Fed Funds Rate Definition Impact and How It Works

Post on: 25 Апрель, 2015 No Comment

Why It’s the Most Interesting Interest Rate in the World

The Fed funds rate is the most interesting interest rate in the world. It’s the rate banks charge each other for overnight loans needed to maintain the reserve requirement. (Photo by Eugene Gologursky/Getty Images for Dos Equis)

The Fed funds rate is the target interest rate banks charge each other to borrow Fed funds overnight. They need these funds to maintain the Federal reserve requirement. This is the amount the nation’s central bank. the Federal Reserve. requires they keep on hand each night. That prevents them from lending out every single dollar they get their hands on, and have enough cash on hand to start each business day.

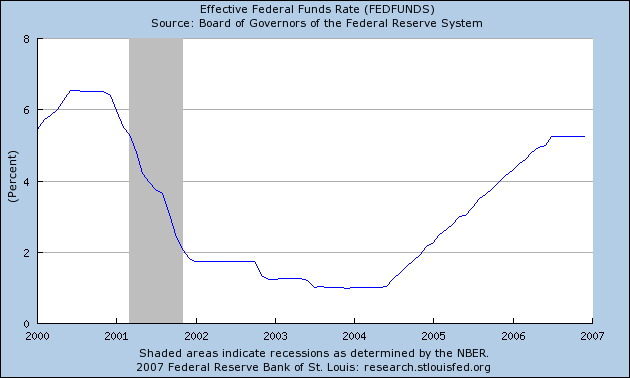

The current Fed funds rate is effectively zero. To combat the financial crisis of 2008. Former Federal Reserve Chairman Ben Bernanke lowered to this level by aggressively dropping it ten times in 14 months.

Obviously, this is the lowest the Fed funds rate can go. The highest was 20% in 1979 when former Fed Chair Paul Volcker used it as a tool to combat inflation. For more on the Fed funds rate highs and lows, see Historical Fed Funds Rate.

The Fed uses the Fed funds rate as a tool to control U.S. economic growth. That makes it the most important interest rate in the world.

Banks use the Fed funds rate to base all other short-term interest rates. That includes LIBOR. which is the interest rate that banks charge each other for one-month, three-month, six-month and one-year loans, and the prime rate. which is the rate banks charge their best customers. That’s how it also affects interest rates paid on deposits, bank loans, credit cards, and adjustable-rate mortgages.

Longer-term interest rates are indirectly influenced. Usually, investors want a higher rate for a longer-term Treasury note. The yields on Treasury notes drive long term conventional mortgage interest rates.

How It Works

Banks hold the reserve requirement either at their local Federal Reserve branch office or in their own vaults. If a bank is short of cash at the end of the day, it borrows from a bank with extra cash. The Fed funds rate is the rate that banks charge each other for overnight loans to meet these reserve balances. The amount lent and borrowed is known as the Fed funds.

The Federal Reserve, through its Federal Open Market Committee ( FOMC ), targets a specific level for the Fed funds rate. It uses open market operations to push the Fed funds rate to its target.

If it wants the rate lower, the Fed purchases securities from its member banks. It deposits credit onto the banks’ balance sheets, giving them more reserves than they need. That means the banks need to lower the Fed funds rate to lend out the extra funds to each other. For more, see How Does the Fed Lower Interest Rates?

When the Fed wants rates higher, it does the opposite. It sells its securities to banks, removing funds from their balance sheet, giving them less reserves. This allows them to raise rates. For more, see When Will the Fed Raise Interest Rates and What Is Being Done to Control Inflation?

How the Fed Uses It to Control the Economy

The FOMC changes the Fed funds rate to control inflation while maintaining healthy economic growth. The FOMC members watch economic indicators to determine if the economy is speeding up (inflation) or slowing down ( recession ). The key indicator for inflation is the core inflation rate. The most important indicator in predicting a slowdown is the durable goods report.

It can take 12-18 months for the effect of a change in the Fed funds rate to percolate throughout the entire economy. To maintain the expertise necessary to plan that far ahead, the Federal Reserve has become the nation’s expert in forecasting the economy. The Federal Reserve employs 450 staff, about half of which are Ph.D. economists.

When the Fed raises rates, it’s called contractionary monetary policy. A higher Fed funds rate means banks are less able to borrow money to keep their reserves at the mandated level. This means they will lend less money out, and the money they do lend will be at a higher rate. That’s because they themselves are borrowing money at a higher Fed funds rate to maintain their reserves. Since loans are more difficult to get and more expensive, businesses will be less likely to borrow, thus slowing the economy.

When this happens, adjustable-rate mortgages become more expensive, so homebuyers can only afford smaller loans, which slows the housing industry. Housing prices go down, so homeowners have less equity in their homes, and feel poorer. They spend less, further slowing the economy.

When the Fed funds rate is lowered, the opposite occurs. Since overnight lending is cheaper, banks are more likely to borrow from each other to meet their reserve requirements. They lend more and at a lower rate. With cheaper bank lending, businesses expand. This is called expansionary monetary policy .

Adjustable-rate home loans become cheaper, so the housing market improves. Homeowners feel richer, and spend more. They can also take out home equity loans more easily. They usually use these loans to buy home improvements and new cars, stimulating the economy.

For this reason, stock market investors watch the monthly FOMC meetings like a hawk. A 1/4 point decline in the Fed funds rate not only stimulates economic growth, but sends the markets higher in jubilation. However, if it stimulates too much growth, inflation will creep in.

A 1/4 point increase in the Fed funds rate will curb inflation. but could also slow growth and prompt a decline in the markets. Stock analysts pore over every word uttered by anyone on the FOMC to try and get a clue as to what the Fed will do.

Fed Funds Rate, Discount Rate and Other Tools

The Fed funds rate is the most important tool of the Federal Reserve, but there are others. The Federal Reserve also has a discount rate. which it keeps above the Fed funds rate. This is what the Fed charges banks to borrow from it directly through the discount window.

The Fed created an alphabet soup of programs to fight the financial crisis. For more, see the Federal Reserve Tools. Article updated November 14, 2014.