Fewer hospitals have positive margins as they face financial squeeze Modern Healthcare

Post on: 12 Апрель, 2015 No Comment

In recent years, Cone Health has experienced solid growth in patient service revenue, generating a 10.3% jump to $1.1 billion in fiscal 2013 over the previous year.

The Greensboro, N.C.-based system received a boost from new operations and added patient volume through its affiliation with Alamance Regional Medical Center in Burlington, N.C. an alliance strategy being widely pursued across the country. It also negotiated higher rates with its insurers .

Yet despite the revenue increase, it finished the year with an operating deficit of $44.1 million as rising salary, benefit and retirement costs contributed to an explosive 18.3% hike in expenses. Its higher volume translated into higher supply costs. And it incurred new expenses from installing an electronic health-record system. opening a new tower and integrating Alamance.

Only investment income and the inherent contribution from the Alamance affiliation allowed the system to finish in the black. It’s been a period of investment; it’s been a period of preparation, said Terry Akin, president and chief operating officer for Cone Health. It’s also been a time of financial challenges. Last year in particular was the perfect storm for us.

A Modern Healthcare analysis of earnings reports for about 200 hospitals and health systems, both not-for-profit and investor-owned, found that hospital margins narrowed significantly last year despite an improving economy.

Despite a buoyant stock market streak by some publicly traded chains, healthcare providers as a group continue to operate with slim and shrinking margins. Overall, a smaller percentage of healthcare providers saw positive operating margins last year compared with the previous two years.

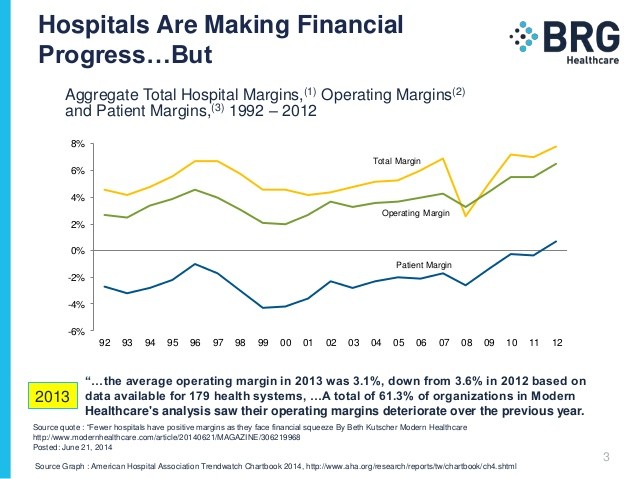

Modern Healthcare’s analysis found that the average operating margin in 2013 was 3.1%, down from 3.6% in 2012 based on data available for 179 health systems, which included acute-care, post-acute care, rehabilitation as well as specialty hospital groups and some stand-alone hospitals. A total of 61.3% of organizations in Modern Healthcare’s analysis saw their operating margins deteriorate over the previous year.

Healthcare executives acknowledge that the business landscape has been challenging. But some believe a turnaround could happen as soon as this year as some cost pressures ease and they begin to test the business case for bundled payments and accountable care organizations.

I’m very excited about the trends that we’re seeing in 2014, said Todd Hofheins, senior vice president and chief financial officer at Renton, Wash.-based Providence Health & Services. We’re starting to see the value of shared services. We finished our Epic (EHR) implementation this year. We’re also seeing the benefit of Medicaid expansion.

Is the worst over yet?

But analysts remain skeptical that the worst is over. Volumes are down as much as 7%. All three credit-rating agencies have a negative outlook on the not-for-profit healthcare sector. Moody’s Investors Service, for instance, says it has been downgrading twice as many not-for-profit providers as it has upgraded. Many of the upgrades are due to acquisitions rather than organic growth.

Ratings are reacting to the margin pressure, said Martin Arrick, managing director at Standard & Poor’s. There is a lot of operating pressure on hospitals and our expectation is that it’s going to continue.

Revenue from patient care has been squeezed as Medicare and commercial insurers attempt to hold down spending and reduce utilization. The explosion of high-deductible health plans has led more patients to delay care, creating staffing and operational challenges.

At the same time, costs are rising as providers invest in the new technology and care-coordination staff needed to participate in healthcare reform’s new payment models.

Financial information for this report was assembled from the new Modern Healthcare Financial Database, which allows subscribers to search through three years of key financial data for the country’s 260 largest healthcare systems. View the database

Things are picking up at Cone

At Cone Health, Akin acknowledged that a drop in utilization outstripped our ability to cut costs. But things are picking up. The first six months of fiscal 2014 are already ahead of budget. The system made major improvements in its revenue-cycle functions and instituted more flexible staffing arrangements to match swings in volume. I think the next few years will be very, very challenging, Akin said.

Cone isn’t alone. Only 84.4% of provider organizations operated in the black last year, down sharply from the 89.2% that had positive results in 2012 and even below the 86.9% of providers that posted positive results in 2011. Data were available for 222 organizations for fiscal 2012 and 206 for fiscal 2011.

The brief improvement in 2012 came from cost-cutting, said S&P’s Arrick. The strategy workedbut only temporarily. Hospitals are running out of room to cut costs even as the decline in patient volume accelerates, he said. It’s all kind of catching up to us.

Major investments to get ready for new payment and delivery models still aren’t generating a meaningful return. Arrick said hospital executives estimate less than 5% of revenue comes from population health management.

It’s going to be really slow and there are a lot of people who basically see themselves operating in a fee-for-service environment, he said.

Providence was among the systems with shrinking margins last year. The falloff in its financial performance this month led to a ratings downgrade from both Moody’s and S&P.

To prepare for population health management, the five-state system implemented a new EHR system across all its hospitals at a cost of $750 million. It has also invested heavily over the past three years to build a shared-services divisiona centralized unit that handles back-office functions such as revenue-cycle management and accounts payable.

While that move was projected to save as much as $400 million over the next three to four years, Providence is just beginning to realize those gains. It has yet to offset the sharp decline in inpatient volumes, which, as at most systems, have been replaced by less lucrative observation stays, office visits and outpatient services.

MH Takeaways

Cost-cutting worked temporarily, but now providers must invest in improving their ability to keep enrolled populations healthy.

It’s really getting paid for a new competency, which is getting paid for keeping people healthy, Hofheins said. Unfortunately, you can’t just get there by cutting costsyou have to get there by investment.

As revenue from patient care declines, hospitals are increasingly making up the shortfall with non-operating revenue, said Paula Song, an associate professor of health policy and management at the University of North Carolina’s Gillings School of Global Public Health.

In a bull market, revenue from investment portfolios, endowments and donations can provide a boost to the bottom line.

However, the systems that are most likely to be struggling financially are also the ones with the smallest cash cushions and therefore less cash to invest. They missed out on the opportunities in last year’s bull market, Song said.

The groups with the strongest operating margins last year included:

- United Surgical Partners International, which operates ambulatory surgical centers as well as hospitals.

- HealthSouth Corp. which operates 103 rehabilitation hospitals in 28 states, according to Securities and Exchange Commission filings.

- Cook Children’s Health Care System, a two-hospital system based in Fort Worth, Texas.

- Universal Health Services, a publicly traded system based in King of Prussia, Pa. which operates 24 acute-care hospitals and 194 behavioral health centers in 37 states, Washington, D.C. Puerto Rico and the U.S. Virgin Islands, according to SEC filings.

Bucking the trend

Click to enlarge

Some acute-care hospitals are bucking the trend, however. NorthBay Healthcare in Fairfield, Calif. which operates 157-bed NorthBay Medical Center, has improved its operating margin from negative 2.1% in 2011 to 0.2% in 2012 and 6.3% last year.

Its secret? Four years earlier, NorthBay, which is about halfway between San Francisco and Sacramento, began focusing on keeping its patients in Solano County for specialty services such as cardiovascular surgery.

It also has received designation as a Level 3 trauma center and is seeking a Level 2 designation.

NorthBay doesn’t need a larger partner to survive, CEO Gary Passama said.

Being smaller, we have much more flexibility, he added. Maybe being too big is not as good as people think.

Follow Beth Kutscher on Twitter: @MHbkutscher