Federal Reserve How and Why Do They Change Interest Rates

Post on: 16 Март, 2015 No Comment

There is a lot of misinformation about the Federal Reserve floating around and a good portion makes it out to be evil. This happens for two reasons:

- It Is powerful

- Many people dont have the slightest clue what it does

- It has its hands in some of the most sensitive areas. YOUR MONEY!

This scares people into thinking going back to a system that is backed by gold or some other hard commodity would be better. It sounds great because gold has always been valuable, will always stay valuable, and the dirty Fed cant mess with it. But is that all really true? Would it have the effect that so many people desire?

www.usa.gov/directory/federal/F.shtml )

From the Richmond Fed website

The holding of this stock, however, does not carry with it the control and financial interest conveyed to holders of common stock in for-profit organizations. It is merely a legal obligation of Federal Reserve membership, and the stock may not be sold or pledged as collateral for loans. Member banks receive a 6 percent dividend annually on their stock, as specified by law, and vote for the Class A and Class B directors of the Reserve Bank. Stock in Federal Reserve Banks is not available for purchase by individuals or entities other than member banks.

www.federalreserve.gov/pubs/frseries/frseri4.htm ) Banks and consumers are both represented.

That is how the system is setup contrary to what anyone else may say. From this point if they want to go deeper and speculate as to the amount of political influence or control the member banks have over the Fed then that is a separate issue entirely and needs to be addressed as such.

What are the functions of the central bank?

- conducting the nations monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates

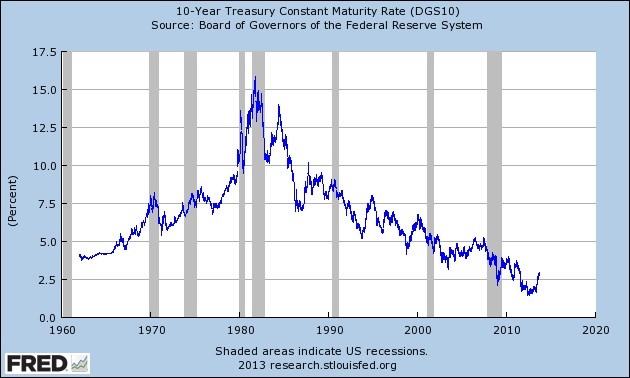

How does the Fed move interest rates?

By controlling interest rates, AKA: influencing the monetary and credit conditions The Fed purchases bonds from the U.S. Treasury on the private market. This means they are taking previously issued bonds (U.S. Treasury debt) out of circulation, and putting more currency into circulation. The effect is an increase in price and a decrease in effective yield of the bonds. Remember they were already issued from the treasury to someone else at a par value. interest rate. and maturity date .

This act increases the supply of money in the economy because the money that the Fed used to buy the bonds was not previously in circulation. That ultimately ends up in the banks which they use to create new loans. An infusion of cash into banks means that the banks are more likely to lend out the money at lower rates. If the supply of money goes up (inversely, the supply of debt goes down) then the interest rate will fall.

How is the supply of money tied to the demand for debt? The supply of debt goes down because the Fed has bought a lot of it up and taken it out of circulation. Less supply of debt means that the buyers of it (people who want to make money from interest) will have to pay a higher price. Sellers can wait for a better price, or lower effective interest rate on the outstanding debt. The Fed buys this debt with cash that is then left in the economy. What happens when there is extra money laying around? People dont usually stuff it in their mattress or plant it in the ground hoping it will grow a tree. They usually loan it out at interest to make more money. So there is more money on the market available to loan (higher supply). Both congruent situations have the effect of lowering interest rates.

Of course if they wanted to raise interest rates they would do everything the opposite way. The Fed would take U.S. Treasury bonds that they currently have on their balance sheet and sell them into the open market, which would increase the supply of debt and decrease the supply of money (they would be inserting bonds into the market and removing the money they received for them). The supply of money will go down and the supply of debt will go up. In this case buyers of debt (people who want to make money from loaning money out at interest) can hold out for better deals (higher interest rates)

Just follow the flow of money

The Fed can intervene in the economy and make adjustments as needed to prevent it from stalling, becoming too strong, or too weak. The process works because the central bank has the authority to bring money in and out of existence. They are the only point in the whole system with the unlimited ability to produce money. Another organization may be able to influence the open market for a period time, but the central bank will always be able to overpower their influence with an infinite supply of money. Ideas of going back to the gold standard may sound appealing at first but there are countless problems that would arise from it.

What happens when wages become too high for them to be sustained? Or prices fluctuate?

Would workers agree to a pay-cut in order to keep their jobs? Or would they strike and constantly demand higher wages? Even though inflation is one of the causes of the need for higher wages, gold would cause severe price swings due to trade imbalances while workers would need to constantly be adjusting to new salary levels that wouldnt necessarily match the prices. The economy would be booming and crashing constantly. Not only do you have the raw effects of an unstable economy, but the consumers perception of stability and safety would also go out the window.

What happens when gold is hoarded off the market causing liquidity problems? What happens when that gold is suddenly injected back into the market?

Gold can be taken out of circulation in the same way that the supply of money is done right now by the Fed. All it takes is someone with a sufficient supply of gold to move the market *cough* governments *cough*. If the world would somehow adopt the gold standard, then you would not only be subject to your own governments expansion and contraction of the money supply, but that of foreign governments as well since they now use the same currency.

There would still be inflation with gold.

What happens when more gold is mined out of the earth? It will cause inflation just like it does now, except it will not be controlled and monitored like it is now. It may go through periods of extreme inflation, to deflation, etc. The whole job of the Fed is to keep this balancing act as stable as possible so the economy can go and do its thing without being bothered.

Gold is always valuable, so it must make a good currency, right?

Gold is seen as valuable because it has a high value to weight ratio. Right now if weighted equally, gold is worth 47 times as much as dollars. (1 Dollar = 1 gram while 1 gram of gold is worth $47) Something of perceived high value seems logical to become a currency, but value is also relative. In the past years gold has had enormous price fluctuations

A 10% move in the price of a dollar would be seen as a huge move. Just look at the massive increase in gold prices from 05 to 11

Thats a 440% increase in the price of gold over 6 years. The massive 10% possible fluctuation in the price of the dollar is looking pretty stable right about now isnt it? Economies cannot withstand that rapid of price movements.

So Why does the Fed change interest rates?

They do it to avoid shocks to the economy which could be harmful to consumers. In the end, gold would lead to many more shocks to the economy. It simply does not operate as people dream it does. The reality is that it would be far too volatile for any economy to handle.

If you want to read about historical issues with the gold standard, check this out!