Federal Reserve Printing Money

Post on: 16 Март, 2015 No Comment

Definition: What does it mean when they say the Federal Reserve is printing money? It doesn’t mean the Fed has a printing press that spouts out dollars. Only the Treasury Department does that. However, most of the money, also known as capital. in use today is not cash. Instead, it’s credit — the same kind of credit you receive when your employer deposits your paycheck directly into your bank account .

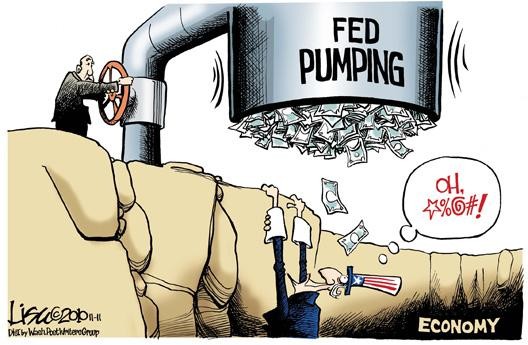

The Federal Reserve manages the amount of capital that is available to spend or invest. The total amount of capital is known as the money supply. while its availability is known as liquidity. The Fed manages liquidity with monetary policy. Its most-used tools are open market operations and the Fed funds rate. In December 2008, the Fed launched Quantitative Easing. a massive expansion of open market operations.

When Does the Fed Print Money?

People say the Fed is printing money whenever it engages in expansive monetary policy. By lowering the Fed funds rate target, the Fed lowers all bank rates. This adds liquidity, and has the same effect as printing money. High liquidity occurs when interest rates are low. That makes capital affordable, so businesses and investors are more likely to borrow. The return on investment only has to be higher than the interest rate. so more investments look good. In this way, high liquidity spurs economic growth.

If overdone, it can lead create inflation. As cheap capital chases fewer and fewer good ventures — or houses, or gold. or barrels of oil, or high tech companies — then the prices of those assets increase.

The official measure of inflation, the Consumer Price Index. doesn’t measure all of these price increases. It captures oil prices. but not gold or stock prices. It does measure housing, but it uses a statistic that actually measures rental prices, not housing itself. That’s why Fed actions can easily create asset bubbles instead of inflation. For more, see these recent Asset Bubbles .

This leads to irrational exuberance . Eventually, more of this capital is invested in bad ventures. As they go defunct, investors panic, and prices plummet, as they scramble madly to sell. That’s what happened with mortgage-backed securities during the 2007 Banking Liquidity Crisis. This phase of the business cycle. known as contraction, usually leads to a recession. The Fed then prints money to spur borrowing, investing and economic growth.

Can the Fed Unprint Money?

People get concerned about the Federal Reserve printing money because they don’t understand how the Fed can unprint money. It uses contractionary monetary policy to dry up liquidity. This has the same effect as taking money out of circulation.

The Fed can just as easily raise the Fed funds rate as lower it. By raising the Fed funds rate, banks have less money to lend. They’ve got to pay each other more to keep fed funds in the overnight account to fulfill the Reserve Requirement. Raising the Fed funds rate also increases all other interest rates. This makes it more expensive to borrow for business expansion, automobiles and homes. That slows economic growth, removing the demand needed to drive inflation.

It can also reverse the effects of QE by selling Treasuries and mortgage-backed securities to its banks. People worry that the banks won’t buy these securities, but the Fed doesn’t have this problem. It simply removes dollars from the banks’ balance sheets, and replaces them with these securities.

What happens to the dollars? They vanish. In other words, they go back into the thin air where the Fed got them in the first place. Article updated March 6, 2015.