Figuring Net Profit From Selling Your Home

Post on: 9 Июль, 2015 No Comment

Figuring Net Profit from Selling Your Home

tomch/E+/Getty Images

Every diligent real estate agent I know prepares a net sheet for the seller when signing a listing agreement or presenting a comparative market analysis. Because the second question on sellers’ minds — right after real estate commission negotiation — is how much the seller will net. Home sellers expect a reasonable response to: What is the seller’s net profit?

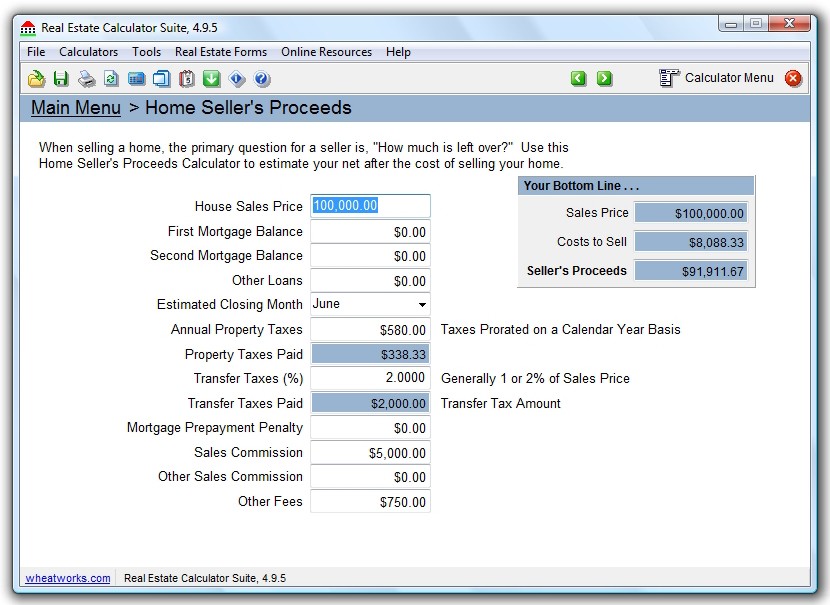

To figure a seller’s net profit, you need to have access to the expenses of sale. As a Realtor. I compute two net sheets for sellers. The first net sheet is based on receiving full list price. The second net sheet is figured on receiving the median sales price of similar homes in the neighborhood. This way sellers can look at a range of net profit numbers.

Closing Statement Debits and Credits

- Seller’s Closing Statements

A seller’s closing statement, not to be confused with a HUD-1. is a balancing of credits and debits. A credit, for example, is the sales price amount, because that is the amount the seller receives. Debits involve all the costs of sale associated with home selling. Other credits may appear such as prepaid property taxes. which will be prorated. returning to the seller that portion which has been paid in advance for the time period the seller does not own the home.

If sellers are selling without equity. the check the seller brings in to close will be shown as a credit on the closing statement. Absent of seller credits. apart from the sales price, the bottom-line totals of both debits and credits will equal the sales price .

Buyers, on the other hand, receive a closing statement showing the sales price as a debit, because that is the amount the buyer owes. If the buyer will be paying a tax bill that covers a portion of the time the seller has occupied the property, that amount will show up as a credit to the buyer (and a debit to the seller).

Seller’s Closing Statement Debits

The following fees are considered debits to the seller and charged against the sales price. Because a seller’s expenses of sale can vary from state to state, county to county and city to city, the example shown is based on a sample closing statement for a seller in Sacramento, CA. Your actual fees may vary. Third-party fees such as those for title policies, escrow companies or real estate commissions will depend on the vendor selected.

Net Profit Due the Seller

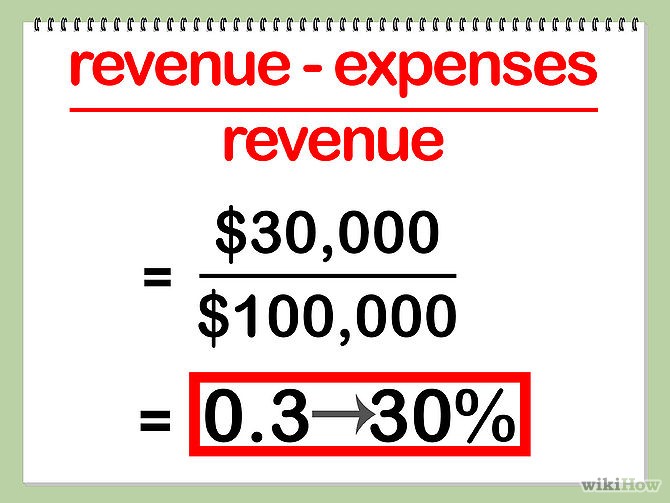

First, add up all the charges to determine the total amount of debits. Then add the sales price to the credit prorations. Subtract the credit from the debit. The balance leftover is the seller’s net profit of sale.

Providing the seller has sufficient equity, the net profit amount, added to the total debits, will equal the bottom-line credit. This is why the total debit will always equal the total credit on a seller’s closing statement.

At the time of writing, Elizabeth Weintraub, DRE # 00697006, is a Broker-Associate at Lyon Real Estate in Sacramento, California.