FC SWAPS Accounting policy Toolbox for Finance Groups

Post on: 23 Май, 2015 No Comment

Popular White Paper On This Topic

Marcus replied Oct 4, 2009

FOREIGN CURRENCY SWAP ACCOUNTING POLICY*

Foreign currency swaps are initially recognized and subsequently carried at fair or market value, the foreign currency leg is translated into local currency at the spot exchange rate corresponding with transaction dates, any gains or losses from changes in fair value or the foreign currency exchange rate are separately identified and allocated to the profit and loss account except when the swap is part of a cash flow hedge, where any gains or losses are allocated to equity and any asset or liability subsequently recognized is net of the cumulative effect on equity. Swaps are settled net and shown in the Balance Sheet as the difference between each leg.

EXPLANATION

(i) In a foreign currency swap a foreign entity borrows some of our local currency from us in return for interest and principle repayments in our local currency to us and we borrow some foreign currency from the foreign entity in return for interest and principle repayments in foreign currency to the foreign entity.

(ii) The swap gives rise to an asset swap receivable equal to the present value of the principle and interest payments the foreign entity will make in our local currency to us and a liability swap payable equal to the present value of the principle and interest payments we will make in foreign currency to the foreign entity.

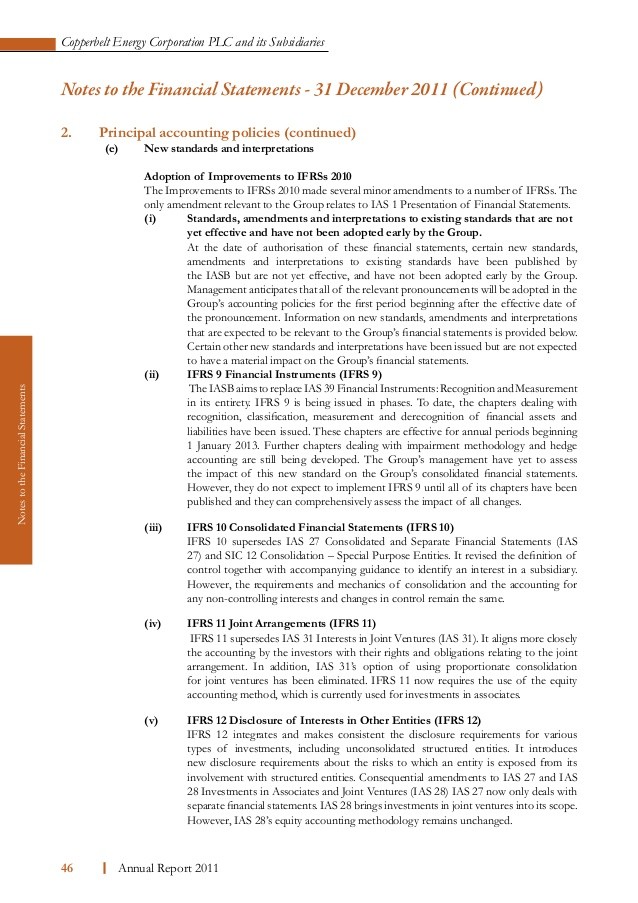

(iii) The swap is recognized and subsequently carried at fair or market value under International Accounting Standard 39 (Financial Instruments. Recognition & Measurement) because it is a derivative financial instrument (it is derived from two debt instruments), using the market interest rate for debt with the same features to calculate the present value of the principle and interest payments relating to the swap payable and swap receivable.

(iv) The foreign currency leg of the swap, our debt to the foreign entity called swap payable which is a monetary item, under IAS 21 (The Effect of Changes in Foreign Exchange Rates) is translated into our local currency for financial reporting upon initial recognition and following subsequent interest payments at the corresponding spot foreign currency exchange rate.

(v) Any gains or losses from changes in fair value or the foreign currency exchange rate are allocated to the profit and loss account except when the swap is part of a cash flow hedge, where any gains or losses are allocated to equity and any asset or liability subsequently recognized is net of the cumulative effect on equity.

(vi) In the Balance Sheet, the outcome of the swap or the difference between the swap receivable and the swap payable is shown.

*IAS39 is currently under review 4-Oct-2009 and due to be ammended early next year.