Filing IRS Form 1116 to Claim the Foreign Tax Credit TurboTax Tax Tips & Videos

Post on: 18 Май, 2015 No Comment

Updated for Tax Year 2014

OVERVIEW

To avoid making expatriates, military personnel stationed abroad and international mutual fund investors pay taxes to two countries, the Internal Revenue Service gives them a choice: They can deduct their foreign taxes on Schedule A, like other common deductions, or they can use Form 1116 for a tax credit and subtract the taxes they paid to another country from whatever they owe the IRS.

The U.S. taxes worldwide income. To avoid making expatriates, military personnel stationed abroad and international mutual fund investors pay taxes to two countries, the Internal Revenue Service gives them a choice: They can deduct their foreign taxes on Schedule A, like other common deductions, or they can use Form 1116 for a tax credit and subtract the taxes they paid to another country from whatever they owe the IRS.

When the credit is larger than their U.S. tax obligation, Form 1116 filers can use the leftover amount to reduce their IRS bill on future tax returns, known as carrying it over.

Foreign tax credit eligibility

Taxes paid to other countries qualify for the foreign tax credit when:

- They were levied on your income.

- You were legally obliged to pay them.

- You did pay them.

- You did not gain from paying them, and

- The United States has not sanctioned the country.

Eligible taxes include income tax you paid to local and provincial governments. They do not include sales, value-added, real estate or luxury taxes paid to a foreign government.

As of 2011, the foreign tax credit does not apply to any tax paid to Syria, Sudan, North Korea, Iran or Cuba. These countries are sanctioned because the U.S. believes they support terrorism or has no diplomatic relations with them.

Reporting foreign income with Form 1116

Form 1116 first asks you to classify your foreign income by category. You must complete a separate form for each type of income you have.

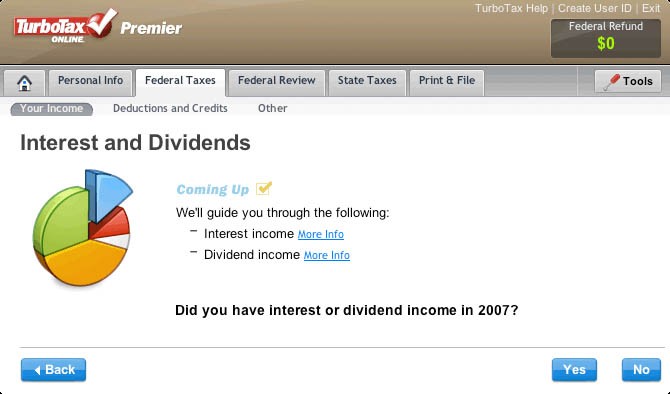

- Passive income includes interest, dividend, royalty and annuity income for which you received a 1099 form. The 1099 shows what and whom you paid: taxes in Box 6, and country in Box 7.

- The general limitation category covers your wages, salary and any highly taxed passive income. Income becomes highly taxed for IRS purposes when the foreign country’s tax rate is higher than the U.S. rate. For example, if Country Z taxes your interest income at 50 percent, and the U.S. taxes it at 35 percent, the interest you earned in Country Z goes under general limitation income on Form 1116.

- Section 901(j) countries are the five countries the U.S. has sanctioned. You must report earnings from any of them.

- The lump-sum distribution category represents income you got from a foreign-sourced pension plan.

- Resourced by treaty relates to tax treaties the U.S. has with other countries. You complete a Form 1116 for this category if the country in which you worked has a special agreement with the U.S. about how it taxes your income as a foreigner. Under resourced by treaty agreements, all of your income, including any money you made in the U.S. counts as income from the treaty country when figuring out the taxes you owe it.

Overview of Form 1116

If you have only one type of foreign income, you complete just one Form 1116. All Form 1116 filers must choose how they regard their income: on a cash basis or an accrual basis. These accounting methods track the timing of your income for tax purposes.

If your budget doesn’t recognize income until you receive it, you use the cash method. If your budget records income when you earn it rather than when you get paid, you use the accrual method. Most individuals use the cash method.

Form 1116’s instructions walk you through each line item and include worksheets. You provide detailed information using each of the form’s four sections:

- Part 1 to calculate taxable income from one to three countries.

- Part 2 to list taxes paid in both the foreign currency and their U.S. dollar equivalent.

- Part 3 to figure the foreign tax credit for the income category.

- Part 4 to total all credits from all income categories.

Foreign tax credit without Form 1116

Situations exist that allow you to claim the foreign tax credit without filing Form 1116, as long as the income concerned meets the qualifying definition.

If all of your foreign-taxed income was 1099-reported passive income, such as interest and dividends, you don’t need a 1116, provided that any dividends came from stock you owned for at least 16 days.

Single filers who paid $300 or less in foreign taxes, and married joint filers who paid $600 or less, can omit filing the foreign tax credit form. However, using the form enables you to apply any credit balance to future tax years. Without filing Form 1116, you give up this carryover tax break.

If your income came from a U.S. territory such as American Samoa, Puerto Rico, Guam and the Virgin Islands, special rules govern how you use Form 1116 for the foreign tax credit.

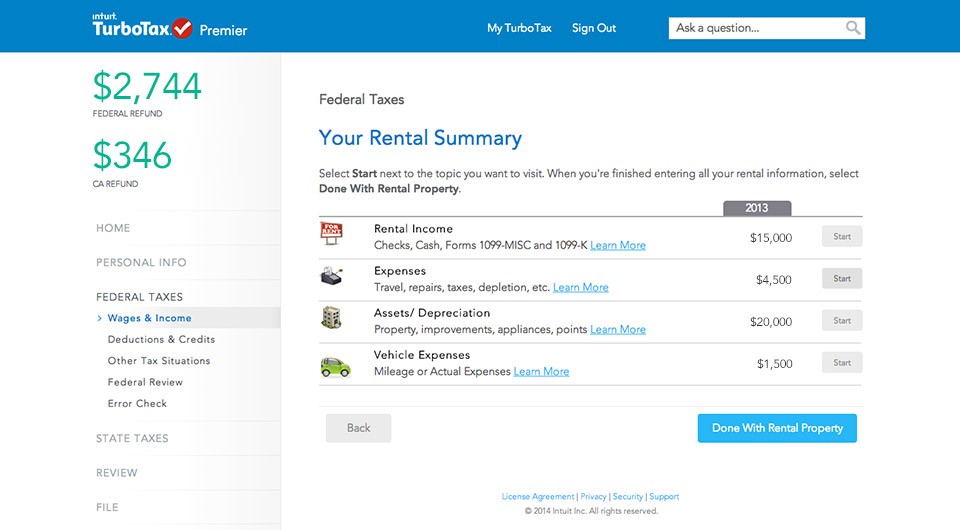

When you use TurboTax to prepare your taxes, well ask you straightforward questions about your foreign income, determine how much of it is deductible (or available as a credit), and fill in all the right forms for you.