishment.

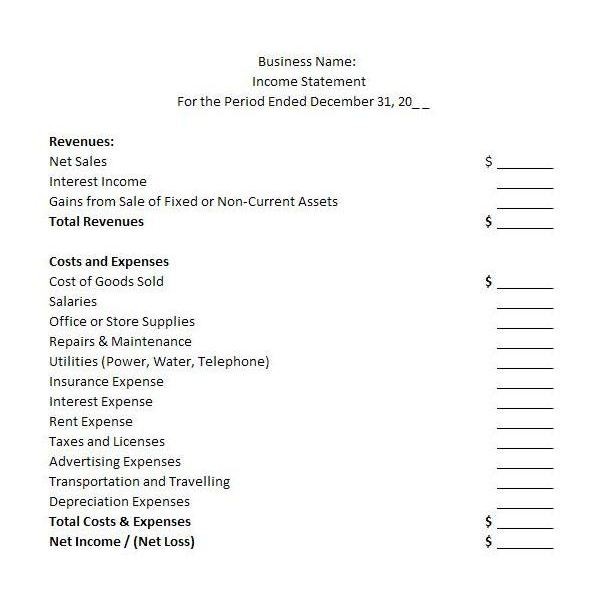

This reporting also includes information regarding other issues which may affect the financial stature of an enterprise that would assist in the interpretation of a set of fiscal declaration or develops one’s capability to make prudent economic decisions as IFRS apply to single business and combined financial reports. An absolute set of monetary report contains reports on monetary position, comprehensive income, cash flows, modifies in equity, bookkeeping policies and illustrative notes. If a separate revenue declaration is presented in accordance with IAS 1(2007), it is treated as part of the complete set.

While emergent values, IASB does not allow choices in secretarial management. It also proposes to re-evaluate the option in accessible IASs with an intention of dropping the quantity of those options. The basic principles presented by IFRS will be in both bold letters and non-bold category. Both have equal authority.

Many countries including European Union, Hong Kong, Malaysia, Turkey, Australia, Russia, India, South Africa, GCC countries, Singapore and Pakistan accept IFRS. There are around 113 countries, which includes Europe, which is permitting IFRS reporting. It is estimated that IFRS reports will be helpful for the populace using the financial details, as they reduce the costs involved in the getting the adequate information and planning for investments in alternative options.

Companies are also projected to do well, as company holders or lenders would be additionally eager to offer remuneration, optimistic by the information. Companies involved in intense international trading would gain from reports from IFRS. Foreign investors also benefit as an accepted accounting standard is in force. But there has been some skepticism about the cost that may incur for the international standard.

It is argued that implementation of the principles may not be tight enough and adding to it the provincial differences in secretarial may get masked by a tag. There was also the worry about the value of IFRS in addition to the attitude of accountants of different countries with different laws regarding losses which may not be anticipated before it was too late.

Though the transition to International Financial Reporting Standards can be categorized into various phases, five stages to achieve International Financial Reporting Standards readiness have been accepted.

While the economic scenario in world seems on the verge of a change almost every day, the authenticity of IFRS statement is the one thing that the investor and businessman alike can rely on. These statements are accurate guidelines so far as they give an impartial and non-prejudiced report on financial undertakings and go with the trend of the moment.

As IFRS is not interested in making any profit its reports on financial institutions are believed to be true as far as facts and figures go. Any upward or downward trend is carefully studied before the report was prepared. Utmost care would be taken to ensure that the public, particularly the investor was not misguided.

The IFRS reports are created by concentrated survey and monitoring and extreme care would be taken to avoid misguidance.

The annual or periodic reports were prepared according to the investment trend so as to assist the investor. The IFRS reports can be interrupted in various countries according to their norms and laws and made easy for the common man to understand and utilize them better.

While the business community is a close knit community there are ample opportunities to err and the investor may end up in financial trouble. Also while the IFRS provides non-biased reports on the financial position of business institutions it would be prudent on the part of the investor to have first hand knowledge as far as possible.

The following list contains Europe Union officially accepted IFRS standards. Note that it’s not pure IASB standards, but EU adopted version of IFRS.

IAS 1 Presentation of Financial Statements

This Standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entitys financial statements of previous periods and with the financial statements of other entities. It sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content.

IAS 2 Inventories

The objective of this Standard is to prescribe the accounting treatment for inventories. A primary issue in accounting for inventories is the amount of cost to be recognised as an asset and carried forward until the related revenues are recognised. This Standard provides guidance on the determination of cost and its subsequent recognition as an expense, including any write-down to net realisable value. It also provides guidance on the cost formulas that are used to assign costs to inventories.

IAS 7 Statement of Cash Flows

Information about the cash flows of an entity is useful in providing users of financial statements with a basis to assess the ability of the entity to generate cash and cash equivalents and the needs of the entity to utilise those cash flows. The economic decisions that are taken by users require an evaluation of the ability of an entity to generate cash and cash equivalents and the timing and certainty of their generation.

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors

The objective of this Standard is to prescribe the criteria for selecting and changing accounting policies, together with the accounting treatment and disclosure of changes in accounting policies, changes in accounting estimates and corrections of errors. The Standard is intended to enhance the relevance and reliability of an entitys financial statements, and the comparability of those financial statements over time and with the financial statements of other entities.

IAS 10 Events after the Reporting Period

(a) when an entity should adjust its financial statements for events after the reporting period; and

IAS 11 Construction Contracts

The objective of this Standard is to prescribe the accounting treatment of revenue and costs associated with construction contracts. Because of the nature of the activity undertaken in construction contracts, the date at which the contract activity is entered into and the date when the activity is completed usually fall into different accounting periods. Therefore, the primary issue in accounting for construction contracts is the allocation of contract revenue and contract costs to the accounting periods in which construction work is performed. This Standard uses the recognition criteria established in the Framework for the Preparation and Presentation of Financial Statements to determine when contract revenue and contract costs should be recognised as revenue and expenses in the statement of comprehensive income. It also provides practical guidance on the application of these criteria.

IAS 12 Income Taxes

The objective of this Standard is to prescribe the accounting treatment for income taxes. The principal issue in accounting for income taxes is how to account for the current and future tax consequences of:

(a) the future recovery (settlement) of the carrying amount of assets (liabilities) that are recognised in an entitys statement of financial position; and

IAS 16 Property, Plant and Equipment

IAS 18 Revenue

Income is defined in the Framework for the Preparation and Presentation of Financial Statements as increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants. Income encompasses both revenue and gains. Revenue is income that arises in the course of ordinary activities of an entity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties. The objective of this Standard is to prescribe the accounting treatment of revenue arising from certain types of transactions and events.

IAS 19 Employee Benefits

The objective of this Standard is to prescribe the accounting and disclosure for employee benefits. The Standard requires an entity to recognise:

(a) a liability when an employee has provided service in exchange for employee benefits to be paid in the future; and

IAS 20 Accounting for Government Grants and Disclosure of Government Assistance

This Standard shall be applied in accounting for, and in the disclosure of, government grants and in the disclosure of other forms of government assistance.

IAS 21 The Effects of Changes in Foreign Exchange Rates

IAS 23 Borrowing Costs

Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset form part of the cost of that asset. Other borrowing costs are recognised as an expense.

IAS 24 Related Party Disclosures

The objective of this Standard is to ensure that an entitys financial statements contain the disclosures necessary to draw attention to the possibility that its financial position and profit or loss may have been affected by the existence of related parties and by transactions and outstanding balances, including commitments, with such parties.

IAS 26 Accounting and Reporting by Retirement Benefit Plans

This Standard shall be applied in the financial statements of retirement benefit plans where such financial statements are prepared.

IAS 27 Consolidated and Separate Financial Statements

This Standard shall be applied in the preparation and presentation of consolidated financial statements for a group of entities under the control of a parent.

IAS 28 Investments in Associates

IAS 29 Financial Reporting in Hyperinflationary Economies

This Standard shall be applied to the financial statements, including the consolidated financial statements, of any entity whose functional currency is the currency of a hyperinflationary economy.

IAS 31 Interests in Joint Ventures

This Standard shall be applied in accounting for interests in joint ventures and the reporting of joint venture assets, liabilities, income and expenses in the financial statements of venturers and investors, regardless of the structures or forms under which the joint venture activities take place.

IAS 32 Financial Instruments: Presentation

The objective of this Standard is to establish principles for presenting financial instruments as liabilities or equity and for offsetting financial assets and financial liabilities. It applies to the classification of financial instruments, from the perspective of the issuer, into financial assets, financial liabilities and equity instruments; the classification of related interest, dividends, losses and gains; and the circumstances in which financial assets and financial liabilities should be offset.

IAS 33 Earnings per Share

The objective of this Standard is to prescribe principles for the determination and presentation of earnings per share, so as to improve performance comparisons between different entities in the same reporting period and between different reporting periods for the same entity. Even though earnings per share data have limitations because of the different accounting policies that may be used for determining earnings, a consistently determined denominator enhances financial reporting. The focus of this Standard is on the denominator of the earnings per share calculation.

IAS 34 Interim Financial Reporting

The objective of this Standard is to prescribe the minimum content of an interim financial report and to prescribe the principles for recognition and measurement in complete or condensed financial statements for an interim period. Timely and reliable interim financial reporting improves the ability of investors, creditors, and others to understand an entitys capacity to generate earnings and cash flows and its financial condition and liquidity.

IAS 36 Impairment of Assets

The objective of this Standard is to prescribe the procedures that an entity applies to ensure that its assets are carried at no more than their recoverable amount. An asset is carried at more than its recoverable amount if its carrying amount exceeds the amount to be recovered through use or sale of the asset. If this is the case, the asset is described as impaired and the Standard requires the entity to recognise an impairment loss. The Standard also specifies when an entity should reverse an impairment loss and prescribes disclosures.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

IAS 38 Intangible Assets

The objective of this Standard is to prescribe the accounting treatment for intangible assets that are not dealt with specifically in another Standard. This Standard requires an entity to recognise an intangible asset if, and only if, specified criteria are met. The Standard also specifies how to measure the carrying amount of intangible assets and requires specified disclosures about intangible assets.

IAS 39 Financial Instruments: Recognition and Measurement

The objective of this Standard is to establish principles for recognising and measuring financial assets, financial liabilities and some contracts to buy or sell non-financial items. Requirements for presenting information about financial instruments are in IAS 32 Financial Instruments: Presentation. Requirements for disclosing information about financial instruments are in IFRS 7 Financial Instruments: Disclosures.

IAS 40 Investment Property

IAS 41 Agriculture

The objective of this Standard is to prescribe the accounting treatment and disclosures related to agricultural activity.

IFRS 1 First-time Adoption of International Financial Reporting Standards

The objective of this IFRS is to ensure that an entitys first IFRS financial statements, and its interim financial reports for part of the period covered by those financial statements, contain high quality information that:

(b) provides a suitable starting point for accounting in accordance with International Financial Reporting Standards (IFRSs); and

IFRS 2 Share-based Payment

The objective of this IFRS is to specify the financial reporting by an entity when it undertakes a share-based payment transaction. In particular, it requires an entity to reflect in its profit or loss and financial position the effects of share-based payment transactions, including expenses associated with transactions in which share options are granted to employees.

IFRS 3 Business Combinations

The objective of this IFRS is to improve the relevance, reliability and comparability of the information that a reporting entity provides in its financial statements about a business combination and its effects.

IFRS 4 Insurance Contracts

(b) disclosure that identifies and explains the amounts in an insurers financial statements arising from insurance contracts and helps users of those financial statements understand the amount, timing and uncertainty of future cash flows from insurance contracts.

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

The objective of this IFRS is to specify the accounting for assets held for sale, and the presentation and disclosure of discontinued operations. In particular, the IFRS requires:

(a) assets that meet the criteria to be classified as held for sale to be measured at the lower of carrying amount and fair value less costs to sell, and depreciation on such assets to cease; and

IFRS 6 Exploration for and Evaluation of Mineral Resources

The objective of this IFRS is to specify the financial reporting for the exploration for and evaluation of mineral resources.

IFRS 7 Financial Instruments: Disclosures

The objective of this IFRS is to require entities to provide disclosures in their financial statements that enable users to evaluate:

(a) the significance of financial instruments for the entitys financial position and performance; and