FailSafe Investing Harry Browne s Permanent Portfolio

Post on: 21 Май, 2015 No Comment

The first rule of investing is dont lose money; the second rule is dont forget rule number one. Warren Buffett

At the end of March, I asked you what topics youd like to see covered during Financial Literacy Month. I received many great suggestions, and will continue to fulfill requests not just in April, but for months to come. One comment especially caught my eye. Kenneth F. LaVoie III wrote :

Never again will I be in a position to lose 50% of my money. There must be a way to see the Big Picture and lighten up on areas that are over-valued, but still enjoy an average return at least approaching that of the market as a wholeI’d love to hear some simple strategies that require a little thought, and don’t just focus on keeping a lot of money in cash and short term bonds.

It sounds to me as if Ken is asking about defensive investing, which is actually something Ive been thinking about a lot lately. When I was younger, my investments were mostly speculative. They were gambles. I wanted to earn huge returns and I wanted them today. Even two years ago, I was investing in Countrywide and The Sharper Image .

But as Ive built wealth and become better educated about money, Ive become a defensive investor. Ive become less interested in quick gains. Last years market collapse was another shock to the system, not just for me but for many others. Weve realized that our risk tolerance isnt as high as we once thought it was.

Risk tolerance is the degree to which you, as an investor, are willing to accept uncertainty and possible loss in the investments that you make. If you have a high risk tolerance, youre willing to accept large fluctuations in your investment returns in exchange for the possibility of large gains. If you have a low risk tolerance, youd rather your return was constant.

More and more, Ive become a fan of index funds mutual funds built to track the broad movements of the stock market. They dont outperform the market, but they dont underperform it, either. To learn more about index funds, Ive begun to attend the quarterly meetings of the local Diehards group.

The Diehards are fans of John Bogle, who founded The Vanguard Group. and who is considered the father of index funds. The Diehards mostly hang out in an internet discussion forum. but from time-to-time they meet in groups around the country to discuss investing.

At the last meeting, we took turns describing our current asset allocations and what weve done to respond to the faltering economy. It was no surprise that most people hadnt done much to change their investing strategies. What was surprising is that although everyone was a fan of John Bogle, I was the only one whose portfolio was composed primarily of index funds.

Each member of the Portland Diehards group has his own approach to investing. Many focus on real estate. But one mans choice especially appealed to me. Craig told the group that he has based his asset allocation on Harry Browne s Permanent Portfolio.

Asset allocation is the division of money among different types of investments. The classic example is the basic 60/40 split: 60% invested in stocks and 40% in bonds. Asset allocation is just a fancy way of saying the things in which Ive invested.

After listening to Craigs explanation of the Permanent Portfolio, I picked up Harry Brownes little book, Fail-Safe Investing . Browne divides investment money into two categories:

- Money you cannot afford to lose.

- Money you can afford to lose.

For the former, Browne recommends investing in a permanent portfolio that provides three key features: safety, stability, and simplicity. He argues that your permanent portfolio should protect you against all economic futures while also providing steady performance. It should also be easy to implement. (For the money you can afford to lose, Browne suggests a variable portfolio, with which you can do anything you want even invest in Beanie Babies!)

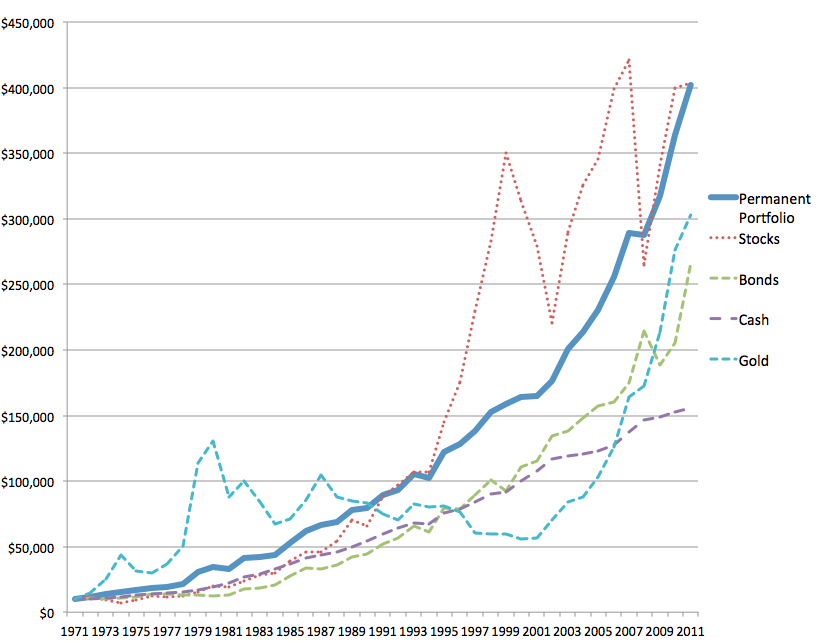

There are many ways to approach safe, steady investing, but Brown has some specific recommendations for his own Permanent Portfolio:

- 25% in U.S. stocks, to provide a strong return during times of prosperity. For this portion of the portfolio, Browne recommends a basic S&P 500 index fund such as VFINX or FSKMX .

- 25% in long-term U.S. Treasury bonds, which do well during prosperity and during deflation (but which do poorly during other economic cycles).

- 25% in cash in order to hedge against periods of tight money or recession. In this case, cash means a money-market fund. (Note that our current recession is abnormal because money actually isnt tight interest rates are very low.)

- 25% in precious metals (gold, specifically) in order to provide protection during periods of inflation. Browne recommends gold bullion coins.

Because this asset allocation is diversified, the entire portfolio performs well under most circumstances. Browne writes:

The portfolios safety is assured by the contrasting qualities of the four investments which ensure that any event that damages one investment should be good for one or more of the others. And no investment, even at its worst, can devastate the portfolio no matter what surprises lurk around the corner because no investment has more than 25% of your capital.

To use the Permanent Portfolio, you simply divide your capital into four equal chunks, one for each asset class. Once each year, you rebalance the portfolio. If any part of the portfolio has dropped to less than 15% or grown to over 35% of the total, then you reset all four segments to 25%. Thats it. Thats all the work involved.

Brownes Permanent Portfolio is unlike anything Ive ever considered before, but I have to admit: I like it. A lot. It has a distinct get rich slowly feel to it. That is, this portfolio is not designed to earn lots of money; its designed to not lose money.

Whats more, the Permanent Portfolio is based on the smart investment behaviors weve explored before. Its a passive strategy built on diversification. It doesnt use market timing. Its a defensive investment strategy that also happens to produce a decent return. (Crawling Road has posted a table of Permanent Portfolio historical returns .)

Diversification is often mentioned with asset allocation, and for good reason. Diversification is the process of investing in many different things, of not putting all of your eggs in one basket. Studies have shown repeatedly that by investing in different types of assets that arent correlated (i.e. do not move the same way at the same time), investors can reduce risk while maintaining (and sometimes increasing) return. This is the power of diversification.

All of this is a long way of saying that, like Kenneth F. LaVoie III, I too am interested in reducing my risk while maintaining a decent return. I understand that, in general, risk and return are intertwined. If you want maximum possible returns, you must accept great risk. If you want no risk, you will receive meager returns. But as William Bernstein demonstrates in The Four Pillars of Investing [my review ], diversification can lower risk while increasing return.

To read more about the Permanent Portfolio, check out the following articles:

I should also point out that theres actually a mutual fund built around the concept of the Permanent Portfolio. PRPFX has an impressive record, though one based on less than a decade of data.

Note: Just because I am giving serious consideration to the Permanent Portfolio does not mean that you should do the same. Please base your investment decisions on your personal goals and psychology, not on my personal goals and psychology.

GRS is committed to helping our readers save and achieve their financial goals. Savings interest rates may be low, but that is all the more reason to shop for the best rate. Find the highest savings interest rates and CD rates from Synchrony Bank. Ally Bank. GE Capital Bank. and more.