Fear Cycles and Greed Cycles in technology investment

Post on: 23 Август, 2015 No Comment

broadstuff

Friday, June 1. 2007

I was chatting to a friend the other night about the buys of Last.fm, Photobucket and so on, the assumptions in the pricings, and reflecting that 3 years ago — in the UK at any rate — getting a VC to even think about funding these sort of businesses was a major uphill task.

She opined that the market for technology investing cycles between Greed and Fear, and that 3 years ago was Deep Fear, but we were moving from Fear to Greed now.

This is how it works:

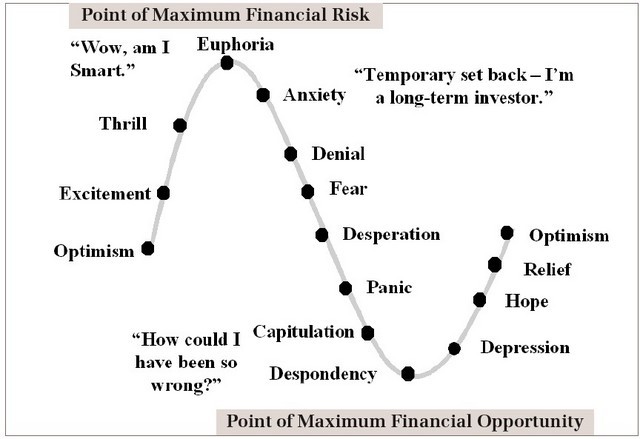

At the beginning of the cycle, as a market starts to expand, investors swing from fear to optimism to excitement to out-and-out greed. As the market peaks and contracts, investors shift back from greed to denial to anxiety to out-and-out fear.

In the Fear phase there is no assumption of upside, and a desire to only fund sure fire wins — ideally with assets to sell if it all goes belly up. Biscuit companies are great investments, dodgy tech is a no-no

Before moving into the Greed phase we go through the optimism phase — new ways of doing things emerge, a few old orders are disrupted — new things seem possible, and a few interesting businesses are started (think Flickr).

Then comes excitement as its clear they can work — and at this point a few brave souls who did start out early make some serious money by selling to large players coming in.

My friend opined that the tipping point in each Greed cycle is also kicked off by the Landmark Deal — Netscape, YouTube — that gets all the investors who have put their money into the game salivating. At this point the PE / VC people are rudely nudged from their comfy armchairs and management fee collection tins and told in no uncertain terms to go and get me a deal like XXX over there has just got.

Then we enter the Greed phase proper, and we move from irrational exuberance to the madness of crowds in short order, where, to quote from older and wiser heads who have seen it all before — to boot, Wikipedia :

The venture capitalists saw record-setting rises in stock valuation of these and other similar companies, and therefore moved faster and with less caution than usual, choosing to hedge the risk by starting many contenders and letting the market decide which would succeed. The low interest rates in 1998–99 helped increase the start-up capital amounts. Although a number of these new entrepreneurs had realistic plans and administrative ability, most of them lacked these characteristics but were able to sell their ideas to investors because of the novelty of the dot-com concept.

A canonical dot-com company’s business model relied on harnessing network effects by operating at a sustained net loss to build market share (or mind share). These companies expected that they could build enough brand awareness to charge profitable rates for their services later. The motto get big fast reflected this strategy. During the loss period the companies relied on venture capital and especially initial public offerings of stock to pay their expenses. The novelty of these stocks, combined with the difficulty of valuing the companies, sent many stocks to dizzying heights and made the initial controllers of the company wildly rich on paper.

Bear in mind this was written about the 1997- 2001 dotcom bubble, but you can pretty much trot that out verbatim today — except that today Web 2 not dot com, its M&A not IPO, and many of the deals are cash, not paper. We have clearly learned so much .

By the way, while searching for the above quote I found this little video from Vinod Khosla on the subject of Greed and Fear