Financial Advisor Get a Top Financial Advisor with

Post on: 11 Май, 2015 No Comment

Financial Success with a Financial Advisor

The 2009 economic situation has made it difficult to plan for the future, and to grow the assets you need to realize that future. Although there are good investments to be made, finding them requires considerable time, skill, and knowledge, as well as access to real-time financial data and other information that is available only to professionals in the financial sector. For most people, the cost of a good financial advisor is more than outweighed by the additional gains that can be realized by relying on a professional, rather than your own intuition. Choosing this advisor may not seem much easier than investing on your own, but with a little work, you can forge a relationship that will bring returns for years to come.

A financial advisor focuses primarily on helping you grow your capital while maintain a desired level of investment income. By creating a portfolio of financial products, including stocks and bonds, options and future, mutual funds, real estate investments, insurance products and annuities. They can also assist with related issues such as financial risk management, retirement and estate planning, and keeping your tax liability as low as possible. A financial planner will assess your personal risk and liability, and make sure you have the insurance coverage you require. They can help you establish a stable cash flow while generating capital for the future projects and a comfortable retirement. An advisor can also help you plan for one-time expenditures such as purchasing a second home, a boat, or other large asset.

The portfolio and plan that your advisor creates for you should be unique to your situation, goals, risk tolerance, and other personal factors. a good financial advisor will take the time to learn who you are and where you are going, rather than push a particular stock or scheme. They should be aware not only of your financial situation, but also have any necessary information about relevant non-financial information, such as a child’s chronic medical needs, or having to care for an elderly relative.

Most of us have more financial goals than we can reasonably achieve; we want to retire early, own a second home, put our kids through college, and take extravagant vacations every year. A good financial advisor will offer you a number of different portfolios and plans, each allowing you to achieve some of your goals at the expense of others. For example, you may be able to ensure that your children will go to college, but not retire early as well. You may be able to retire early by forgoing the second home. Your advisor will present the pluses and minuses associated with each plan, and help you prioritize your goals and decide amongst them.

Once you and your advisor have settled on a plan, you should meet on a regular basis to monitor and adjust your portfolio and trajectory. This is especially true if you make any major life changes, such as a divorce, birth of a child, or inherit additional assets. It is vital that you have a relationship with your financial advisor that is built on trust and sound financial advice. If you cannot be honest with your advisor, you cannot expect them to be able to provide the help you need.

Financial advisors work in brokerage houses, public and private investment firms, or may own their own advising firm. Whatever the setting, they earn their keep in a number of ways. They may earn a fee from you for their services, or they may be paid a commission for selling certain financial products. A fee-only advisor is often more expensive than a fee-based advisor, who also receives commissions from brokerages and other financial institutions. However, fee-only advisors are not financially motivated to sell certain products and therefore may be better able to advocate for their clients. You should always inquire about any commissions your advisor may be receiving when considering their advice.

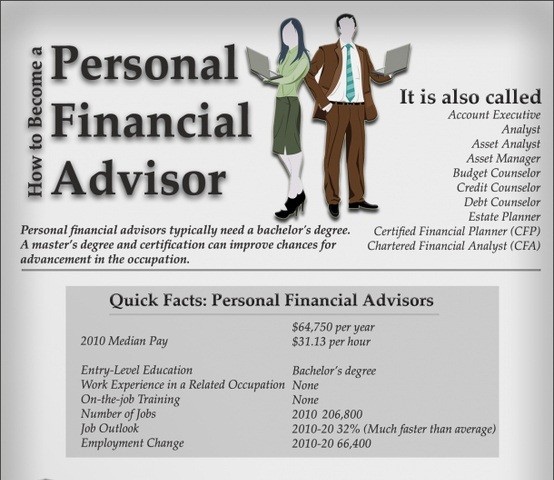

In the United States, there is no official training to become a financial advisor. However, the Financial Industry Regulatory Authority (FINRA) provides exams which allow a person to gain access to certain financial sectors and carry out certain transactions. For example, in order to act as a stock broker, a person must pass the Series 7 exam; Series 63 (state exam), passing the Series 65 or 66 Registered Investment Advisor (RIA) exams allows a person to take a fee for providing investment advice. Other exams are required to sell property and casualty insurance, and still others to sell life insurance. It is a good idea to check your advisor’s credentials with your state licensure body. Your advisor should limit him or herself to those areas in which they are properly qualified.

Trying to plan for your own financial future is extremely challenging; the knowledge and skills required are substantial, the time commitment is daunting, and your moods and emotions can hinder your decision making. A financial advisor can relieve you of many of these burdens, and become your partner and advocate in achieving financial success.