Expected Rate of Return

Post on: 16 Март, 2015 No Comment

What’s your expected rate of return on your retirement investments. Do you even have a concrete number in your mind? You should.

Consider for a moment your assumptions. You assume you’ll live a relatively long and healthy life (and I hope that turns out to be correct). You assume that your taxes will stay about the same, and that your cost of living won’t rise unexpectedly. That if you have a health problem or an accident, that insurance will bail you out and get you back to a normal life.

You probably also assume that your investments are pretty sound and that your expected rate of return is likely to be about 10 percent a year.

If your health holds up, and nothing else goes terribly wrong, let me tell you that your single biggest problem, by far, is that final assumption, the expected rate of return. You won’t make 10 percent. You might easily average 5 percent.

How do I know this? Because, if you are like most Americans, you don’t have a state-run pension plan. You have instead an IRA or a 401k. These are great tools, but horribly expensive. And they don’t afford you the brainpower and discipline of large, well-run retirement systems, such as you find in the states.

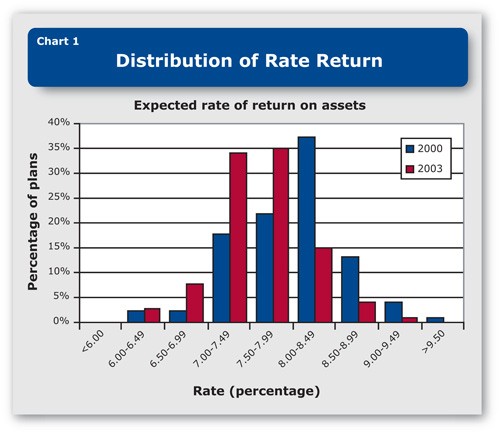

Consider for a moment that some of the biggest state plans have been slashing their own expected rate of return .

Baltimore County in Maryland recently cut to 7.25% from 7.875%. Calpers in California to 7.5% from 7.75%. The State of Virginia to 7% from 8%. New York to 7.5% from 8%.

Now Indiana has fallen below even that line, to 6.75% from 7%. It’s now the lowest expected rate of return of the big public retirement plans.

So what? I have great 401k at work, you might say. I can beat that.

Possibly, but state plans really set the bar for professionally managed retirement accounts. Over time, research has shown, IRAs and 401k funds fall far short of the assumptions of state plans.

Phyllis Borzi, Assistant Secretary of Labor for the Employee Benefits Security Administration (EBSA), had this to say in recent testimony to Congress:

From 1998 to 2007, the average annual returns for IRAs were 4.5 percent, compared with 5.4 percent for 401ks. IRA holders often pay fees that can be two to three times higher than the fees paid by employee benefit plan participants.

Individual investors no longer have professional pension managers, such as the folks who run retirement funds for the states. They have to manage their own 401ks and IRAs. And their returns have been dismal.

Your expected rate of return is everything

Why do self-management investments do so poorly? Because you pay too much in fees and get poor advice for that money — even conflicted advice.

See, your broker is not a fiduciary. He or she might talk a good game, but the law doesn’t require him or her to act on your behalf. Some financial advisors are fiduciaries, but few and far between. Chances are very high that if you don’t know your advisor’s legal status, the news won’t be good. A fiduciary would go to the trouble of making sure you know that.

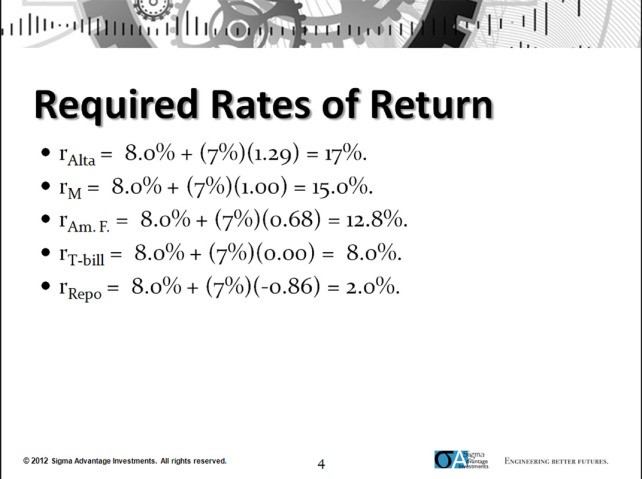

Remember the Rule of 72. Take your expected rate of return and divide into 72. The result is the number of years it takes to double your money.

A 7% return means your money will double in 10 years (72/7=10.29). Say you end up at 6% (12 years to double) but I manage an expected rate of return of 9% (just eight years), thanks to low fees and superior management. In 24 years, I’ll have two times more money than you! (Your money will double and double again, while mine will double, double again, then double once more.)