FAFSA Understanding Parent and Student Assets

Post on: 16 Июль, 2015 No Comment

February 7, 2011 by LendKey Staff

8 comments

Update: January 2014

With FAFSA filing season well under way, millions of students and parents around the country are working to get this important document filed.

Because the FAFSA requires detailed tax and asset information the process can be intimidating and frustrating. Nothing hurts like spending an hour filing the FAFSA to be told the only financial aid available for you is the Direct loan. Dont let the frustration get to you!

One area that leaves FAFSA filers flummoxed is valuation of assets held by the parents and students. What you dont know may cost you. Here are some key points you need to know.

What assets is the FAFSA looking for?

- Savings and checking account balances

- Net worth of non-retirement investments (FYI: Retirement funds and pensions are generally not considered assets)

- Investment property separate from the familys primary residence

- Net worth of a business or a farm that is not the familys primary residence.

What value will the FAFSA associate with my asset?

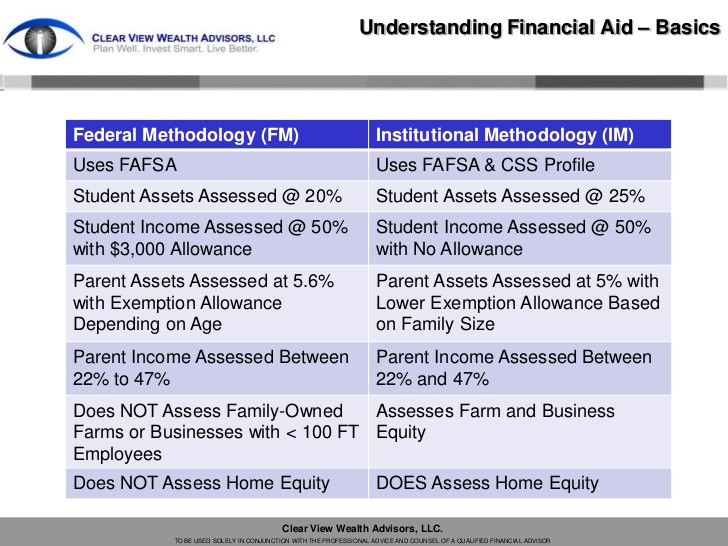

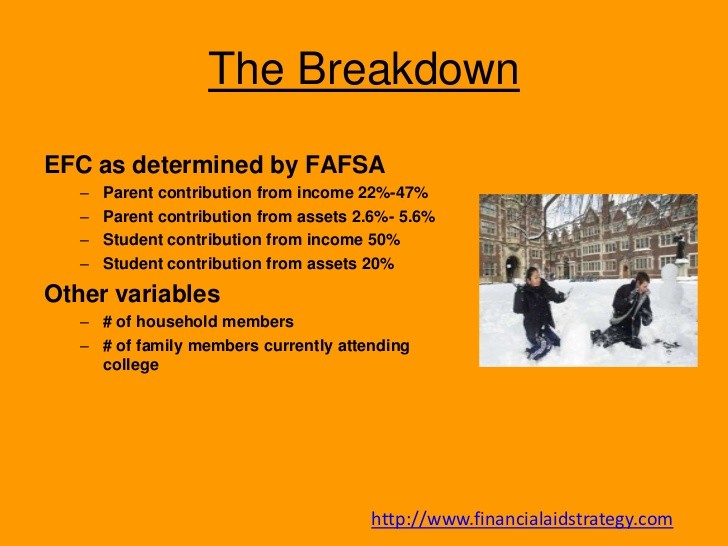

- The student asset conversion rate for the 2014 2015 FAFSA is 20% of total value when calculating the expected family contribution (see page 10, line 49 FAFSA EFC Formula Guide )

- The parent asset conversion rate for the 2014 2015 FAFSA is 12% of total value when calculating the expected family contribution (see page 9, line 23 of the FAFSA EFC Formula Guide. )

With valuations like this, it pays to make sure assets are allocated correctly. With assets in the childs name being weighed most heavily, one should avoid putting any cash assets in the students name prior to filing the FAFSA.

1. The student should keep no cash or cash equivalents saved in their name: Students are punished by the FAFSA for saving any cash. The FAFSA will specifically ask As of today what is the cash balance of checking, savings accounts for the student. Because the question is phrased As of today it leaves room for interpretation. If all money were pulled from checking and savings the day before the FAFSA were filed, then the answer would be zero. A nominal value of $200 or $300 may be listed, but the reality is that there is no good reason to include anymore cash assets than that because no one else in their right mind does. Cash assets sink financial aid eligibility, but are virtually untraceable unless admitted to on the FAFSA. (See FAFSA Tip: Reduce Cash to Maximize Financial Aid )

2. Declared cash assets should be in the parents name: Certain cash assets are simply too large to be avoided. In such cases, the assets should remain in the parents name to minimize the percentage weight. Do not give any of it to the kid as a gift.

3. For divorced parents: Because only the custodial parent assets are weighed on the FAFSA, do not include the other parent information. The custodial parent officially cares for the student for the majority of the prior 12 months, and usually claims the child as a dependent. College planning in divorce situations dictates that the parent with lower income should be custodian to the student to ensure maximum financial aid eligibility.

4. My great uncle Harold wants to give me college money!: First of all thank Great Uncle Harold for helping you out! However this could reduce eligibility for financial aid if not handled correctly. If Uncle Harold gives the money directly to the kids, it should be counted as a cash asset in the students name and will be weighed heavily against financial aid eligibility. If the money is given to the parent, it is weighed at a lower percentage but still must be calculated as a cash asset. The smart move is to tell Uncle Howard to hold the cash in his hands and provide support indirectly. The cash would not be declared a student asset in their checking account in this scenario. The other way to handle this would be if Uncle Harold funded a 529 plan for the children about to attend college. 529 assets are assessed at a much lower value than cash in checking or savings.

5. To work or not to work: Though earnings from work are not considered the same as assets like owning a business, its important to note this issue. Students with parents earning low income may have reduced incentive to work for themselves if financial aid eligibility is at risk. Again, this is because any money in the students can be weighed heavily against financial aid eligibility depending on other variables. The FAFSA does allow the student to have an income protection allowance, and for the 2014 2015 FAFSA its $6,260. Any student earnings above that amount may actually reduce financial aid eligibility.

I have seen students reduce their financial aid eligibility because they earned too much income on their own. The FAFSA says that any earnings are supposed to be included as part of income no matter how they are earned. However, there are many students that get jobs to earn cash and never admit to the income on FAFSA because it is untraceable. This is unfair but it happens all the time. If given the option to work before or during college, recognize that any cash earnings are invisible unless you admit to them on the FAFSA. If you receive a W-2 and have to file a tax return as a result of a job, the earnings are easily traceable if selected for financial aid verification. Lean more about the FAFSA Income allowance for students.

Dont forget to follow us on Facebook !