Federal Reserve Chairman Ben Biography

Post on: 16 Март, 2015 No Comment

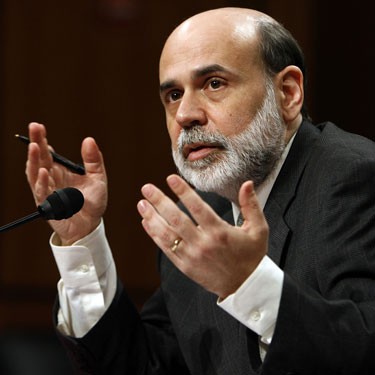

Federal Reserve Chairman Ben Bernanke (Credit:Win McNamee/Getty Images).

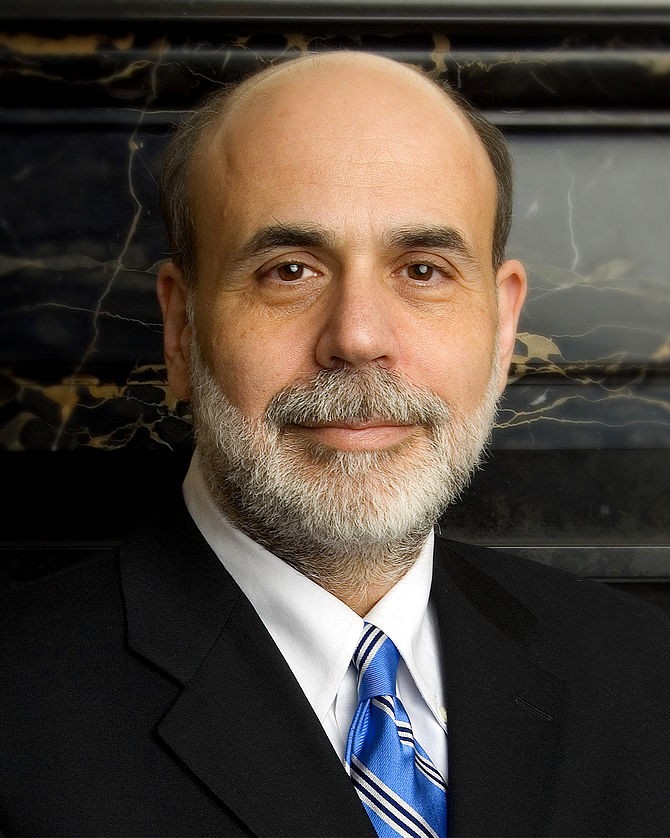

Who Is Ben Bernanke?:

Ben Shalom Bernanke was appointed Chairman of the Board of Governors of the Federal Reserve System on February 1, 2006, replacing Alan Greenspan. Congress appointed Bernanke for his knowledge of how monetary policy contributed to the Great Depression and his belief in inflation targeting .

He created many innovative Fed tools to prevent a global depression in the early stages of the banking crisis. He led the Fed in taking on new roles, such as bailing out Bear Stearns and the $150 billion bailout of insurance giant AIG. The Fed loaned $540 billion to money market funds to stop a global panic.

Bernanke also led the push to expand open market operations when lowering interest rates alone wasn’t enough to end the 2008 financial crisis. He was responsible for Operation Twist and other aspects of Quantitative Easing .

Bernanke resigned from the Fed Chairmanship on January 31, 2014. He is succeeded by former Federal Reserve Vice-Chair Janet Yellen. who is sympathetic to his policies. On February 3, 2014, he became a Distinguished Fellow in Residence in the Economic Studies Program at the Brookings Institute. He will be affiliated with the Hutchins Center on Fiscal and Monetary Policy to analyze and educate the public on fiscal and monetary policy.

Why Is Bernanke Important to the U.S. Economy?:

Federal Reserve Chairman Bernanke was responsible for guiding monetary policy for the U.S. economy. This was more critical through the last decade, as fiscal policy became hamstrung by the national debt. As the spokesperson for the Fed, Bernanke was the country’s premier economic expert, and his words swayed the stock market and the value of the dollar. During his tenure as Fed Chair, Ben Bernanke was the most important person in the U.S. and, therefore, the global economy.

What Is the Role of the Federal Reserve Chairman?:

Although it is the FOMC committee that sets and executes monetary policy, the Chairman has traditionally taken a strong leadership role. Since the Chairman is appointed for four-year terms, he is expected to be more independent than an elected official who answers to voters. This allows the Fed to take a long-term view, and not react to short-term political pressure. That’s because the Fed’s tools, such as the Fed funds rate. act slowly over six months. The U.S. economy is like a large ship — it needs gradual direction. Stop-go monetary policy causes uncertainty, which was a major reason for the 1970s stagflation .

Bernanke and the 2008 Financial Crisis:

Under Bernanke, the Federal Reserve made very creative use of its tools. Prior Chairmen used only the Fed funds rate — raising it to stem inflation or lowering it to prevent recession. Between September 2007-December 2008, Bernanke decisively lowered the rate 10 times, from 5.25% to 0%. But this wasn’t enough to restore liquidity to banks panicked by defaulting subprime mortgages. These loans had been repackaged and sold them in mortgage-backed securities that were so complicated that no one really understood who had the bad debt.

As a result, banks stopped short-term lending, which was routinely done as a way to meet the Fed’s reserve requirement. In response, the Bernanke relaxed the requirements, lowered the discount rate. and finally provided credit itself through the discount window .

When this wasn’t enough, Bernanke created the Term Auction Facility in December 2007. The TAF lent billions to banks, taking on bad debt as collateral. The TAF was meant to be temporary, until the banks marked down the bad debt and started lending to each other again. When this didn’t happen, the TAF grew larger, reaching a peak of $1 trillion by June 2008.

Bernanke worked with central bankers around the world to restore liquidity when credit markets froze. He added $180 billion in dollar credit swap lines .These are agreements to keep a supply of dollars available to trade to other central banks for overnight and short-term lending. It was necessary because panicked banks were hoarding cash. They were afraid to lend to each other because they didn’t want to get stuck with derivatives based on sub-prime mortgages.

In April 2008, the Fed held its first emergency weekend meeting in 30 years to guarantee Bear Stearns ‘ bad loans so JP Morgan would buy it. This prevented default on $10 trillion in Bear Stearns’ holdings, and the banking community relaxed for a few months. By Q2 2008. the economy was growing, and many thought disaster was averted.

In September 2008, the world’s largest insurance company, AIG. announced it was going bankrupt. AIG insured trillions of dollars of mortgages throughout the world. If it fell, it would have disrupted every bank, hedge fund and pension fund that had mortgage-backed securities as an asset. Bernanke said that AIG’s bailout made him angrier than anything else in the recession. AIG took risks with unregulated products, like credit default swaps. while using cash from people’s insurance policies.

Bernanke Has Been Criticized:

Many legislators and economists criticized Helicopter Ben for injecting untold trillions into the economy, potentially triggering inflation. and expanding the debt. Others fault him for not predicting the recession in time. He was accused of hiding the identities of banks who received up to $2 trillion in TAF loans. Representative Ron Paul (R:TX) and others have called for a Fed audit to reveal the names of these banks. For these reasons, many legislators opposed his reappointment as Federal Reserve Chairman for a second term in January 2010. Obama easily reappointed him.

Bernanke After the Fed:

Bernanke joined the Brookings Institute as a Distinguished Fellow in Residence on February 3, 2014. He will advise the Hutchins Center on Fiscal and Monetary Policy on how to better educate the public on fiscal and monetary policy, as well as improve the effectiveness of those policies. He plans to write a book about his tenure. He will, no doubt, follow Former Treasury Secretary Tim Geither’s lead and make hundreds of thousands of dollars as a speaker.

Bernanke’s Early Career:

Bernanke received a B.A. in economics from Harvard University in 1975, and a Ph.D in economics from MIT in 1979. See Bernanke’s MIT 2006 Commencement Address for his chronicle of the evolution of economics.

He taught at Stanford Business School until 1985, when he became a professor at the Economics Department at Princeton University, becoming chair in 1996. In 2002, he joined the Federal Reserve Board of Governors and become chair in 2006. He was Chair of the President’s Council of Economic Advisers in 2005.

In 2009, he was named Time Magazine Person of the Year. Article updated February 26, 2014.