Fed Funds Rate

Post on: 24 Август, 2015 No Comment

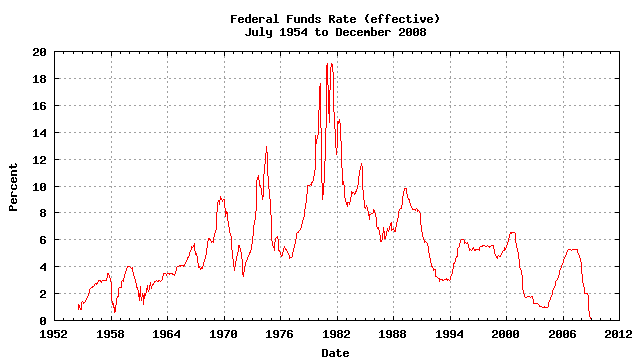

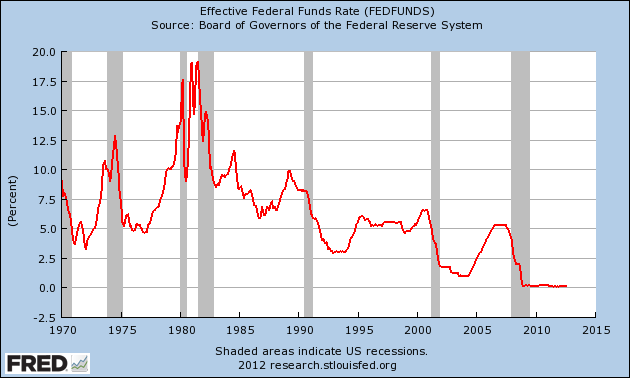

(Fed Funds Rate):

The Fed Funds Rate — short for Federal Funds Rate — is the short-term interest rate at which U.S. depository institutions (commercial banks, savings and loan associations, credit unions, mutual savings banks, etc.) lend to each other overnight within the Federal Reserve system (minimum loan amount is $1,000,000.)

In most cases, when economists, academics, investors and central bankers refer to the Federal Funds Rate, they are actually referring to the Fed Funds Rate Target .

The U.S. Federal Reserve sets a target for the Federal Funds Rate, and keeps the rate on target by executing open market operations, i.e. the buying and selling of U.S. Treasuries, mortgage-backed and agency securities via repurchase agreements and reverse repurchase agreements (also known as repos.) These repo transactions take place at the Trading Desk inside the Federal Reserve Bank of New York*. The Fed sells debt when it wants to drain cash from the banking system, and buys it when the Fed wants to pump money into the system.

Open market trading with primary dealers is the Fed’s main tool used to manipulate the fed funds rate. The Fed has three other tools at its disposal it can use to achieve its monetary policy goals: tweaking bank reserve requirement ratios, modifying the terms associated with borrowing from the Fed’s discount window and, as of October 1, 2008. adjusting the rate of interest paid to banks that have required and excess reserve balances on deposit at the Fed[1 ].

The Fed Funds Target Rate (FFTR) is America’s most important and most influential benchmark interest rate. The FFTR can be described as the main or key interest rate for the United States. The interest rate-setting Federal Open Market Committee (FOMC) uses the Fed Funds Target Rate as its most potent tool for regulating the U.S. economy, lowering it when the economy needs a boost, and raising it when the rate of inflation is too high.

NB. On December 16, 2008, the FOMC decided to take the unusual step of setting a target range of 0% — 0.25% for the fed funds rate, as opposed to setting a simple target. Since the FOMC can’t set short-term rates below zero, it has devised unique and unorthodox tools it will use to promote economic growth. From a December 16 press release :

. The focus of the Committee’s policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve’s balance sheet at a high level. As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.

U.S. law requires that depository institutions keep a certain percentage of their customers’ money on reserve at one of the 12 regional Federal Reserve banks situated in major U.S. cities:

- Atlanta, GA

- Boston, MA

- Chicago, IL

- Cleveland, OH

- Dallas, TX

- Kansas City, MO

- Minneapolis, MN

- New York City, NY

- Philadelphia, PA

- Richmond, VA

- San Francisco, CA

- St. Louis, MO

Banks try to stay as close to the reserve limit as possible without going under it, lending money back and forth so as to maintain a reserve level that is both legal and allows banks to maximize profits.

The FFTR is set by the FOMC. the Fed’s 12-member monetary policy body (7 Fed Governors plus 5 Federal Reserve Bank presidents). The FOMC convenes regularly scheduled monetary policy meetings eight times per year, and it is at these meetings that the FOMC decides whether to raise or lower the FFTR, or leave it unchanged. During times of economic crisis, the chairman of the Federal Reserve may at any time convene an emergency FOMC monetary policy meeting and raise or lower the FFTR, depending on the nature of the crisis.

As America’s cardinal short-term interest rate, the FFTR influences some of the most important market interest rates throughout the world, including the LIBOR rates and the U.S. Prime Rate .

The Current Target Range for the

Federal Funds Rate is: 0% — 0.25%